The pace of global growth a year after the pandemic-induced crash exceeds all preliminary expectations, with notable rebounds in economic activity in the U.S. and Europe. Despite these welcoming developments, however, there are some looming threats to the financial system's future stability. Even though the world has coped with the initial coronavirus crunch, many uncertainties remain, which could hurt the already fragile global economy.

As the Managing Director of the International Monetary Fund (IMF), Kristalina Georgieva, recently observed, the persisting coronavirus fallout could widen the evolving debt gap between the developed world and emerging markets. The underlying cause is related to the uneven fiscal and monetary responses to the threat in different areas.

The economic outlook is improving overall, but recovery prospects are diverging dangerously.

— Kristalina Georgieva (@KGeorgieva) April 2, 2021

Emerging & developing economies face a much larger loss in per capita income than advanced economies.

This loss of income could harm millions for years to come. Urgent action needed! pic.twitter.com/uCkEymtZfU

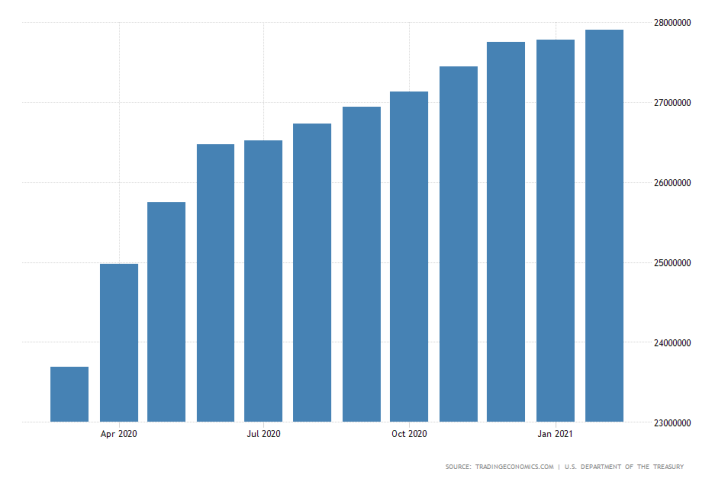

The fiscal stimulus package in the U.S., underpinned by Joe Biden's massive "American Rescue Plan", cushioned the hit on many lower-income American households, which is why consumer sentiment remains quite high. This fiscal injection also resulted in a sizable uptick in the yields of U.S. Treasuries, as well as strengthening the value of the greenback. On the other hand, the spiralling government spending coupled with soaring prices could create a new debt trap threatening the global economic recovery.

The potential ramifications of a new debt bubble are going to be discussed in length tomorrow at IMF's seminary aptly titled "Averting a Covid-19 Debt Trap", which is going to be one of the top-tier events taking place this week. Kristalina Georgieva is going to take part in a panel discussion outlining some of the most pressing dangers associated with soaring debt, being used as pain relief to the coronavirus fallout.

Also tomorrow, the IMF is going to publish the latest "World Economic Outlook" survey, which is also expected to garner significant investors' interest.

"The Analytical Chapters of the World Economic Outlook find that compared to the global financial crisis, the COVID-19 recession had three times the impact on global output in half the time."

The report is going to examine in detail the discrepancies between the mid-term and long-term prospects for global recovery, which remain subject to uneven fiscal and monetary support. Moreover, it is going to expound upon the transformational changes to employment and labour market conditions that were brought about by the pandemic.

"[…] While medium-term losses are expected to be lower than after the global financial crisis, they are still substantial, at about 3 per cent lower than pre-pandemic anticipated output for the world in 2024. The degree of expected scarring varies across countries, depending on the structure of economies and the size of the policy response. […] The labour market fallout from the COVID-19 pandemic shock continues, with young and lower-skilled workers particularly hard-hit. Pre-existing employment trends favouring a shift away from jobs that are more vulnerable to automation are accelerating."

The above-mentioned economic scarring varies across countries, but it is likely to become especially pronounced in developing countries whose recuperation is additionally impeded by the rallying greenback.

As shown, the yields of U.S. and German government bonds continue to climb, whereas yields in emerging markets, such as India remain comparatively subdued. Meanwhile, gold continues to lag behind while the dollar index strengthens.

Tomorrow's statements and economic releases by the IMF are likely to shed more light on the path to full global recovery, contrasted against the experiences learned from the 2008 credit crunch. Economic numbers as of late have been highly volatile, which is why a longer-term outlook on the future prospects for recovery is needed to recalibrate the underlying expectations.