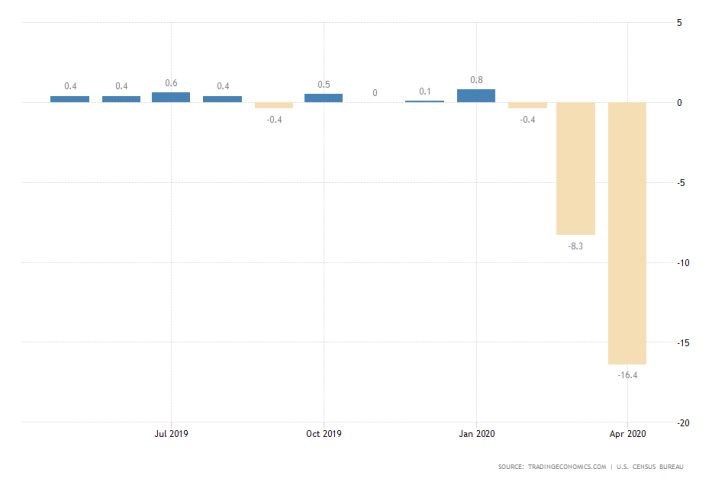

The retail sector of the US economy just had its worst month as the aggregate sales plummeted by 16.4 per cent. This is the steepest monthly decline on record, which exceeded the consensus forecasts of a 14 per cent deterioration.

The massive tumble is attributed unsurprisingly to the coronavirus epidemic in the US, and the government's efforts to contain the outbreak by enforcing stringent policies of social distancing.

The findings of the Census Bureau for April come just a day after Jerome Powell's remarks delineating on the far-reaching economic complications stemming from the coronavirus fallout.

This is likely to bolster investors' overall concerns further as they have started to question the recent stock market rally, and whether or not stocks are currently being overvalued.

Additionally, the muted retail numbers have also underscored the weak inflation data that was released earlier in the week, thereby signalling the deepening of the price stability crisis in the country.

As more and more people are now being laid off from work, with some 20 million US citizens becoming unemployed since the beginning of the coronavirus crisis, the muted inflationary pressures are likely to persist in the foreseeable future.

This, in turn, is going to impede the normalisation of the general economic activity, as consumer spending is now anticipated to deter growth. Meanwhile, these distortions are unlikely to be even across all sectors of the broader economy.

For instance, the segment of the comprehensive retail sales report that recorded the most substantial collapse in April that reached nearly 80 per cent is clothing and accessories. At the same time, sales at gasoline stations fell by almost 30 per cent.

The latter, however, is much likelier to register a snap rebound next month, as the oil prices start to stabilise following the somewhat mitigation of the turmoil in the energy market that shattered the price of crude oil last month.

All of this seems to confirm some policymakers fears that the road to economic recovery is going to be rocky and uneven, thereby making a V-shaped recovery seem much less likely due to these massive discrepancies in the overall price stability in the States.

All underlying factors seem to suggest that the FED would have a difficult task ahead in achieving its price stability goals, which would also have a negative impact on the US dollar's strength.

The greenback is experiencing some difficulties in the short run as well, with the EURUSD bouncing back up within range of the minor resistance level at 1.08800 and the minor support level at 1.08280.

With the underlying bullish momentum picking up speed once again, the pair is likely to test the strength of the resistance level one more time.

If a successful breakout does indeed form, the newly evolving bullish trend's next goal would be the major resistance level at 1.09880.