No Need for RBA to Rush Adopting a More Hawkish Policy Stance

Market liquidity looks poised to drop even more over the next several days due to the lack of major economic releases in the calendar. However, the AUDCAD is likely to register the most significant price movements. Due to the Loonie's correlation with the price of crude oil, you can prepare yourself for trading the pair by checking out our last analysis of the commodity.

The Governing Board of the Reserve Bank of Australia (RBA) is meeting on Tuesday to deliberate on its current monetary policy stance. Arguably, this looks like the most impactful event on the calendar in an otherwise quite uneventful week.

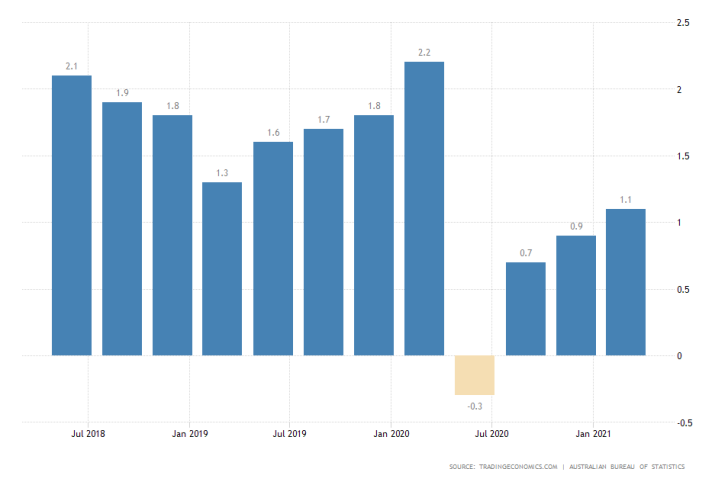

Unlike the FED, the RBA has fewer incentives to adopt a more hawkish policy stance. This is owing to the fact that the pace of inflation growth in Australia remains slower than in the U.S.

The market is therefore expecting the RBA to maintain the near-negative Official Cash Rate unchanged at 0.10 per cent. RBA's asset purchase rate is also expected to be kept the same.

U.S. Initial Jobless Claims Projected to Grow Marginally

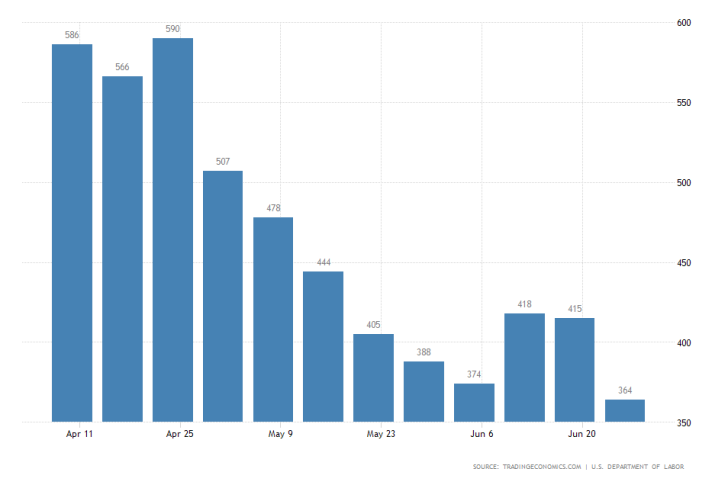

Volatility on the dollar is likely to increase temporarily on Thursday when the U.S. Department of Labour is scheduled to publish the latest initial jobless claims data.

According to the preliminary forecasts, the number of people claiming unemployment benefits is projected to grow by 375 thousand. This would mark a marginal deterioration from the previous week's expansion of 364 thousand.

The U.S. labour market is continuing to perform robustly, managing to add new jobs faster than initially expected. If this trend is preserved, the recuperation of the greenback is likely to be extended further.

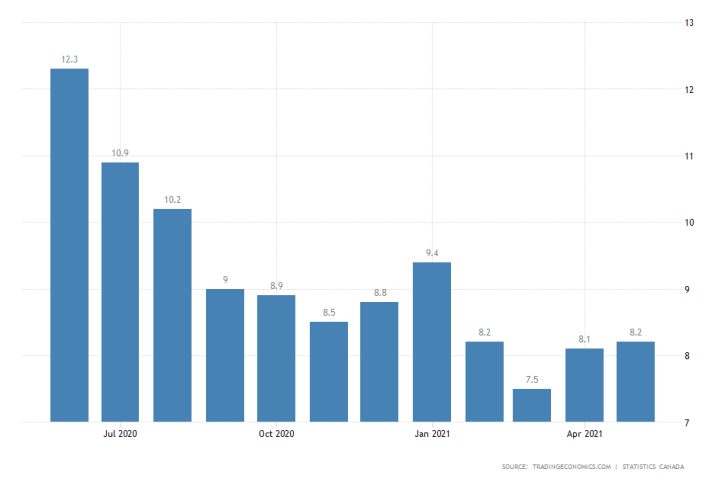

Canada's Headline Unemployment Likely to Remain in Range

On Friday, Statistics Canada will release the unemployment numbers for June. According to the preliminary forecasts, the rate is projected to be revised back to 8.1 per cent from last month's marginal uptick.

These forecasts do not envision a substantial change in headline unemployment, which is why it is unlikely for the Canadian dollar to be underpinned by massive fluctuations following the release of the data.

That is why the Loonie's direction will instead be primarily dependent on whether the price of crude oil establishes a bearish correction over the near term. Given these expectations for somewhat weakened Loonie and the policy meeting of the RBA, the AUDCAD pair is likely to establish the most significant price swings over the next several days.

As can be seen on the 4H chart below, the AUDCAD established a Descending Wedge pattern, which in itself is demonstrative of a potential bullish rebound from its lower end. The likelihood of such a rebound taking place is bolstered by the fact that the Wedge appears to be bottoming out at the major support level at 0.92650.

Moreover, bullish pressure appears to be rising now that the price action has reached the lower end of the broader consolidation range, as underpinned by the Stochastic RSI indicator.

If the price manages to penetrate above the upper boundary of the Wedge, it is likely to then pull back before continuing to head higher. The first target is the 61.8 per cent Fibonacci retracement level at 0.93402.

Other Prominent Events to Watch for:

Monday - OPEC JMMC Meetings; Australia MoM Retail Sales.

Tuesday - U.S. ISM Services PMI.

Wednesday - FOMC Meeting Minutes.

Thursday - RBA Governor Lowe Speaks; U.S. Crude Oil Inventories; G20 Meetings.

Friday - BOE Governor Bailey Speaks; China YoY CPI.