Early on Tuesday morning the RBA released its comprehensive report from the last session on the 4th of June, at which the board of directors decided to lower the primary interest rate with 25 basis points to 1.25 per cent. The statement of the central bank deliberated in details on the leading causes, which compelled the board of directors to reach such a decision, and it also revealed hints about its future policy.

Regarding the current situation of the global economic conditions, the RBA commented on the slight increase in real GDP growth in some economies for the quarter ending in March relative to the same period of 2018, which is welcoming news, even though labour markets' remain tight'. Seemingly, the Reserve Bank of Australia appears mostly concerned with the conditions of the global manufacturing sector, which had remained weak for the period.

“New export orders had been little changed at subdued levels and growth in industrial production had slowed in many economies[…].” [source]

The expressed concern, however, did not acknowledge some of the more dubious examples from the international stage, such as the case in the UK, and thus, the RBA skimmed over some relevant facts about global manufacturing. As we have already examined in a previous article, in the particular case of Great Britain, the decline of manufacturing orders for April, has been attributed to the country’s for early completion ahead of the deadline, as a precautionary measure against any potential woes from Brexit (you can read more on the story here). Hence, there has not been any actual hampering decline in manufacturing, and instead, the performance had already been acknowledged in an earlier statement.

As regards domestic economic conditions, the RBA commented on the mixed data.

“Business conditions and consumer sentiment had been broadly stable at or slightly above average levels. […] The overall net effect of lower interest rates was nevertheless expected to boost aggregate household disposable income and thus spending capacity.”

The central bank went further to acknowledge that a smaller interest rate has a different impact on different social groups, and some of them are suffering because of it, however, the ultimate decision of the RBA to lower the rate seems to be dictated by the desire to boost the spending capabilities of as many Australians as possible.

The RBA also commented on the recent trend of rising unemployment by acknowledging that the basket of indicators, which are used to derive models of future trends in the labour market, warns against possible future distortions.

“Forward-looking indicators of labour demand pointed to a moderation in employment growth in the near term […] On a number of measures, it was apparent that the labour market still had significant spare capacity.”

From the remarks expressed by the board of directors of the RBA, it becomes apparent that the intention of the central bank to speed up growth is contingent on the continuation of the trend of rising consumer expenditure. Conversely, the spending is generally expected to be accommodated by the lower interest rates, which are also forecasted to revitalise the demand in the labour market and conversely reduce the unemployment rate, owing to the expected surge in newly created jobs.

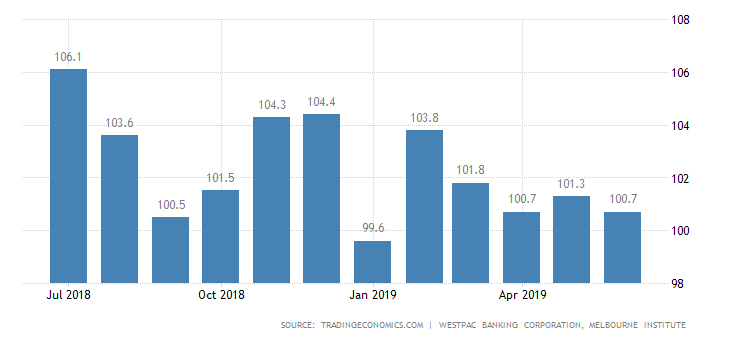

However, the plan of RBA is susceptible to backfire in case that the consumer confidence does not appreciate on the more accommodative monetary policy that had been implemented recently, and therefore the expected growth in overall demand in the economy does not occur. On the whole, the consumer confidence index in Australia has been steadily decreasing throughout 2019 except for January, which was one of the prime reasons for the lowering of the interest rate.

“Members observed that the outlook for the Australian economy also remained reasonable, with the sustained low level of interest rates continuing to support economic activity. A pick-up in growth in household disposable income, continued investment in infrastructure and a renewed expansion in the resources sector were expected to contribute to growth in output over coming years.”

Following the release of the minutes report, the Australian dollar appreciated against its American counterpart, as the AUDUSD pair finished Tuesday's trading session with a 0.34% hike. Thus, the price managed to move above the historically significant support level at 0.68715, which was reached for the last time in January 2016 (disregarding the flash crash from the 3rd of January of this year).

The initial market reaction to the minutes report release was a welcoming change of pace for the Aussie, which is still suffering from the long-term bearish trend. The overall accommodative monetary stance that was implemented by the RBA in early June looks promising and if the central bank manages to realise the goals which it has set before itself, yesterday's trading session could potentially turn into one of the first early signals of a change in the market sentiment. The primary expectation is for the effects of the lower interest rate to start supporting even more economic growth in the future.