The world holds its breath as the prospect of a war between Russia and Ukraine seems to loom larger as U.S. President Joe Biden recently stated that Vladimir Putin, the President of Russia, has already made up his mind to attack to invade. And while the latter continues to deny the accusations, the amount of Russian troops massing near the Ukrainian border is still increasing.

It is impossible to predict with absolute certainty how the situation will evolve next, though the behaviour of the energy market may elucidate the sentiments of investors as they weigh in on each development. Judging by the current behaviour of the price action on both crude oil and natural gas, the market seems more inclined to believe that there would be a peaceful resolution to the situation. Here is why:

History (and market seasonality) matter

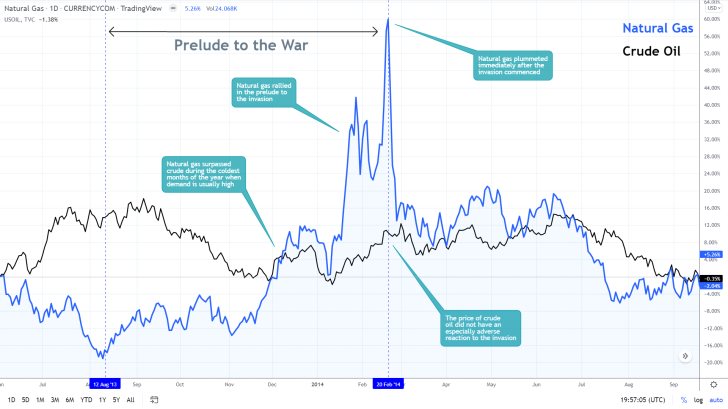

The energy market behaved quite unexpectedly back in 2014, following the Russian invasion and eventual annexation of Crimea. Firstly, it is important to note that Russia remains the largest exporter of natural gas to Europe and a key member of OPEC +, which is why the energy market is so responsive to the geopolitical situation in the country.

What can be discerned on the comparison chart above is that demand for natural gas was bolstered quite significantly in the prelude to the 2014 conflict, adding to the seasonal upsurge in demand that was already being observed towards the end of the year. Adverse volatility on natural gas was exploding while crude oil, though still in an uptrend, was lagging far behind.

Then, quite surprisingly, the day that Russian troops entered Crimea, the price of natural gas collapsed. If the prolonged threat of war had been the catalyst of the rally, then the actual invasion was the release that completely reversed the animal spirits. And since volatility spikes underpin heightened market speculation, we can discern that back in 2014, the animal spirits were expecting the eventual escalation of tensions in Crimea.

Volatility levels this time around are considerably more subdued

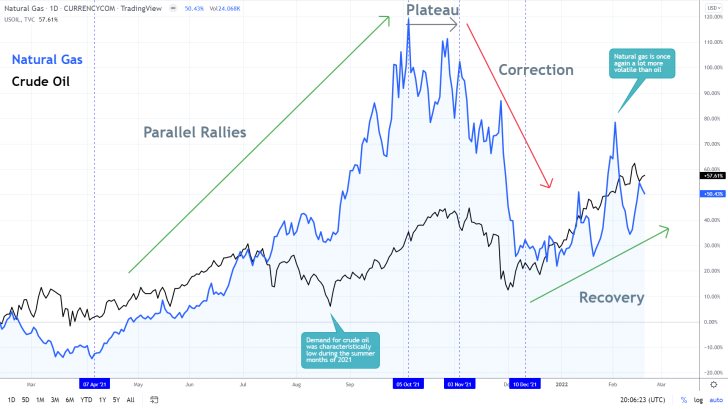

This time around, however, the market seems conspicuously unfazed by the likelihood of Russia invading the rest of Ukraine, at least with regards to the behaviour of the price of natural gas on the second comparison chart above. Even though adverse volatility has been rising steadily since the 10th of December, the price remains well below the levels that were observed beforehand.

The rally that was recorded between early April and early October was at its strongest when seasonal demand was also at its highest. It follows that, unlike in 2014, this time speculations of a potential invasion seem a lot more subdued. Therefore, it is prudent to ask what might cause the next selloff on natural gas.

The new downtrend may have already begun developing, given what can be seen on the daily price chart above. It commenced following the decisive breakdown below the Pennant on top of the previous rally. The breakdown itself was then followed by a throwback to the lower limit of the Pennant, which was converging with the 23.6 per cent Fibonacci retracement level at 5.572 at that time. This confirmed the latter's new role as a major resistance level.

However, the subsequent dropdown was then terminated at the 61.8 per cent Fibonacci at 4.020, as tensions started rising alongside Ukraine's border with Russia in late 2021. This underpins the existence of a major Support Area (in green) just below the 61.8 per cent Fibonacci.

At present, the adverse volatility is driving the price action, which is likely to reach either one of the two Fibonacci thresholds above. The eventual reversal from either the psychologically significant barrier at 5.000 or the major resistance at 5.572 would thus signal the likely continuation of the downtrend. Bears can take advantage of this by potentially implementing trend-continuation strategies.