FED Chair Powell Set to Speak at the Jackson Hole Symposium

All eyes will be fixed on the Jackson Hole symposium taking place this week, on which heads of the most prominent central banks will be laying out their economic outlooks. This is likely to bolster the volatility of the recuperating U.S. dollar. Check out our latest analysis of the EURUSD to get a sense of the broader market sentiment.

The two-day Jackson Hole symposium is scheduled to take place on Thursday and Friday, with its central event being FED Chair Jerome Powell's speech on the second day of the gathering.

Powell is expected to reaffirm FED's newly adopted hawkishness following the July meeting of the Federal Open Market Committee.

We have posted the minutes from the #FOMC meeting held July 27-28, 2021: https://t.co/sMyuFaow4H

— Federal Reserve (@federalreserve) August 18, 2021

Despite some moderate seasonal tribulations, the U.S. economy remains on a path to stable recovery. This is already having an imprint on secondary markets as investors' demand for longer-term securities is rising, meaning that fears of a potential crash in the short term are waning.

This heightened optimism implies that market participants expect FED tapering by early-2021, which is what drives the greenback's rally at present. That is why any additional hawkish hints in Powell's speech on Friday are likely to strengthen the currency even more.

Germany's Industrial Growth Anticipated to Slow Down in August

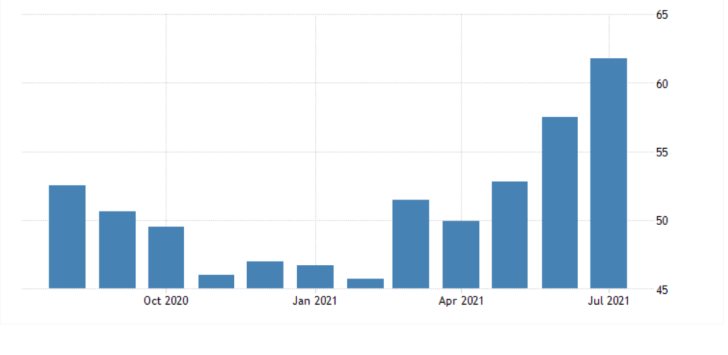

On Monday, the Markit institute will post the latest industry numbers of the biggest economy in the Eurozone. The services PMI data is likely to exert the most significant impact on the market.

The preliminary forecasts anticipate the index to decrease to 61.0 points from the 61.8 points that were recorded a month prior. July's numbers underpinned the biggest monthly expansion of the sector on record.

The projections of a moderate contraction are not really all that surprising given the diminished investors' optimism in Germany that was observed over the same period.

U.S. Economic Growth to be Revised Up Marginally

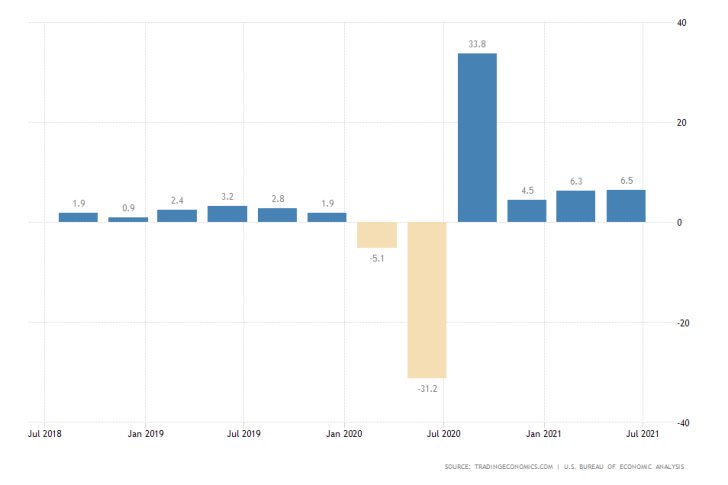

This week's other prominent release will be the U.S. preliminary GDP growth rate survey, which is scheduled for publication on Thursday. The advance gross domestic product numbers for the second quarter are expected to be revised up by 0.1 per cent.

If the consensus forecasts are met, this would mean that the GDP growth rate would be upwardly revised to 6.6 per cent. This would be the highest level since Q2 of 2020.

The Bureau of Economic Analysis will post their findings at the outset of the Jackson Hole symposium, further bolstering the greenback's volatility. This implies that all currency pairs involving the dollar are likely to move by the end of the week.

A particularly interesting setup can be found on the price action of the USDCHF. As can be seen on the daily chart below, the pair is currently consolidating within an increasingly narrower bottleneck (underpinned by the two trend lines).

The price action has been range trading since the 9th of July, which is when the ADX indicator fell below the 25-point mark. Seeing as how the Stochastic RSI indicator is currently threading near its overbought extreme, the USDCHF may be due for another dropdown soon.

In addition to the bottleneck, the price action is also consolidating in a range between the 38.2 per cent Fibonacci retracement level at 0.92009 and the 61.8 per cent Fibonacci at 0.90302. This means that the next dropdown is likely to emerge from the upper limit of the range.

It is, however, likely to be checked by the two floating supports - the 100-day MA (in blue) and the 200-day MA (in orange) - before the price action can test the ascending trend line (in green) and the lower boundary of the range.

Other Prominent Events to Watch for:

Monday - Germany Flash Manufacturing PMI; U.S. Flash Services and Manufacturing PMI; UK Flash Services and Manufacturing PMI.

Wednesday - German ifo Business Climate; U.S. Durable Goods Orders.

Thursday - Jackson Hole Symposium Day 1.

Friday - Jackson Hole Symposium Day 2; Australia MoM Retail Sales; U.S. Core MoM PCE Price Index.