Fighting in Ukraine Intensifies as Ukrainian Resistance Ramps Up

Russia's invasion of Ukraine last week sent global markets into a frenzy underpinning massive upsurges of adverse volatility. One of the most affected assets was crude oil, which broke out above the psychological threshold of $100 per barrel. You can read more about the commodity from our newest comprehensive analysis.

Unsurprisingly, the most significant driver of price action over the next five days will be the ongoing war between Ukraine and Russia, as fighting in Kyiv and Kharkiv intensifies. Expect adverse volatility to remain heightened as there are no clear indications of what might happen next.

Ukraine has submitted its application against Russia to the ICJ. Russia must be held accountable for manipulating the notion of genocide to justify aggression. We request an urgent decision ordering Russia to cease military activity now and expect trials to start next week.

— Володимир Зеленський (@ZelenskyyUa) February 27, 2022

Ukrainian resistance against Russian forces is proving stiffer than initially anticipated by most experts, staving off the advance on Kyiv. Meanwhile, the West is ramping up its sanctions on Russia. Earlier today, it was announced that several Russian banks would be excluded from swift.

Stocks are likely to continue seesawing, while demand for lower-risk securities is likely to remain high. Bitcoin managed to recover partially from the initial market shock.

Powell to Testify on Monetary Policy in Washington

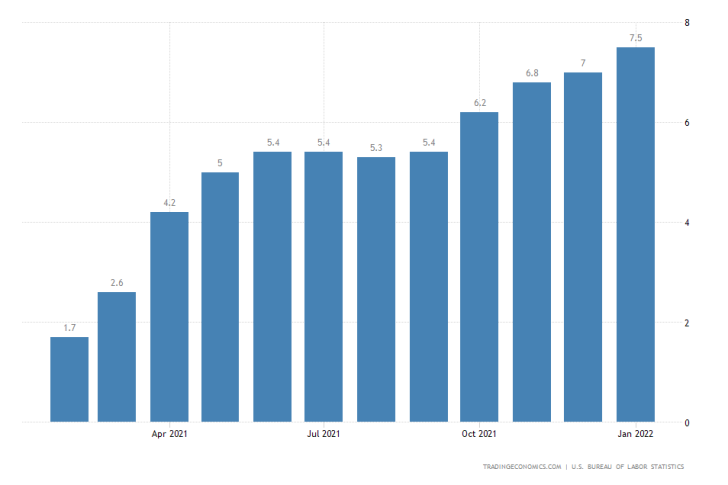

Fed Chair Jerome Powell is scheduled to testify on the semi-annual monetary policy report before the House Financial Services Committee on Wednesday and Thursday. The war in Ukraine will weigh down on global logistics, quite possibly exacerbating the already strained supply bottlenecks. Mr Powell will thus comment on Fed's plans to curb inflation, which jumped to 7.5 per cent last month.

Mr Powell will likely adopt an even more hawkish stance in order to reassure markets that the FOMC remains committed to mitigating inflation growth in light of recent developments. This would be reflected on the dollar in the short term.

U.S. Manufacturing Forecasted to Bounce Back in February

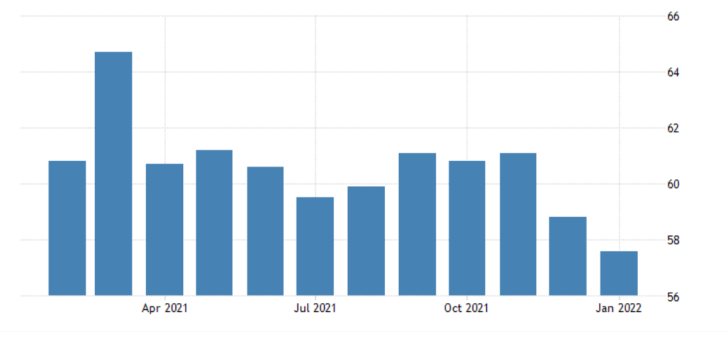

The Institute for Supply Management (ISM) will post the manufacturing PMI data for February on Tuesday. According to the preliminary forecasts, factory activity is expected to bounce back up for the first time in two months, reaching 58.0 index points from the 57.6-point dip that was recorded last month.

Manufacturing grew elsewhere over the same period, prompting expectations for a temporary dollar strengthening shortly after the publication of the data. Nevertheless, the greenback lost some of the ground it had gained against the euro in the initial hours of the Russian invasion of Ukraine.

As can be seen on the 4H chart below, the EURUSD appears to have completed a bearish 1-5 impulse wave pattern, as postulated by the Elliott Wave theory, at the previous swing low at 1.11250. This underscores the apparent completion of the Markdown and the subsequent emergence of a new Accumulation.

Under the expectations of the Wyckoff method, the latest rebound to the 61.8 per cent Fibonacci retracement level at 1.12642 could indicate the snap beginning of a new Markup. The price action is now poised to probe this critical threshold at the market open on Monday.

Other Prominent Events to Watch Out for:

Tuesday - Australia RBA Cash Rate Decision; Canada MoM GDP Growth Rate; China NBS MoM Manufacturing PMI; Germany MoM Retail Sales; Germany MoM CPI.

Wednesday - Australia QoQ GDP Growth Rate; OPEC-JMMC Meetings; Canada BOC Overnight Rate Decision; U.S.

Thursday - U.S. ISM Services PMI; U.S. FED Chair Jerome Powell Testifies.

Friday - U.S. MoM Unemployment Rate; EU MoM Retail Sales.