On Thursday afternoon the Governing Council of the European Central Bank announced its newly implemented adjustments to the monetary policy for the European bloc. The primary interest rate on the main refinancing operations will remain unchanged at 0.00 per cent whilst the interest rate on the borrowing facilities will be decreased by ten basis points to -0.50 per cent.

The accommodative monetary stance is intended to regain investors’ confidence despite the mounting internal and external pressures that are currently thwarting the economic recovery of the European bloc. In addition to the globally subdued inflationary pressures, international trade continues to be impeded by the pervasive trade war, which in turn hinders investing operations worldwide.

Internally, the ECB has to stabilize the markets that are being constantly shaken up by the mounting Brexit woes, which are expected to peak on the 31st of October. Additionally, the divisiveness of Italian politics, encapsulated by the recent spat between the 5 Star Movement and the League party, has worried investors that the soaring Italian debt problem might cause a new recession (You can read more about it here).

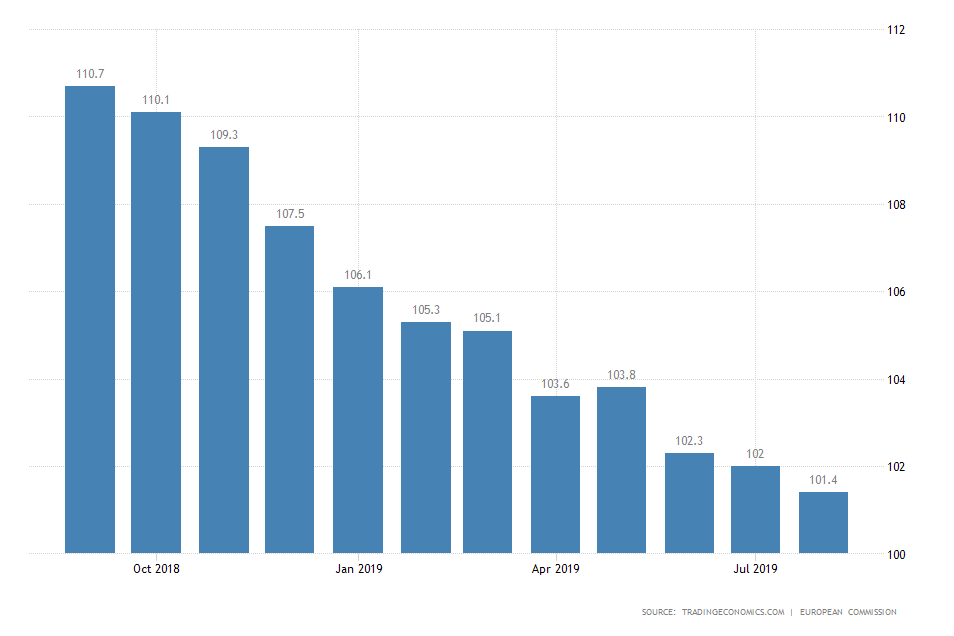

With all of that in mind, the ECB’s most pressing objective seems to be the need to restore the trust of investors in the capacity of the monetary policy to promote economic expansion. As of recently, the Economic Optimism Index in the EU has been barely scoring just above the 35 years’ average of 100.92 points, and it has been steadily tumbling for over a year.

In the post-decision statement, the Governing Council stated that:

“The Governing Council now expects the key ECB interest rates to remain at their present or lower levels until it has seen the inflation outlook robustly converge to a level sufficiently close to, but below, 2% within its projection horizon […] The modalities of the new series of quarterly targeted longer-term refinancing operations (TLTRO III) will be changed to preserve favourable bank lending conditions, ensure the smooth transmission of monetary policy and further support the accommodative stance of monetary policy.” [source]

Overall, the ECB will continue to pump liquidity stimuli to the banking sector within the union, with the intention of supporting the borrowing rate by small and medium-sized investors and businesses. The Governing Council hopes to stimulate the economic participation rate and overall activity so that the economic growth rate can eventually pick up.

Meanwhile, the EURUSD gained a significant boost following the release of ECB’s monetary policy statement, in addition to lessened reported inflation in the US. The pair initially tumbled with more than 70 pips to the previous support level at 1.09250, but then the price quickly corrected itself, and the EUR/USD closed

Thursday's trading session with a 0.48 per cent gain, at 1.10640. The FX pair has already broken the previous bearish channel in addition to the resistance level at 1.10700 and is currently attempting to gain additional bullish momentum.