The Federal Open Market Committee (FOMC), chaired by Jerome Powell, is scheduled to meet this Wednesday in what might turn out to be the most pivotal FED meeting in years. Ultimately, the policy decision of the Committee could have lasting consequences on all facets of economic activity, from housing markets across the world to the pace of global recovery.

According to the preliminary forecasts, Jerome Powell and his colleagues are expected to maintain the near-negative Federal Funds Rate unchanged at 0.25 per cent, in line with FED's long term strategy for fostering maximum employment and price stability. At the same time, market experts and investors would also expect to see a much more hawkish FED clearing the way for a rate hike in 2022, as was recently alluded to by Powell himself, which adds an extra layer of urgency for the Committee.

Under nominal conditions, a rate hike in January would be considered to be premature as the U.S. recovery remains fragile and threatened by external factors. However, both political and socio-economic tensions demanding a swift change are currently on the rise, which might force the FED into action ahead of schedule. In light of this rapidly changing climate, here is our breakdown of the most significant factors that are likely to determine FED's next course of action.

Soaring Inflation Potentially Getting Out of Hand

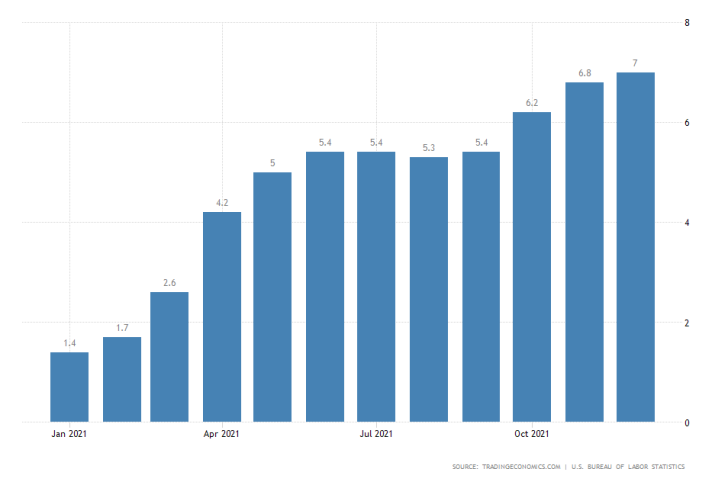

The big elephant in the room that has been percolating on everybody's mind lately is, of course, inflation. Consumer prices jumped to 7.0 per cent in December, the highest level on record in forty years.

The massive increase in headline inflation over the last year is owing in large part to FED's accommodative policy stance. The extensive quantitative easing program was intended to offset the pandemic fallout and foster jobs creation. This has been mostly a success, though the FED seemingly failed to weigh in on the impact that persisting supply squeezes would have on activity.

The Continuous Impact of Global Supply Bottlenecks

The global supply squeeze is the other major factor that keeps pressure on consumer and producer prices. Frequent lockdowns and pandemic restrictions have revealed just how fragile the global supply chains are, unearthing deep structural inadequacies of global logistics. The longer that such a substantial discrepancy in the supply and demand equilibrium is allowed to persist, the longer that inflation pressures would remain elevated.

An acute shortage of homes for sale is driving U.K. housing prices higher https://t.co/anZfdgsk8e

— Bloomberg (@business) January 22, 2022

Inflation at 7.0 per cent alone would generally be enough to prompt a decrease in the underlying QE programme and a possible rate hike, though the situation is less clear-cut in the current context. At any rate, soaring inflation cannot be taken as a direct indication that FED's pandemic response has already delivered on its promise to secure price stability.

When the underlying supply squeeze is thrown into the equation, it becomes apparent that a rate hike might offset (at least temporarily) this negative consequence, but it would also leave the broader economy exposed to the possibility of additional pandemic-related fallout in the future. It is this juxtaposition of fragile recovery against transitionary supply squeezes that makes the decision to increase the rate at present so inconclusive. At worst, it could jeopardise the progress that has been achieved in the wake of the initial coronavirus crash.

The Stock Market May Not be in a Better Place Anytime Soon

On the other hand, the state of the stock market may not get any more suitable to such transformational FED changes anytime soon, which is why Jerome Powell and his colleagues should at the very least consider the possibility of acting now. Despite the recent stocks selloff, major U.S. companies continue to deliver better-than-expected earnings performances for the fourth quarter, beating Wall Street's consensus forecasts.

If the FED is to lift the Federal Funds Rate in 2022, now may be the best time to do it. If such a drastic move is instead conducted at a time when corporate performance falters behind the general expectations - a possibility that is not entirely inconceivable in the near future - this transition would be marked by more uncertainties.

At any rate, the FOMC has to deal with a lot of uncertainties even now, with multiple factors justifying both courses of action - to pursue a rate hike now or to continue waiting patiently. Whatever FED's ultimate decision turns out to be, the market reaction is sure to be significant.