U.S. Inflation Expected to Grow Moderately in October

The recent upsurge in bullish pressure on the dollar is prompting the development of a new major downtrend on the GBPUSD. Meanwhile, the pound selloff is likely to continue in the short term as well. To understand how this week's economic releases will affect this dynamic, have a look at our comprehensive analysis of the cable from last week.

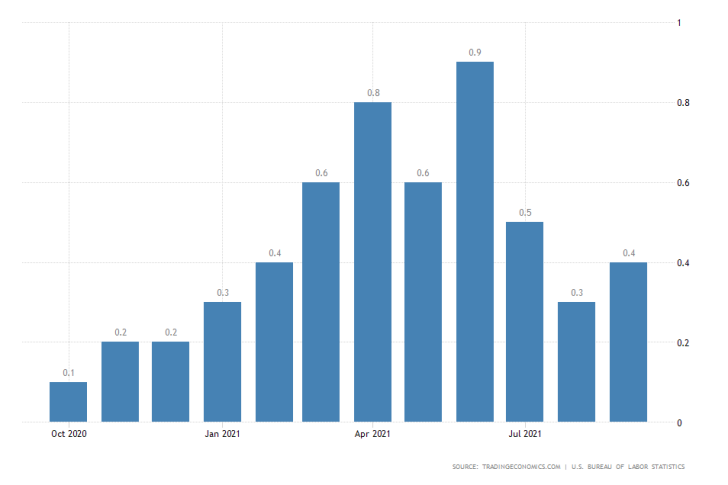

The U.S. Bureau of Labour Statistics (BLS) will publish the latest production prices index (PPI) reading on Tuesday and consumer prices index (CPI) numbers on Wednesday. According to the market forecasts, headline inflation is expected to increase by 0.5 per cent in October, reflecting an upsurge in consumer demand.

The robust employment growth that was recorded over the same period is likely to be the biggest determinant of this pick-up in consumer demand. The U.S. economy is growing steadily despite some minor tribulations such as declining factory activity.

This is why the Federal Reserve decided to taper its asset purchases starting next month.

Germany's Economic Sentiment to Continue Tumbling in November

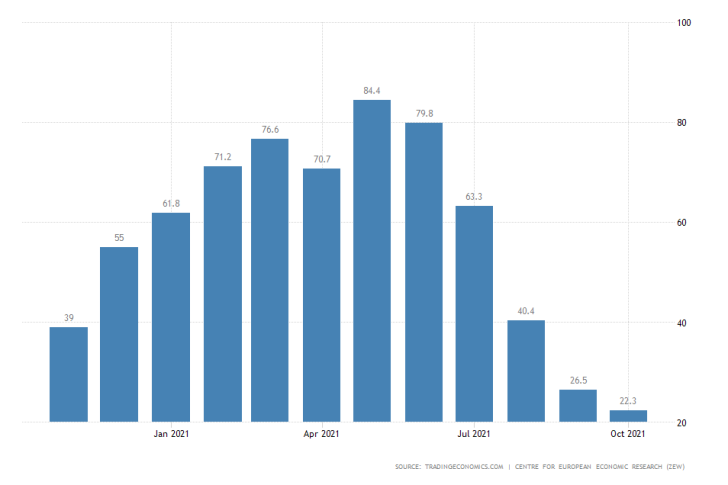

Investors outlook on the Eurozone's biggest economy continues to sink as pandemic fallout stymies activity. On Tuesday, ZEW will post the November economic sentiment data.

The index is projected to sink to 20.3 points from the 22.3 index points that were recorded in October. If these forecasts are realised, this would mean that Germany's economic sentiment would falter for the sixth consecutive month.

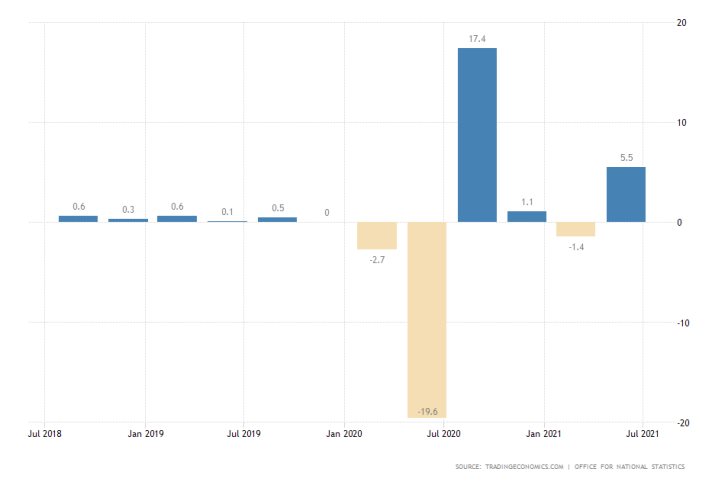

British GDP Growth Rate to Seesaw in the Third Quarter

The pace of British economic expansion is projected to decline in the third quarter. The preliminary GDP growth rate, which is scheduled for publication on Wednesday by the Office for National Statistics, is forecasted to reach 1.5 per cent in the three months leading to September. This would mark a sizable depreciation from the 5.5 per cent that was recorded in the second quarter.

Even still, the Bank of England adopted a very hawkish policy stance last week, when two members of the Monetary Policy Committee (MPC) proposed to lift the Official Bank Rate in light of the overall pick-up in economic activity over the short term.

The U.S. inflation and British GDP numbers are likely to have the biggest impact on the GBPUSD pair. As can be seen on the daily chart below, the price action has been developing a major downtrend since June.

It takes the form of a 1-5 impulse wave pattern, as postulated by the Elliott Wave Theory. The second retracement leg (3-4) was completed recently, which means that the price action is currently in the process of establishing the final impulse leg (4-5).

Given the fractal nature of the price action, there is a very high likelihood that the third impulse leg would be structured as a minor 1-5 impulse wave pattern as well. The ultimate goal is the 38.2 per cent Fibonacci at 1.31632. However, before the price could sink there, it is likely to bounce up and down from the 300-day MA (in green) and 400-day MA (orange) as presented on the chart.

Other Prominent Events to Watch Out for:

Monday - U.S. FED Chair Jerome Powell Speaks; UK BOE Governor Andrew Bailey Speaks.

Tuesday - U.S. MoM PPI.

Wednesday - China MoM Inflation Rate.

Thursday - Australia MoM Unemployment Rate.

Friday - U.S. MoM Preliminary UoM Consumer Sentiment.