The dollar continues to be impacted by strong diverging factors, such as the robust Big Tech earnings data and FED's policy decision. Find out how much could the greenback rally on this heightened enthusiasm from our comprehensive GBPUSD analysis.

In its highly anticipated July policy meeting, the Federal Reserve expectedly decided not to lift the near-negative Federal Funds rate. The latter was thus kept unchanged at 0.25 per cent.

The Federal Open Market Committee (FOMC) did not bring anything new to the table as the scope and pace of the underlying asset purchasing programme was also maintained the same. This weakened the dollar marginally in the first few trading hours following the meeting.

As shown on the 4H chart above, the recent breakout of the EURUSD above the descending channel was bolstered yesterday.

Following a failed test of the 150-day MA (in orange) and a throwback to the channel from above, the price action was then able to penetrate above the 38.2 per cent Fibonacci retracement level at 1.18361 decisively.

Presently, the price action is probing the 200-day MA (in purple). If it fails to break it from the first attempt, a pullback to 1.18361 may follow next. This is further substantiated by the fact that the 150-day MA has now taken the new role of a floating support that is converging with the 38.2 per cent Fibonacci level.

Even still, the 23.6 per cent Fibonacci at 1.18892 represents the next most likely target for the upswing. This assertion is supported by the fact that the underlying bullish momentum remains quite significant, as underpinned by the MACD indicator.

Read Chair Powell's full opening statement from the #FOMC press conference (PDF): https://t.co/RjyCtjAGEZ

— Federal Reserve (@federalreserve) July 28, 2021

Heightened inflation is still being seen as a consequence of transitionary factors

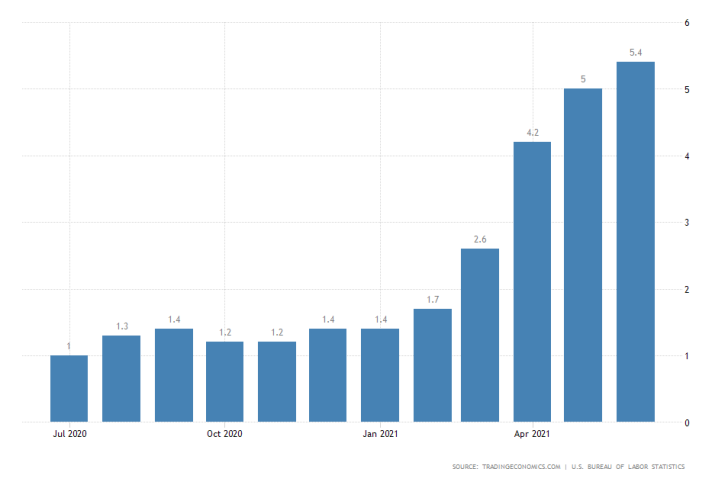

Jerome Powell and his colleagues from the Committee virtually maintained the same stance from their previous meeting in June. Inflation is converging moderately above the 2.0 per cent target level in the short term, but longer-term price pressures remain subdued.

"With inflation having run persistently below this longer-run goal, the Committee will aim to achieve inflation moderately above 2 percent for some time so that inflation averages 2 percent over time and longer-term inflation expectations remain well anchored at 2 percent."

Part of the reason prices have surged over the past several months is owing to pandemic-related complications. Global supply bottlenecks continue to represent a major impediment to international logistics, which is being felt across multiple sectors.

Both Tesla and Apple reflected on the negative impact that these bottlenecks are exerting on international deliveries and production in their earnings reports for the previous quarter.