The Federal Open Market Committee (FOMC), with its Chairman Jerome Powell, is scheduled to deliberate on its current monetary policy stance on Wednesday. The massive jump in consumer prices that is being observed globally represents the main point of concern for investors and policymakers alike. The risk of inflation getting out of hand is palpable, leaving many wondering whether the FED should intervene much sooner than initially expected.

The pace of global recovery exceeds all preliminary forecasts, which is what contributes to the heightened energy demand, and consequently to rising consumer prices. However, the main question that Powell and his colleagues at the FOMC need to address is whether this rally would continue to progress steadily or economic activity would falter at some point by the end of the year.

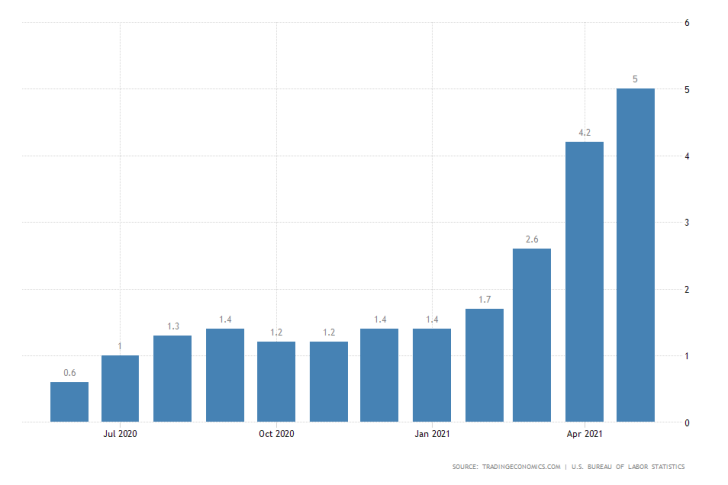

Headline inflation surged to 5.0 per cent in May, above market forecasts. This is the highest reading since the wake of the 2008 Credit Crunch, which underscores the aforementioned concerns. However, the Federal Reserve had previously stated that it anticipates the CPI index to peak by mid-2021 before converging back towards the 2.0 per cent symmetric target level further into the year. So, is there any reason to expect that inflation would diminish on its own over the next several months?

The FOMC would tighten its level of accommodative support on the condition that there are sufficient indications that the financial system can withstand future economic tribulations. This implies taking into consideration additional economic indicators besides inflation.

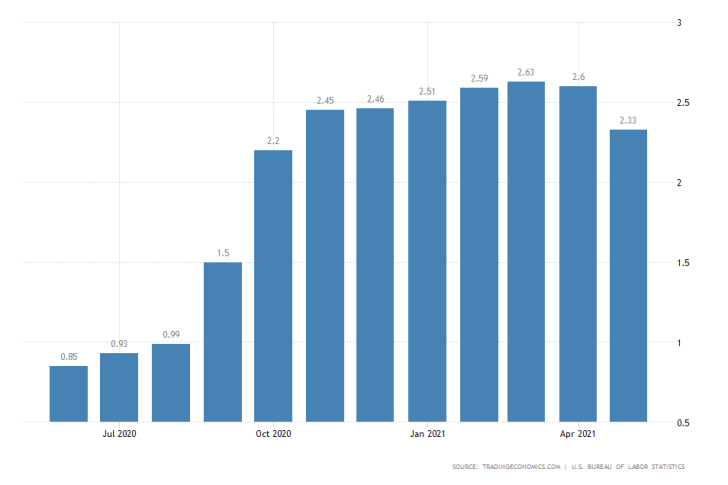

Despite the mixed non-farm payrolls data for May, the decline in long term unemployment represents one such encouraging factor. Last month marked the first instance of a significant monthly drop in persisting unemployment in more than a year, which implies that people finally see it worthwhile to re-join the labour force.

Previously, people were reluctant to do so because of coronavirus concerns or simply because they deemed it unnecessary. Many had preferred to rather stay at home and live off government fiscal support. This is what fuelled the last cryptocurrency rally.

Even so, long term unemployment remains well above the 0.85-0.99 per cent range of mid-2020, which means that monetary policy is still needed to reduce the difference. As regards employment, reducing the level of emergency purchases would be premature at the present rate.

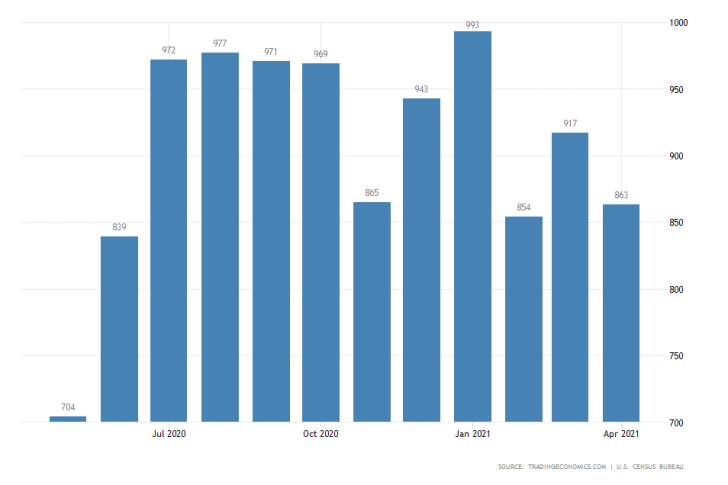

Meanwhile, one of the biggest drivers of inflation - the U.S. housing market - looks poised to lessen its effect on consumer prices over the medium term. As shown on the graph above, new home sales have depreciated on average since last October, which means that aggregate demand is likely to diminish as a consequence.

If this trend is extended over the next several months, it would likely lead to even further easing in consumer prices. Hence, there are reasons to expect that the U.S. economy is already on a path to diminished inflation that is not predicated on an immediate intervention by the FED.

Consequently, there is no need for Powell and the FOMC to implement any drastic measures as soon as Wednesday. The current level of quantitative easing is thus likely to remain unchanged, with the rate of Government treasuries purchases continuing at the same pace. However, that is not to say that the FED should not get back on the drawing board with regards to its longer-term projections.

The vaccination rate and subsequent lifting of restrictions are exceeding all preliminary expectations, and the U.S. economy is likely to continue opening up in the third and fourth quarters. That is why it would be prudent for the Federal Reserve to at the very least hint towards the potential adoption of a more hawkish policy stance by the end of 2021.

This would simultaneously reassure investors and allow for the broader trend of recovery to continue unimpeded. The secondary consequence of this would be the likely strengthening of the greenback in the near future.