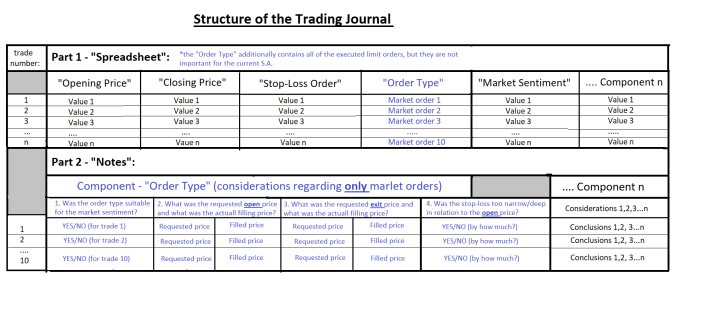

Trading journals can be structured in multiple ways, yet the most common form preferred by most traders is that of a spreadsheet. They choose their favoured components based on their personal preferences and then systematically start filling in all of the relevant data into their journals, following the completion of each trade. The purpose of this article is to demonstrate how one can compile a successful spreadsheet.

There are two broad components to an effective journal. The first is comprising of separate columns in the spreadsheet for different aspects of each trade - date of entry, date of execution, gained profit/incurred loss, and so on.

The second component can be labelled “Notes”, as it contains more intricate reflections on the development of each trade. For instance, corresponding to the price at which a given trade has been opened, inserted in category "entry price level in the spreadsheet, in the "Notes" segment, the particular conditions that motivated the trade should be pointed out.

Consider the proposed categories and their reflection on the two segments of the journal below:

First column – “Instruments”

The first column of the spreadsheet should indicate the particular label of the financial instrument that has been chosen for each respective trade.

As regards the "Notes" segment, the trader has to answer several important questions. Firstly, he has to record the motivations that compelled him to choose that particular instrument for his trade and whether there were any alternatives. Secondly, he has to list the other options (if there were any) and state the reasons why they were not selected. Thirdly, he has to indicate whether his decision was ultimately warranted by studying the subsequent development of the other options.

Second column – “Timing”

The second column should specify the exact date and time the order was placed and subsequently closed. For the sake of simplicity, the column can be further divided into two sub-columns – entry and exit.

In the second segment, the trader is advised to demonstrate the efficiency of his short term and long term trades. He can draw conclusions about his trades' timing by noting during which trading sessions his strategies work best. He can determine whether his entries into a trade are premature or if he tends to join the market rather too late when the price has already moved significantly.

Third column – “Entry/Exit Price Levels”

The logic here should be pretty self-explanatory. The trader can include multiple take profit levels if he has decided to close out the position gradually on several different occasions.

The trader has to acknowledge the conditions that compelled him to open/terminate the trade when he did. He should be able to demonstrate why, at that time, he thought that these levels were his optimal choices. By asking such questions, he is going to be able to improve his trade execution over time by becoming much more precise.

Moreover, by examining all of the associated price levels – the ones that were selected for the underlying position and the ones that were only considered but not utilised – he will gain critical insight into his psychological state of mind. For instance, if he comes up with at least two take profit levels per trade but is content to use only the one that is closer to his initial entry, yet the price reaches the two take profits each time, that would underscore indecisiveness, possibly owing to fear.

Fourth column – “Order Type”

The trader should keep track of the manner in which he decides to trade each opportunity by pointing out the type of order he preferred each time.

Some orders guarantee quantity filling, whereas others guarantee price filling; options, in contrast, provide the trader with the right but not the obligation to exchange his option's rights for the corresponding amount of the underlying. The trader can underscore the performance of his trading orders in the journal by indicating whether their types suit the preferences of his trading plan.

He has to be aware of whether his decision to use, say, a market order instead of an option (or vice versa) is ultimately justified. For instance, in time, he might notice a pattern suggesting that he has been using predominantly market orders, but in some of the cases, it would have been much better to use limit orders instead.

The fifth column – "Stop Loss Orders"

In this part of the spreadsheet, the trader should indicate the exact price level at which he has decided to place the stop loss for each trade. Also, he has to indicate if this level has been changed during the trade's progression. If so, he has to assess the primary reason for that.

The stop-loss order is the first line of defence for most traders. It encompasses the central aspects of risk management, and so, the importance of evaluating its performance cannot be understated.

The trader can examine the efficiency of these stop losses by measuring the applied distance between them and the initial entry price levels for each successful trade and also for every unsuccessful one. Consequently, he can ascertain whether his strategy would function better on average if he were using shallower or deeper stop losses.

Sixth column – “Market Sentiment”

This component of the journal is intended to provide the most profound insights about the trader's outlook on the market when analysed in retrospect. In the spreadsheet, the trader should include his initial opinions of the market sentiment that motivated him to place a particular trade at that time; additionally, he should write down his expectations for the trade and how he envisioned its progress before entering the market.

For instance, he should write "trend" or "range" to represent the conditions of the market as he perceived them at the time. Next to that, he should specify whether the trade was intended to catch the price movement on a trend reversal setup, continuation of an established trend, the intermittent price action within the boundaries of an established range or something else.