The AUDUSD pair looks poised to complete a major Head and Shoulders, which is a type of pattern that is typically taken to represent probable bearish reversals in the wake of the May meeting of RBA's Governing Board.

The Board expectedly decided not to scale up its current asset purchase facility and to leave the near-negative Cash Rate unchanged at 0.10 per cent. The Bank, however, hinted at the possibility of recalibrating its monetary policy stance in June.

The AUDUSD has been developing the aforementioned Head and Shoulders pattern for quite some time now, and the pair is now seemingly finally ready with the establishment of the Right Shoulder. This signifies a likely breakdown below the neckline of the pattern next.

Interestingly enough, the latter coincides with the 38.2 per cent Fibonacci retracement level at 0.76201, a breakdown below which would make it even more decisive.

Accordingly, the temporary consolidation of the price action below the 23.6 per cent Fibonacci at 0.77690, which roughly outlines the upper boundary of the Right Shoulder, represents a strong indication that the direction of the price is indeed ready to reverse.

First, the price would have to penetrate below the 50-day MA (in green) and the 100-day MA (in blue) before it gets ready to test the 38.2 per cent Fibonacci. Afterwards, the new downtrend would be ready to attempt diving towards the next psychological target - the 61.8 per cent Fibonacci at 0.73794.

The market has been range-trading since the 26th of February, as illustrated by the ADX indicator, which confirms that the preceding uptrend is now completed. Given the rising selling pressure depicted on the Stochastic RSI, a breakdown below the H&S now seems even more likely.

Faster-than-expected growth but weak inflation

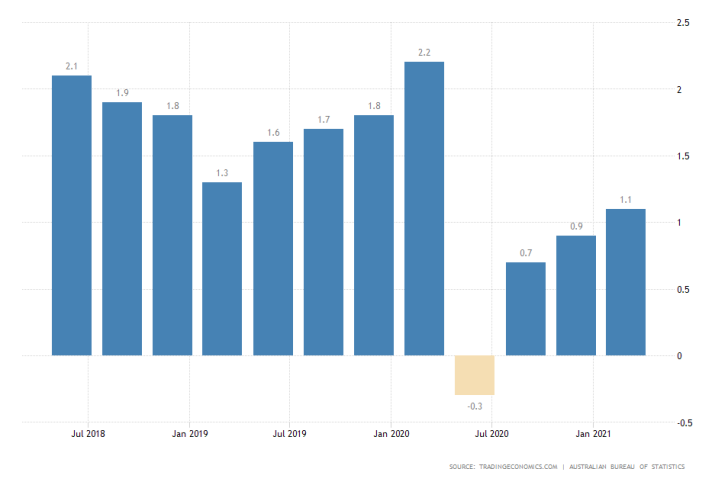

In its monetary policy statement, the Board observed that the pace of Australia's economic recovery was exceeding the initial forecasts; however, inflationary pressures remain subdued.

The continuously weakened price stability in the country represents the most significant reason as to why the Australian dollar is likely to take a dive next. Moreover, the Board observed that the Aussie "remains in the upper end of the range of recent years", which echoes the need for a correction.

At any rate, the RBA does not expect headline inflation to become consistent with its longer-term target until 2023, which means that its current accommodative policy stance is here to stay.

"At its July meeting, the Board will consider whether to retain the April 2024 bond as the target bond for the 3-year yield target or to shift to the next maturity, the November 2024 bond. The Board is not considering a change to the target of 10 basis points. At the July meeting, the Board will also consider future bond purchases following the completion of the second $100 billion of purchases under the government bond purchase program in September. "