Undoubtedly, the most important economic event from this week would be yet another interest rate decision by a major central bank – The Bank of Canada. Most analysts expect the BOC’s Governing Council to maintain the Overnight Rate at 1.75 per cent.

The decision is expected amidst brewing tensions in neighbouring US and recent comments in the public sphere there in regards the "worrisome" global trend of lower interest rates, which is expected to increase the general international trade competitiveness of all major national economies. Conversely, a possible cut in the overnight rate might spark a new round of criticisms from US officials deliberately targeted at the Canadian monetary policy.

"Continued strong job growth suggests that businesses see the weakness in the past two quarters as temporary. Recent data support a pickup in both consumer spending and exports in the second quarter, and it appears that overall growth in business investment has firmed. […] Inflation has evolved in line with the Bank's April projection. The Bank expects CPI inflation to remain around the 2 per cent target in the coming months." [source]

The BOC's last post-decision statement that was released on the 29th of May reflected on the Governing Council's backed trust in the significance of the general economic projections, which would be of significant importance for the outcome of this week's final decision as well.

Since the last interest rate decision, the underlying conditions of the labour market have changed only marginally with the overall unemployment rate rising slightly with 0.1 points to 5.5 per cent in June. You can read an extensive analysis of the Canadian employment and the newest changes in the underlying labour market conditions here.

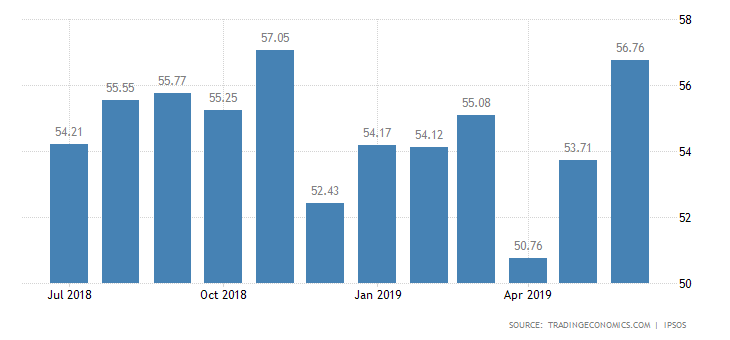

The consumer confidence index in the country has measured a noticeable hike in June, which underlines the expected continuation of the recent trend of robust price stability in the economy, which is also supported by markedly increasing investment rates. The index rose with more than 3 points in the last month, thus reaching 56.76 points.

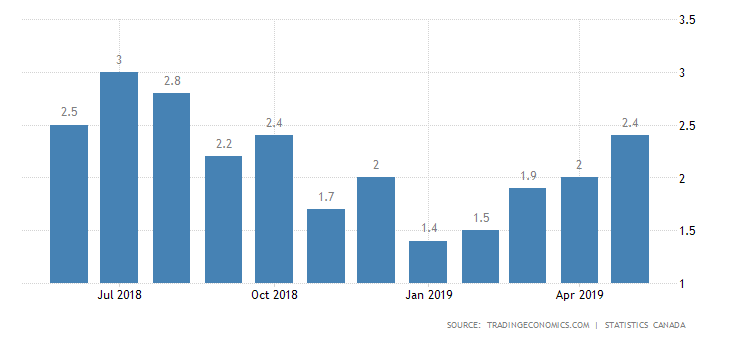

In regards to inflation, the trend of gradually increasing inflation rate that was initiated in January of 2019 was continued in May as well, when the underlying inflation rate surpassed the BOC's target level of 2 per cent and also the market expectations of 2.1 per cent by setting the final tally at a total of 2.4 per cent.

Thus, the inflation rate in Canada has peaked above the desired level and in doing so, has surpassed the initially projected growth rates, which can be perceived as a worrying initial indication of a possible overheating of the Canadian economy.

Overall, the expected continuation of the trend of rising economic growth rate in addition to the spiked underlying inflation rate, a cut the interest rate seems like an improbable outcome. Instead, the BOC's Governing Council might be compelled to take more drastic measures and lift the interest rate to halt the overheating economy by sealing future rises in inflation.