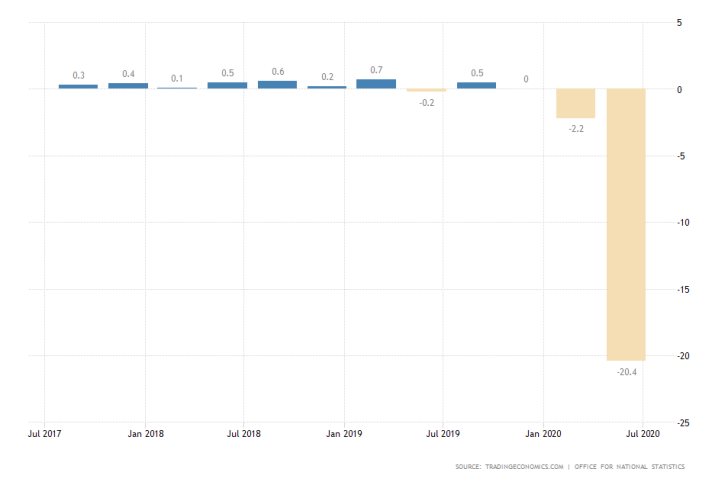

Gross Domestic Product data showed that the British economy has entered into recession after having contracted by 20.4 per cent in the second quarter. The preliminary GDP findings of the Office for National Statistics are almost completely inlined with the initial market expectations of a 20.5 per cent contraction.

The double-digit slump is the biggest in Europe and has been exacerbated by the ongoing gridlock in Brexit negotiations, which have been impeded by the sudden coronavirus crisis.

Additionally, the massive drop in the growth rate is attributed to the Government's containment policies, which were intended to curtail the spread of the virus, but hurt the overall economic activity.

Even though this 20.4 per cent drop underscores the massive impact of the coronavirus fallout, the Pound was not crushed in the wake of the data publication for two reasons.

Firstly, the market had already started to price in such a gloomy scenario, which negated the shock value of the news and lessened the overall market surprise.

Secondly, the quarterly data has a lagging factor that needs to be acknowledged. The British Government has already started to ease these containment restrictions, which would likely result in a rebound in Q3's economic activity.

Thus, investors are hoping to see at least a partial V-shaped rebound from Q2's dip when the GDP data for the three months ending in September is released by the end of the year.

Nevertheless, these hopes are jeopardised by the threat of a second coronavirus crisis. There is mounting evidence highlighting the resurgence of COVID-19 cases globally, which means that the healthcare crisis persists.

Boris Johnson's cabinet could thus be compelled to stop easing the lockdown measures early on and to reimpose more stringent restrictions in a bid to lessen the adverse impact of a forthcoming second wave on the strained NHS.

Such actions would put additional pressure on Britain's tentative recovery, and likely deliver a more lasting blow on the value of the sterling. Meanwhile, more and more central banks are readjusting their monetary policy stances in anticipation of new dropdowns in the global economic activity as prospects continue to worsen.

Today's GDP data in the UK supported the advance of the EURGBP pair in the short run. As can be seen on the hourly chart below, the 30-day MA (orange) is about to cross above the 50-day MA (blue), which is underlining an increase in bullish pressure in the near term.

The biggest test for the current bullish correction will be once the price action reaches the descending trend line (in red), which currently converges towards the consolidation range's upper boundary.

Reversals in the underlying direction of the price action can be anticipated either there, or from the 38.2 per cent Fibonacci retracement level at 0.90340.