The EU Commission released its Summer European Economic Forecast report, in which the growth forecasts and other prominent economic projections were downgraded relative to the previous Spring 2019 report.

“The forecast for euro area GDP growth in 2019 remains unchanged at 1.2%, while the forecast for 2020 has been lowered slightly to 1.4% following the more moderate pace expected in the rest of this year (spring forecast: 1.5%).” [source]

In its report, the EU Commission observed heightened international tensions and a further slump in global trade, which has resulted in slower-than-expected growth and subsequently has had a hampering effect on euro area manufacturing production. It was further stated in the report that:

“The recent escalation in trade tensions and the corresponding uncertainty is depressing already weak global activity, particularly in the manufacturing sector. Recent hard and soft data confirm that the ‘soft patch’ in manufacturing and trade that began in 2018 has extended well into 2019.”

The resulting worse-off manufacturing production, which has been continuously weakened by the ongoing trade war and the relatively recent spike in tensions between the US and Iran, has thwarted EU exports and is seen as the prime reason for the reduction of the EU growth projections to 1.5%.

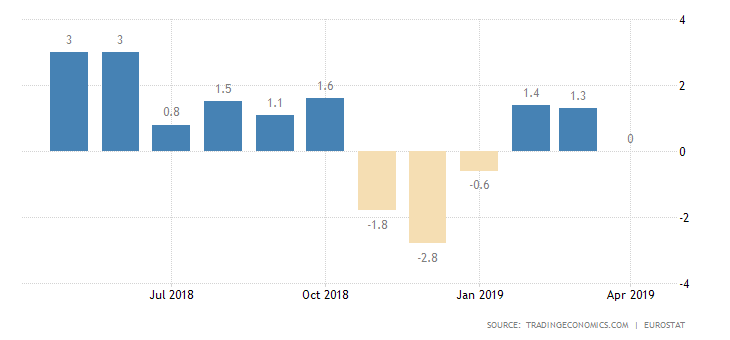

Core inflation expectations have also been lowered with 0.1 points to 1.3% for 2020, which is significantly lower than ECB’s target level of just below the 2% symmetric inflation rate.

“Despite rising wages and relatively robust private consumption, inflation has remained subdued so far. […] Overall, given also the lower technical assumptions about oil prices, the forecast for headline inflation in the euro area is revised down to 1.3% in both years. […] The decline in inflation expectations is a source of concern.”

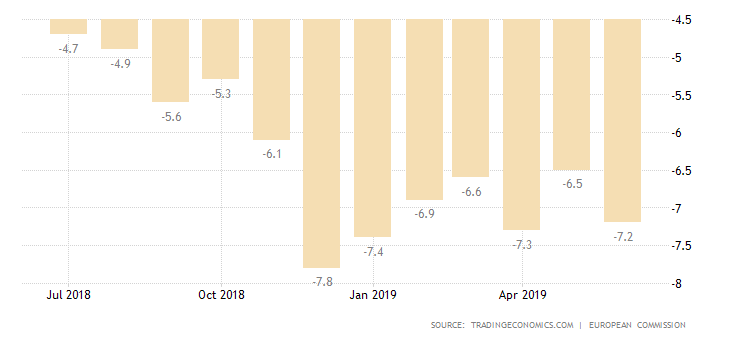

The observed reduction in headline inflation forecasts despite the registered increase in wage growth rates points to a noticeable weariness of European consumers who seemingly prefer to save their extra capital instead of spending it in the economy’s circulation. The resulting distortions in the business cycle are having a damaging effect on the price stability of the bloc and might be a sufficient reason for the ECB to step up.

The consumer confidence index has fallen to -7.2 in June from -6.5 in May, which exemplifies the weariness mentioned above amongst European consumers.

Overall, the deteriorated outlook on the euro area prospects for economic growth is reported at a critical time, just two weeks before the highly anticipated ECB interest rate and monetary policy meeting. Mario Draghi has previously expressed his opinions on the need for more economic stimuli to be provided by the central bank in order to stimulate faster-paced growth in the bloc, and with the recent global and internal developments, those changes seem more necessary than before.

The prevailing consensus amongst investors and financial analysts is that the ECB would decide to lower interest rate, to adopt a more accommodative stance and support the European economy. A lower interest rate would discourage consumers from keeping their capital away from the underlying economic activity in savings accounts and instead compel them to spend and invest more. In turn, the expected higher spending rates should provide more price stability and boost the core inflation towards the mid-term target level.

The EUR has seen most of its recent gains against the USD disappear as the market braces for the highly anticipated rate cut by the ECB. At the same time, last week’s robust labour data from the overwhelmingly positive NFP report (you can read more about it here) makes the possibility for a short-term rate cut by the FED seem less-likely. Overall, the EURUSD is likely to remain strained by the mounting pressures from investors' expectations of the ECB's next meeting in two weeks.