Morgan Stanley the First Major U.S. Bank to Report Quarterly Earnings

With the beginning of the highly-anticipated earnings season, volatility on the stock market is poised to increase drastically over the coming weeks. To get a deeper understanding of the current state of the market, have a look at our latest analysis of the Nasdaq Composite index.

The earnings season, reflecting the quarterly performance of major U.S. companies for the fourth quarter of 2021, will be kick-started by Morgan Stanley on Wednesday. The bank is expected to release its report before the market open on Wednesday.

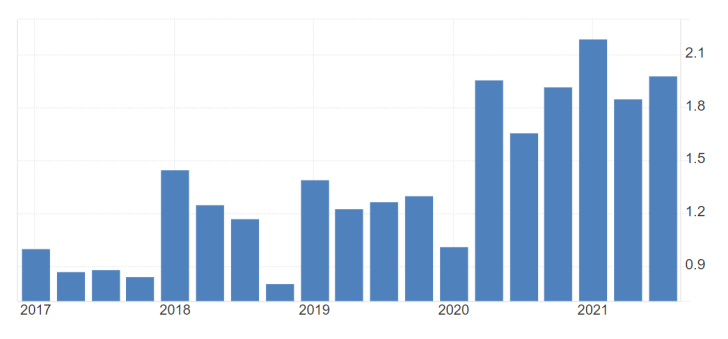

According to the consensus forecasts, Morgan Stanley is forecasted to deliver earnings per share (EPS) of $2.0 for the three months ending December 2021. If realised, this would measure a marginal improvement from the $1.92 EPS that were posted for the same period last year.

Economic Sentiment in the Eurozone Expected to Improve Only Marginally

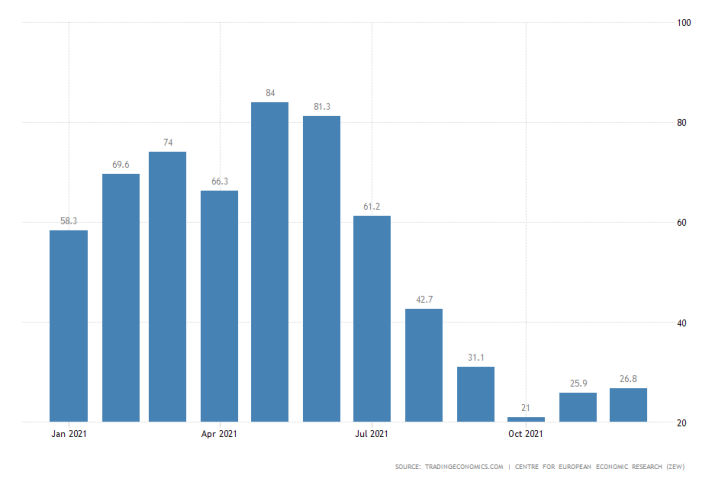

Recovery in the Euro Area remains sluggish, and the overall economic sentiment is expected to remain substantially subdued. However, a marginal improvement is expected to be recorded on a monthly basis.

The ZEW economic sentiment indicator is forecasted to reach 29.2 points in January, exceeding the 26.8 index points that were recorded a month prior. The report is scheduled for publication on Tuesday.

Investors remain wary as inflation growth keep breaking old records, though a moderate increase in German consumption last month elucidates that the tentative and fragile recovery of the economies in the bloc could yet accelerate.

The anticipated sluggish improvement in headline sentiment could therefore help the struggling euro rise higher amidst a general dollar selloff, though bullish commitment on the single currency remains far from being decisive.

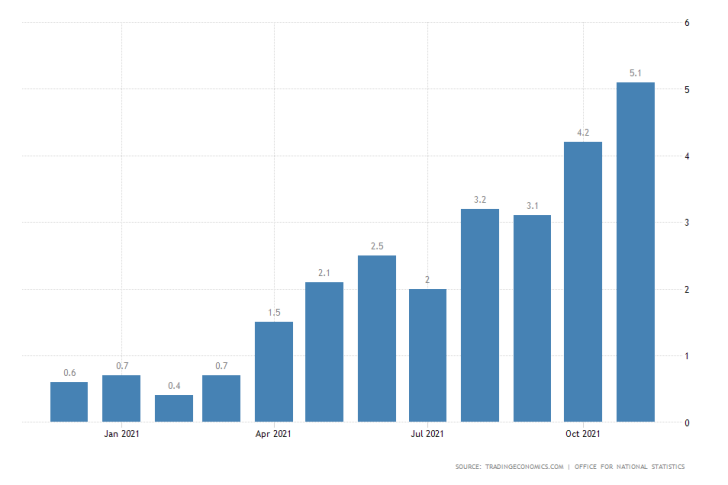

UK Inflation to Rise to a Decade-Peak on Accelerating Pace of Recovery

Again on Wednesday, the Office for National Statistics in the UK will release the newest consumer price index (CPI) revision. The preliminary forecasts expect headline inflation to accelerate to 5.2 per cent in December from the 5.1 per cent recorded a month prior.

This is likely to have a negative impact on the pound in the short term, given that the rate of economic expansion for the same period was weaker than anticipated. For that reason, the price action of the EURGBP is likely to continue climbing higher.

As can be seen on the 30 Min chart below, the price action continues accelerating within the boundaries of an ascending channel. Moreover, the latest upswing appears to be behaving as per the expectations of the Elliott Wave theory.

After completing a minor 1-5 impulse wave pattern, it started developing an ABC correction. Currently, the price action is busy developing the final BC leg of the correction, following the reversal from the 23.6 per cent Fibonacci retracement level at 0.83534.

Bulls can therefore look for signs of another rebound to signify the completion of the ABC structure and the continuation of the broader uptrend. This is likely to occur either around the 61.8 per cent Fibonacci at 0.83387 or the major resistance-turned-support area (currently in green). The latter is also currently converging with the lower limit of the ascending channel.

Other Prominent Events to Watch Out for:

Monday - China QoQ GDP Growth Rate; U.S. Bank Holiday;

Tuesday - Bank of Japan Policy Decision; UK MoM Unemployment Rate.

Wednesday - Canada MoM Inflation Rate; UK BOE Chair Bailey Speaks; Germany MoM Inflation Rate; Alcoa Corp reporting AMC; Bank of America Corp reporting BMO.

Thursday - Australia MoM Unemployment Rate; U.S. MoM Unemployment Claims; American Airlines Corp. reporting BMO; Netflix Inc. reporting TAS.

Friday - UK MoM Retail Sales; Canada MoM Retail Sales; Eurozone ECB President Lagarde Speaks.

BMO - Before Market Open; AMC - After Market Close; TAS - Trade at Settlement.