Tesla's earnings in the first quarter exceeded all initial expectations, despite difficult prospects for growth owing to the coronavirus fallout. The company posted earnings per share of $0.93, thereby exceeding the initially projected EPS of $0.43. This represents the most robust performance to date.

Additionally, Tesla posted record-breaking net sales of $438 billion and revenue of $10.39 billion. This is due to the exceptionally high demand for Model S/X and the newer 3/Y. A total of 180,338 cars were produced alongside combined deliveries of 184,800 units.

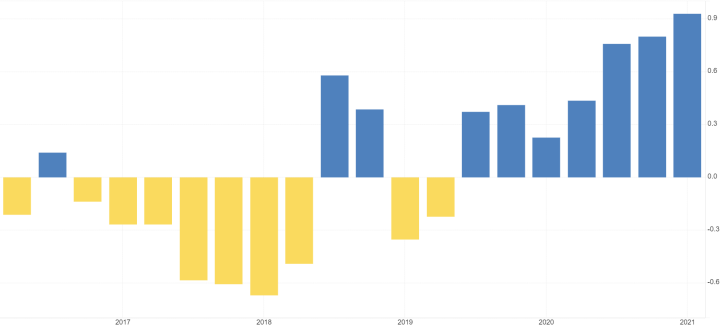

Tesla's solid performance over the first three months of 2021 is also owing to the fact that it managed to reduce its operational costs considerably, which is increasing the company's overall operational efficiency:

"Reducing the average cost of the vehicles we produce is essential to our mission. In 2017, as we began production of Model 3, our average cost per vehicle across the fleet was ~$84,000. Due to the launch of new products and new factories and the reduced mix of Model S and Model X, our average cost declined to sub-$38,000 per vehicle in Q1."

Despite these promising earnings numbers for Q1, Tesla's shares are falling in the pre-market session. TSLA closed yesterday at 738.20 but is currently trading at around 719.00, which measures a drop of 2.57 per cent.

As can be seen on the 4H chart below, the underlying price action is still contained within the boundaries of an Ascending Wedge pattern, which means that there is more room for appreciation. The stock could attempt to test the next major resistance level - the psychologically significant barrier at 800.00.

However, the Ascending Wedge is a type of pattern that typically signifies potential bearish reversals, which means that the underlying bullish momentum could be running on fumes.

Even still, the pre-market drop is likely to consolidate around 720.00 before the uptrend can be resumed because of the significance of the 23.6 per cent Fibonacci retracement level around the psychological support at 700.00, which is currently converging with the 50-day MA (in green) and the 100-day MA (in blue). The price is unlikely to break down lower at the present rate.

Trendsharks Premium

Gold is undergoing a correction, as investors take profits to offset losses from falling stock prices, impacting their margins. However, we anticipate a renewed wave of [...]

The Swiss stock market index is mirroring its global counterparts, such as Germany 40 and US100, experiencing a sharp decline following the announcement of new [...]

We’re analyzing the weekly chart to grasp the broader market trend. Over the past three years, the US30 index has surged by 17,000 points, often resembling a nearly straight [...]

Over the past week, the DAX has experienced a sharp decline, plunging by an astonishing 3,400 points. This downward movement is not isolated, as its international counterparts, such as the UK100 and US100, are also facing significant [...]

EURUSD recently formed a double top at 1.0930, signaling a potential trend reversal, and has since begun a correction. After a 600-pip rally since early March, a pullback at this stage is both expected and healthy. Given these conditions, we are placing a [...]

Since early March, EURJPY has surged nearly 1,000 pips, providing us with several excellent trading opportunities. However, as the rally matures, many early buyers are beginning to take profits, leading to a noticeable slowdown in the uptrend. On Friday, the pair formed a [...]

The AUDJPY currency pair continues to be dominated by bullish momentum, as multiple golden cross patterns reaffirm the strength of the ongoing uptrend. Despite this, we are witnessing a much-needed [...]

The EURAUD currency pair appears to be undergoing a trend reversal, signaling a potential shift in market direction. A notable technical development is the formation of a Death Cross on the chart, a widely recognized bearish indicator that typically suggests a [...]

After securing an impressive 200-pip profit last week, the EURJPY currency pair is now undergoing a southward correction, retracing some of its recent gains. Despite this temporary pullback, the Golden Cross remains intact, reinforcing our view that the overall trend continues to be [...]

The appearance of a Golden Cross in Silver strengthens our analysis that the metal is currently in a strong uptrend, indicating further bullish momentum in the market. This technical pattern, where the short-term moving average crosses above the [...]

This trade presents a considerable level of risk and can be classified as an opportunistic move based on recent price action. The GBPUSD currency pair has experienced a substantial bullish rally, surging by nearly 500 pips in a strong upward movement. However, after this extended period of appreciation, the pair is showing signs of a potential [...]

The anticipated Death Cross on the SMI20 appears to be failing as price finds strong support at the 23% Fibonacci retracement level. After testing this area, the index has shown bullish strength, printing several large green candles, signaling an increase in [...]

A Golden Cross has just appeared on the USDJPY chart, signaling a potential bullish move. This technical pattern occurs when the 20 period moving average crosses above the 60 period moving average, a widely recognized indication of increasing [...]

After 2 months of a down trend, we finally see some indications of price recovery for Oil. The golden cross, a historic buy signal, supports this [...]

For the past month, the German DAX40 has experienced a remarkable 10% surge, reflecting strong bullish momentum. Despite ongoing market volatility and frequent pullbacks, every dip continues to attract fresh buyers, reinforcing the [...]

Oil continues its downward trajectory, despite occasional pullbacks. The overall trend remains bearish, reinforced by multiple Death Cross patterns, a classic sell signal indicating further weakness. Adding to this bearish outlook, the critical [...]

Over the past few days, gold has experienced a sharp decline of more than $100. This downturn can be attributed in part to traders securing profits to manage their margins, which are under strain due to the significant drop in major indices. Currently, gold has fallen below the [...]

The NASDAQ 100 index is showing strong bullish momentum, as evidenced by the formation of a Golden Cross on the chart. This classic buy signal occurs when the short moving average crosses above the long term moving average, suggesting that upward momentum is [...]

The EURAUD currency pair has encountered a significant resistance level, failing to break above the critical 61% Fibonacci retracement level. This suggests that bullish momentum is weakening, reinforcing the case for a potential downward move. Given this technical setup, we favor entering a [...]

The UK100 is experiencing a remarkable rally! Over the past few weeks, the British stock market index has surged nearly 800 points. Each minor dip has attracted more buyers, fueling the bullish momentum. However, since last week, we’ve observed a slight [...]