The most important economic event that is scheduled for release this week is the jobs report in the US, which is going to reflect the observed changes in employment that have been recorded in January.

At the present rate, the US labour market is performing exceptionally well. The participation rate of the labour force remains high, employment growth is stable, and the overall unemployment remains at a historic low.

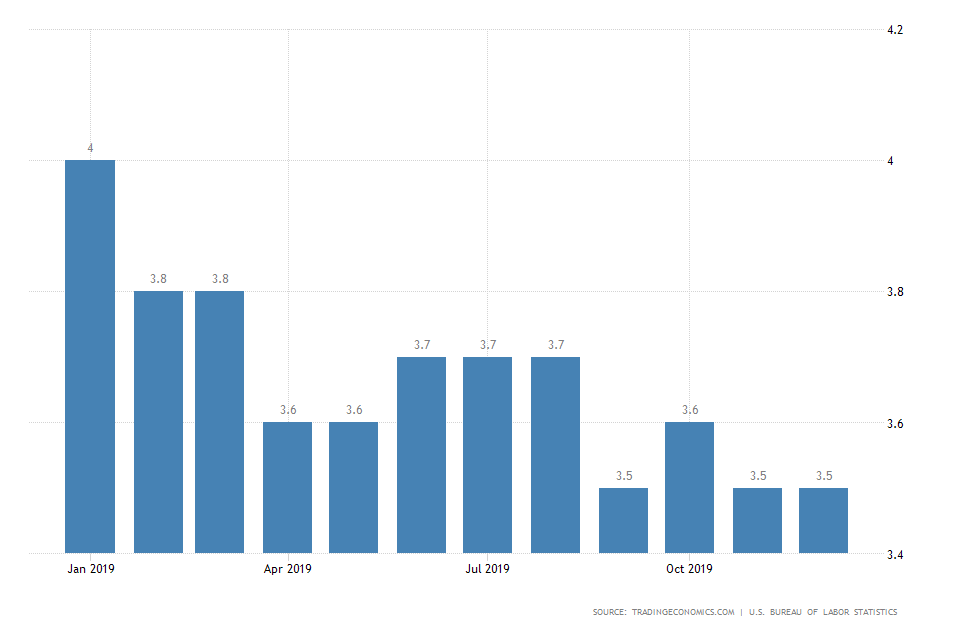

The unemployment rate is currently at 3.5 per cent, which is the lowest level on record since 1969. Moreover, the consensus forecasts project the level of unemployment to remain unchanged in January.

Thus, the Non-Farm Payrolls for January are anticipated to demonstrate little changes in the overall labour conditions in the market. Regardless, firm emphasis would be placed on the observed changes in the average hourly earnings of workers.

The December data in the previous NFP report disappointed by recording a very marginal growth in earnings of only 0.1 per cent, thereby missing the initial expectations.

This time the market would anticipate an improvement encapsulated by a 0.3 per cent growth in earnings.

This is a crucial indication of the American economy’s wellbeing, as higher wages are a necessary factor for ensuring heightened consumer spending, which, in turn, is accommodating price stability.

So far, the American economy has exhibited a commendable ability to generate new jobs; however, inflationary pressures remain somewhat subdued. Workers are not spending as much as the numbers suggest, despite the high employment levels.

This can be attributed to external developments such as global trade uncertainties, which were the leading topic of discussion until recently and a significant impediment to consumer confidence.

Recently, the outbreak of the deadly coronavirus in China has alarmed investors and caused the Chinese Stock Market to open with a considerable gap earlier today. Over 9 per cent of some Chinese stocks were wiped after the Asian open.

The potential escalation of the situation has the capacity to distress American consumers, which could result in even more muted inflation in the mid-term, likely prompting a momentary selloff of the dollar.

It is because of such external factors that Friday’s report becomes especially important, as its findings could swing consumers’ confidence in either direction.

If the initial expectations are met, the dollar would likely gain strength in the immediate aftermath of the release. However, the opposite is true if the employment data disappoints.

Meanwhile, the textbook price action on the EURUSD has resulted in the formation of several crucial setups over the past few weeks. The establishment of a bullish ABC correction following the termination of a classic 1-5 Elliott Wave Pattern is the latest development on the price chart.

The price has subsequently rebounded from the 38.2 per cent Fibonacci retracement and broken down below the major support at 1.10740, which is also the neckline of the former Head and Shoulders Pattern.

If the expectations from Friday’s report are met, the price action is likely to extend the current bearish downswing. The opposite is true if the findings of the report miss the consensus forecasts.