With the beginning of the new earnings season, volatility on stocks will increase. Especially among tech stocks. This comes at a time when the market looks poised for a correction. Check out our last analysis of the Nasdaq Composite index to read about the projected drop.

This week's top-tier market mover will be the monetary policy meeting of the European Central Bank, which is scheduled to take place on Thursday. The Governing Council is not expected to implement any major changes from its last meeting.

Asset purchases under the Pandemic Emergency Purchase Programme (PEPP) will continue at the same elevated pace, and the near-negative Main Refinancing Rate will be kept at 0.000 per cent.

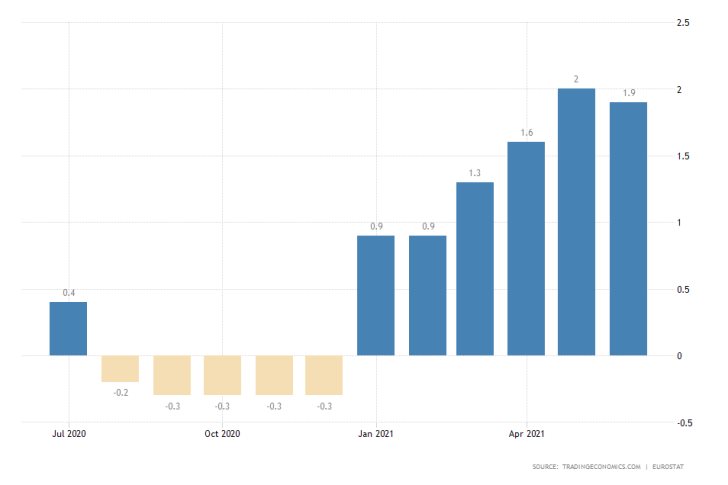

The most important thing to watch for will be the ECB's comments on inflation following the adoption of its new inflation strategy. Especially because prices eased marginally last month.

ECB Chair Christine Lagarde announced that the ECB would strive to foster inflation at a symmetric 2.0 per cent, which means that no upwards or downwards deviations will be tolerated. The euro has been strengthening ever since the announcement was made.

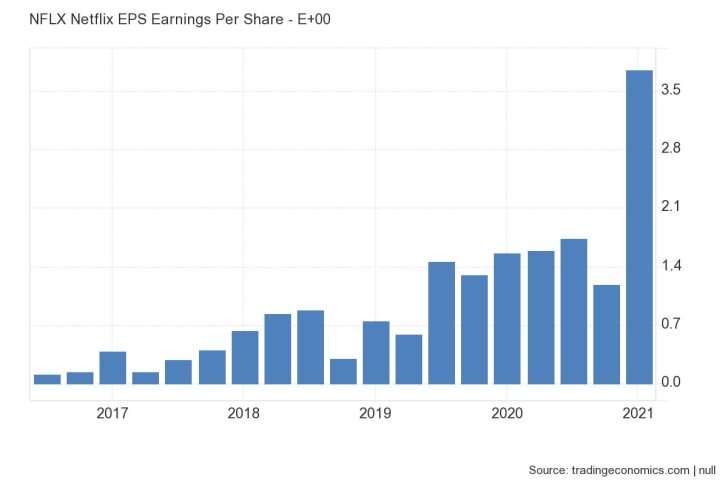

Netflix Kick-starts the Earnings Season on Tuesday

The streaming giant is on line to report quarterly earnings for the three months leading to June on Tuesday. It is still not specified whether the revenue data will be posted before or after the market open.

According to the preliminary forecasts, Netflix will deliver $3.16 earnings per share for Q2. This will measure a slight depreciation from the previous quarter when the company had an all-time record of $3.75 EPS.

Even still, such a performance would constitute a significant improvement from the same quarter last year when Netflix recorded EPS of $1.59.

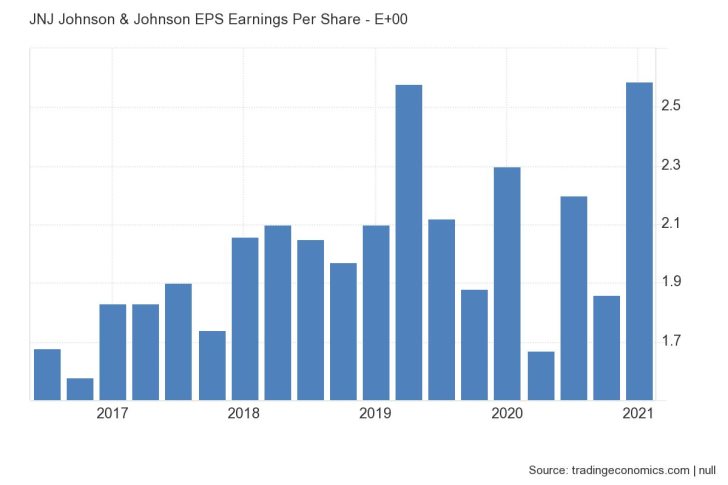

Johnson & Johnson's Woes Likely to be Exacerbated on Wednesday

One of the biggest companies in the U.S., Johnson & Johnson, is scheduled to post its quarterly earnings on Wednesday before the market open. The consensus forecasts expect the pharmaceutical company to deliver EPS of $2.28, down from the all-time record of $2.59 that was observed in Q1.

This would not be a poor performance by any means; however, the expected marginal contraction over the last three months could potentially catalyse a new correction on the company's price action.

As can be seen on the 4H chart below, the price action failed to break out above the psychologically significant resistance level at 700.00 recently. This was the second failed test of said level, underpinning the existence of a strong Distribution area (in red) just above it.

Thus, a lower swing peak was established, implying that the market may be about to establish a new bearish correction. If the price action manages to break down below the 23.6 per cent Fibonacci retracement level at 167.72, it could then head towards the 38.2 per cent Fibonacci at 164.57.

The former is about to be crossed by the 100-day MA (in blue), whereas the latter converges with the 200-day MA (in orange). Meanwhile, the 50-day MA (in green) serves as an intermediate floating support, potentially preventing deeper dropdowns.

The fact that the 50-day MA is concentrated below the 100-day MA means that there is no longer a perfect ascending order of the underlying moving averages. This signifies rising bearish pressure.

Other Prominent Events to Watch for:

Tuesday - Australia RBA Monetary Policy Minutes.

Wednesday - Japan BOJ Monetary Policy Minutes; Coca-Cola Co. Reporting BMO; Nasdaq Inc. Reporting BMO.

Thursday - American Airlines Group Inc. Reporting BMO; Intel Corp. Reporting AMC; Twitter Inc. Reporting AMC.

Friday - Flash Services and Manufacturing PMI data in Germany, France, the U.S., and the UK; Canada MoM Retail Sales;