At its April policy meeting from earlier today, the Monetary Policy Committee (MPC) of the Reserve Bank of New Zealand expectedly decided to maintain the near-negative Official Cash Rate (OCR) unchanged at 0.25 per cent.

The RBNZ will also be keeping the same level of asset-purchasing in order to foster higher consumer prices in New Zealand and to support the still tentative recovery in the country.

The current stimulatory level of monetary settings will be maintained in order to meet our consumer price inflation and employment objectives. The OCR remains at 0.25% and the Large Scale Asset Purchase and Funding for Lending programmes unchanged 👉 https://t.co/0mjsabluU2 #rbnz pic.twitter.com/THPC21PVpl

— Reserve Bank of NZ (@ReserveBankofNZ) April 14, 2021

RBNZ's monetary policy stance continues to be structured in a way that would allow for maximum employment and headline inflation converging towards the 2.0 per cent target level in the long term.

Meanwhile, the MPC remains cautious of the widening discrepancies in recovery that are observed in different countries. These fears resonate with what the International Monetary Fund (IMF) had recently laid out as a potential impediment to future growth.

In the policy statement of the RBNZ it was also argued that:

" Ongoing fiscal and monetary stimulus are continuing to underpin the global recovery in economic activity. However, economic uncertainty remains elevated and divergences in economic growth both within and between countries are significant. New Zealand’s commodity export prices continue to benefit from robust global demand. […] The Committee agreed to maintain its current stimulatory monetary settings until it is confident that consumer price inflation will be sustained at the 2 percent per annum target midpoint […]. "

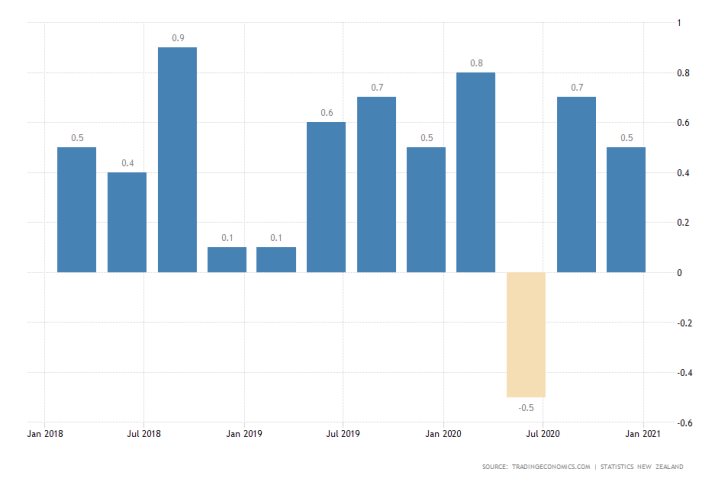

For the time being, headline inflation in New Zealand remains considerably subdued, lagging behind the medium-term goals of the RBNZ at around 0.5 per cent.

The New Zealand dollar jumped against the greenback yesterday following the release of the latest inflation rate numbers in the U.S., and this trend was bolstered today after the RBNZ's policy decision was published.

As shown on the 4H chart below, the NZDUSD rebounded from the lower boundary of the ascending channel recently, which was forecasted quite accurately by our Weekly Expectations article.

The rebound caused the 50-day MA (in green) to cross above the 100-day MA (in blue), which represents a robust bullish signal in itself. Nevertheless, the long-term bullish commitment in the market is not yet confirmed.

The price is yet to test the floating resistance that is the 200-day MA (in purple) before it could probe the next resistance level at 0.71500. A potential rejection at the 200-day MA could prompt a throwback to the minor support level at 0.70650.