The central economic event for this week will be the release of the jobless claims report in the US, which is scheduled for Thursday. The ‘Department of Labor’ is expected to shed more light on the current condition of the virus-stricken labour market in the states, which is impeded by the national lockdown.

The importance of the event is further solidified by the fact that this report will provide empiric data highlighting the real impact of the coronavirus on the American economy. So far, the market rout has been prompted mostly by investors’ anticipations regarding the probable hit on economic growth.

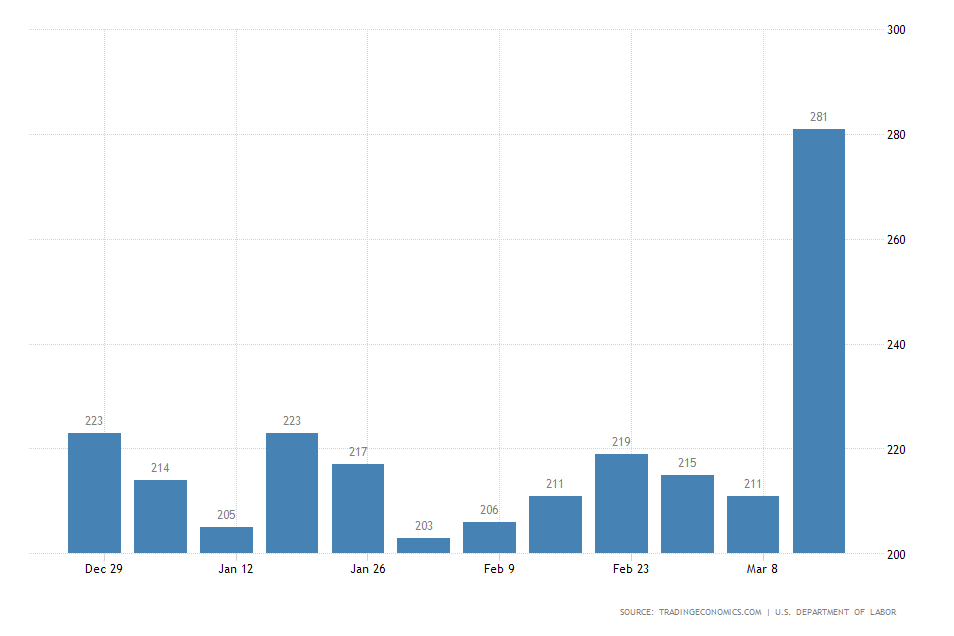

In the week ending March the 14th, the Labor Department reported 281 thousand claimants for unemployment benefits, which was way above the forecasts for 220 thousand. The number of Americans filling for such help rose by 70 thousand from the 211 thousand that were recorded in the previous week.

This was a considerable upsurge at a time when the initial impact of the national lockdown was just beginning to be felt.

Since then, more people have started isolating themselves at home under the ‘Social Distancing’ strategy, which means that this week the number of Americans claiming unemployment benefits is likely to be much higher. The consensus forecasts project that number to reach 750 thousand.

If realised, this number would be a solid confirmation of the gravity of the current situation and validate investors’ fears. The initial claims data is going to manifest the scope of the economic hit on the American economy so far, and likely underpin the potential future losses.

Thereby, the anticipated exponential surge in the number of people claiming unemployment benefits is one of the first key metrics that can be used by policymakers for developing future monetary interventions and adjustments to the virus agenda.

The FED can use the data to structure future stimulus packages for individuals and businesses alike, which is what makes Thursday’s report so important.

In a phone call with Bloomberg media, James Bullard, President of the Federal Reserve Bank of St. Luis, expressed his grim outlook on the American labour market’s current state.

Bullard projected a massive 30 per cent rise in the US unemployment rate and a 50 per cent drop in the Gross Domestic Product for the second quarter.

According to him, these deteriorations in Q2 are going to be caused by the distortions in the underlying economic processes, in a bid to curtail the spread of the coronavirus. Despite Bullard’s bleak forecasts for the current quarter, his longer-term expectations project a quick rebound by the end of the year.

“I would see the third quarter as a transitional quarter with the with the fourth quarter and first quarter next tear as quite robust as Americans make up for lost spending. These quarters might be boom quarters.”

Thursday’s report could disrupt the strengthening of the US dollar temporarily, which is currently being influenced by panic buying of liquid assets internationally. Emerging markets start feeling the strain of the global economic contraction, as local investors’ demand for the greenback skyrockets.

Meanwhile, the initial claims data could support the current attempt of the EURUSD at forming a pullback above the significant support level at 1.07800.