The first major event for this week is going to be undoubtedly the monetary policy meeting of the Board of the Reserve Bank of Australia and their deliberation on the topic of an appropriate interest rate level, and whether the most recent economic developments both internally and externally warrant any changes to the underlying cash rate. The meeting and the post-decision statement before media are scheduled for Tuesday.

After almost three years going by without the implementation of any drastic changes to its monetary policy, the Board has opted to cut the rate on the last two monetary policy meetings, with 25 basis points both times. Thus, the rate has been decreased from 1.50 per cent in May to the current level of 1.00 per cent, which occurred in early May.

Even though the RBA has backed those two monetary decisions by pointing to waning global growth and inhibited international trade as the core reasons for the two cuts, Donald Trump has implicitly criticised such policies of major central banks, as indulging in unfair currency manipulation, which gives the respective countries clear competitiveness advantage over other countries with higher interest rates, insofar as foreign investors are drawn to the more relaxed interest conditions.

Regardless, the Board of the RBA has opted to cut the rate on the two distinct occasions because of the resulted vulnerability of the labour market from external downside risks and also because of internal subdued inflationary pressures, in addition to the already observed global trade tensions and lessened manufacturing and investment rates. In its last statement, the Board argued that:

“This easing of monetary policy will support employment growth and provide greater confidence that inflation will be consistent with the medium-term target. […] the uncertainty generated by the trade and technology disputes is affecting investment and means that the risks to the global economy are tilted to the downside. […] In most advanced economies, inflation remains subdued, unemployment rates are low and wages growth has picked up.” [source]

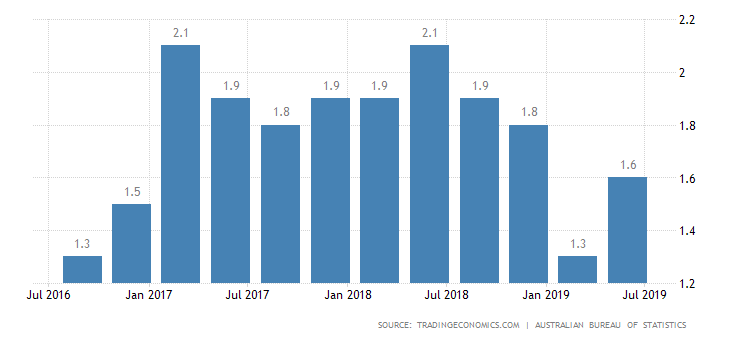

Moreover, while the Australian labour market has remained almost entirely unchanged in the second quarter of 2019, with the overall unemployment rate remaining at the same level of 5.2 per cent since April, inflation has expectedly just started to pick up in July as oil prices have also risen in the previous month (you can read more about the Australian inflation and its current ramifications for the broader economy here).

Overall, the RBA is expected to remain cautious of the currently developing economic situation, and the general forecasts dismiss the possibility for a new rate cut at present. While inflation has picked up with 0.3 per cent in July it remains noticeably below the 2 per cent target level, and at the current time it does not necessitate further reductions of the cash rate, but it also does not warrant any hikes either. As regards the labour market, there have not been any evident changes in employment to necessitate urgent interventions by the RBA.

The recently renewed escalations of the trade tensions between the US and China could be a potential point of concern, and the Board is most certainly going to address them, however, owing to their short-lived impact on the global markets, the Board would most likely prefer to wait and observe the situation as it evolves without rushing to respond prematurely. Thus, all of the major economic forecasts expect the Board of the RBA to maintain the cash rate unchanged at the current 1 per cent level.

The AUDUSD is currently depreciating in value for the 12th consecutive day nearing the historical support level of 0.67400, which has not been reached in more than a decade, the last time being May of 2009.