BOE Set to Deliberate the Pace of its Asset Purchase Facility

In what looks like the most important event taking place this week, the Monetary Policy Committee (MPC) of the BOE is scheduled to meet on Thursday. The Committee is expected to maintain the near-negative Official Bank Rate unchanged at 0.10 per cent.

Even though economic conditions in the UK have not improved considerably since the last meeting of the MPC, the BOE might consider adopting a slightly more hawkish tone, similarly to what the FOMC of the Federal Reserve did last week.

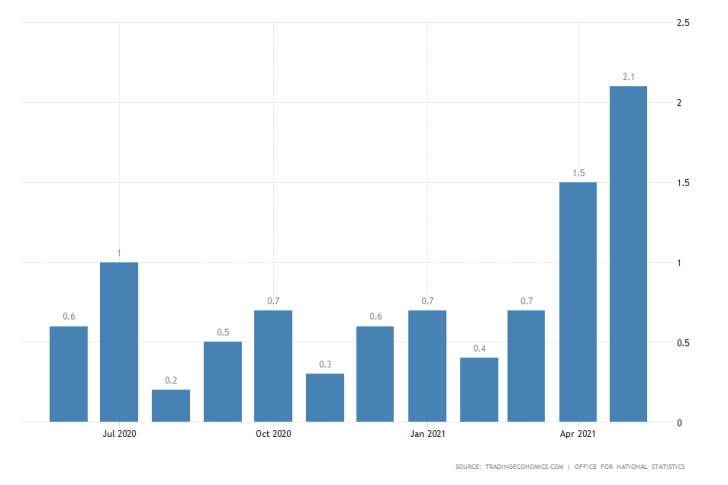

Unsurprisingly, the primary reason for this optimism stems from the improved price stability in the short term. Headline inflation in the UK exceeded the 2.0 per cent target level of the BOE in May, even though longer-term price stability is still subject to the future development of the pandemic.

Coronavirus cases have been surging in Britain recently, which is weighing down on the broader economic activity. That is why the BOE has to decide whether these recent developments warrant the acceleration of the bank's asset purchases.

Powell to Testify Before Congress on Tuesday

FED Chair Jerome Powell will testify before the Committee on Financial Services at the U.S. House of Representatives tomorrow. He is set to discuss the Coronavirus Aid, Relief, and Economic Security Act.

Watch Chair Powell's statement from the #FOMC press conference:

— Federal Reserve (@federalreserve) June 16, 2021

Intro clip: https://t.co/2pJAzzg6dp

Full video: https://t.co/Fk3Op4fK5G

Press Conference materials: https://t.co/3j1trogaL9

Mr Powell is also scheduled to testify before the Banking, Housing, and Urban Affairs at the U.S. Senate on the same day. He will deliver the semi-annual monetary policy report to Congress.

Due to the importance and urgency of the topics that are going to be discussed in length tomorrow, markets may react by resuming the price trends that were initiated last week.

German Services Numbers Expected to Recoup in June

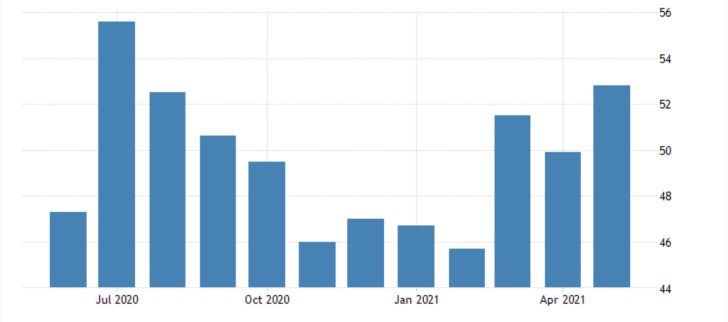

On Wednesday, the Markit institute will post the latest industry numbers for the largest economies in the Eurozone. The German Services data is likely to have the most significant impact on markets.

According to the consensus forecasts, the Flash Services PMI index would jump by 55.4 index points, up from the 52.8 index points that were recorded a month prior. This would be good news for the German economy, following the disappointing sentiment data.

If the forecasts are realised, this will imply not only accelerated growth of the entire sector but would also represent the strongest monthly performance since July 2020.

This would likely strengthen the euro in the very short term. However, the single currency was put under a lot of strain last week as the greenback started to recuperate.

Due to the top-tier events in the UK and the EU, the EURGBP pair is likely to register the biggest price swings this week. As can be seen on the hourly chart below, its price action has already started to appreciate in a new upswing.

Following the successful breakout above the Falling Wedge pattern, the EURGBP went on to consolidate above the 100-day MA (in blue) and the 200-day MA (in orange). The MACD indicator underpins the presently strong bullish momentum.

If the price action manages to break out above the 61.8 per cent Fibonacci retracement level, it would then be able to target the two previous swing peaks.

Other Prominent Events to Watch for:

Monday - Australia MoM Retail Sales; ECB President Lagarde Speaks.

Tuesday - BOJ Monetary Policy Meeting Minutes.

Wednesday - Euro Flash Services and Manufacturing PMI Numbers; UK Flash Services and Manufacturing PMI Numbers; Canada MoM Retail Sales; U.S. Flash Services and Manufacturing PMI Numbers.

Thursday - U.S. q/q Final GDP; EU European Council Meeting; BOJ Kuroda Speaks; U.S. MoM Durable Goods Orders.

Friday - EU European Council Meeting.