On Wednesday, the European Central Bank rolled out its plan for tackling the economic fallout from the COVID-19 pandemic and the resulting market rout, which has wiped out billions of European stocks’ value and continue to pose a serious threat to the price stability in the Eurozone.

The ECB unsurprisingly announced that it would be boosting its asset-purchasing program until the end of the year, similar to other central banks globally, in a coordinated and sweeping bid to curtail further distortions in the economic activity in the Eurozone.

“[…] the ECB’s Governing Council announced on Wednesday a new Pandemic Emergency Purchase Programme with an envelope of €750 billion until the end of the year, in addition to the €120 billion we decided on 12 March. Together this amounts to 7.3% of euro area GDP. The programme is temporary and designed to address the unprecedented situation our monetary union is facing.”

By boosting the aggregate liquidity levels circulating throughout the Eurozone’s economic cycle, the Council, chaired by Christine Lagarde, aims to compensate reeling European businesses for the interruptions to their activities, by providing a vital lifeline of cheap and readily available credit.

The Bank is not reluctant to acknowledge that the zone is headed for a recession in Q1 of 2020; however, it is decisive in its actions and beliefs that the economic hit cannot be and should not be 'bigger than it has to be'.

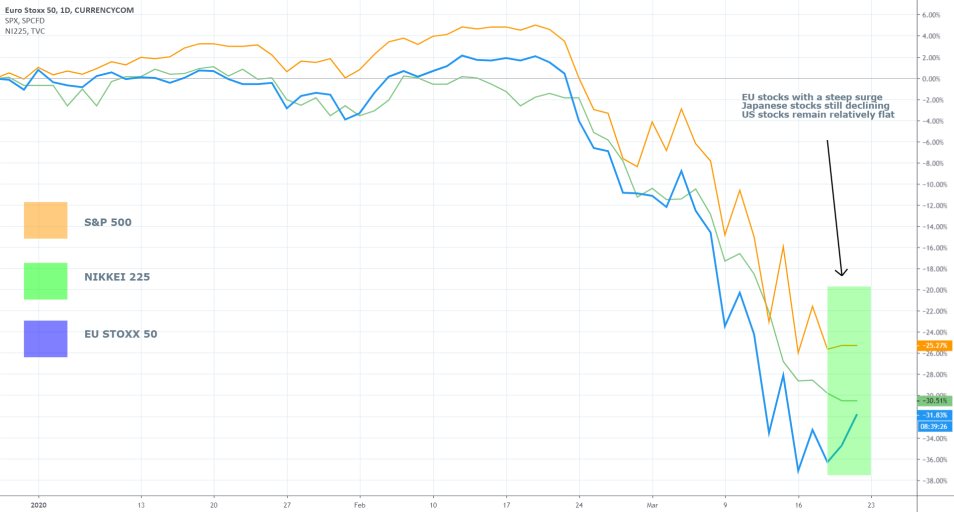

Early estimations of the new policy’s effectiveness seem to suggest that the market is taking on the decision with optimism. The European stock market, which was the most severely hit in the wake of the COVID-19 rout, has now recorded the most substantial correction, outpacing the stock rallies elsewhere.

Investors are receptive to the scope and structure of ECB’s monetary relief package because it addresses the ‘exogenous’ nature of the economic shock, which is ‘detached from economic fundamentals and affecting all countries in the euro area’.

Additionally, the monetary stimuli package is fitted to prevent ‘financial fragmentation and distortions in credit pricing’, which is intended to stabilise the jolted bonds sector in the Eurozone. Bloomberg commented on the plan by stating that:

“It has already pushed borrowing costs down across the bloc and, importantly, it narrowed the gap between the bond yields of stressed economies such as Italy and safer options such as Germany.”

Finally, the ECB insured concerned investors and other market participants, that the new instrument is ‘is tailored to manage the staggered progression of the virus and the uncertainty about when and where the fallout will be worst.’

The assuring tone of the ECB, in addition to the intricate nature of the proposed mechanism for coordinated liquidity distribution, has at least temporarily alleviated the pain away from the strained European stock market.

The EU50 index has so far jumped by 6.50 per cent since yesterday, which outpaced the recorded growth in the S&P 500, despite Donald Trump’s emphatic rhetoric in support of the American indices.

Meanwhile, Japanese stocks continued to tank steadily on the strong demand for the dollar over the past few days and the increasing likelihood for the cancellation of the summer Olympics in Tokyo this year.