A new vision of economic optimism for the Eurozone

Christine Lagarde is the new President of the European Central Bank, and on Friday she had her first speech at the European Banking Congress in Frankfurt. Investors were keen to hear what her opinions of the current state of the European economy were and also what is her vision of the necessary future changes that are to be implemented to the current monetary policy of the Eurozone.

Lagarde’s comments exhibited her comprehensive outlook that can be summarised as a new and invigorated vision of Economic Optimism. She began her speech by quoting T.S. Elliott as saying that "Every moment is a fresh beginning", and concluded with another quote by St. Francis of Assisi, who said, "Start by doing what's necessary; then do what's possible, and suddenly you are doing the impossible".

The selection of these particular citations validates Lagarde’s confidence that there is certainly room for improvement, and it opened the discussion of what needs to be changed in order for the Eurozone to achieve its economic goals.

Europe: New Approaches

Naturally, Lagarde began by acknowledging the fact that the European economy, as well as the global economic cycle, are both currently being affected by geopolitical changes in the international system. The most prominent process that plays a central role in her argument is the ongoing trade war between China and the US, which has been the main topic of discussion for many previous articles and opinion pieces. Thus, she decided to structure her line of reasoning in the following manner – “As the global economy evolves, how can Europe best position itself? “

Lagarde outlined two principal issues from which the most significant challenges to the global economy originate. On the one hand, there is the changing nature of world trade. On the other, she specified the challenges to domestic growth in advanced economies.

As regards the apparent slowdown in global trade growth, she cautioned against the rising geopolitical uncertainties and trade tensions, which are both weighing down on the free-flow of the typical market processes. Additionally, Lagarde warned that these processes are affecting negatively the European economy, which at the current rate is not well-fitted to tackle them. According to her, the subdued international trade is already distorting the EU’s prospects for economic growth, and the ECB has already lowered its projections for the final GDP growth in 2019.

“These uncertainties have proven to be more persistent than expected, and this is clearly impacting on the euro area. Growth is expected to be 1.1% this year, i.e. 0.7 percentage points lower than we projected a year ago."

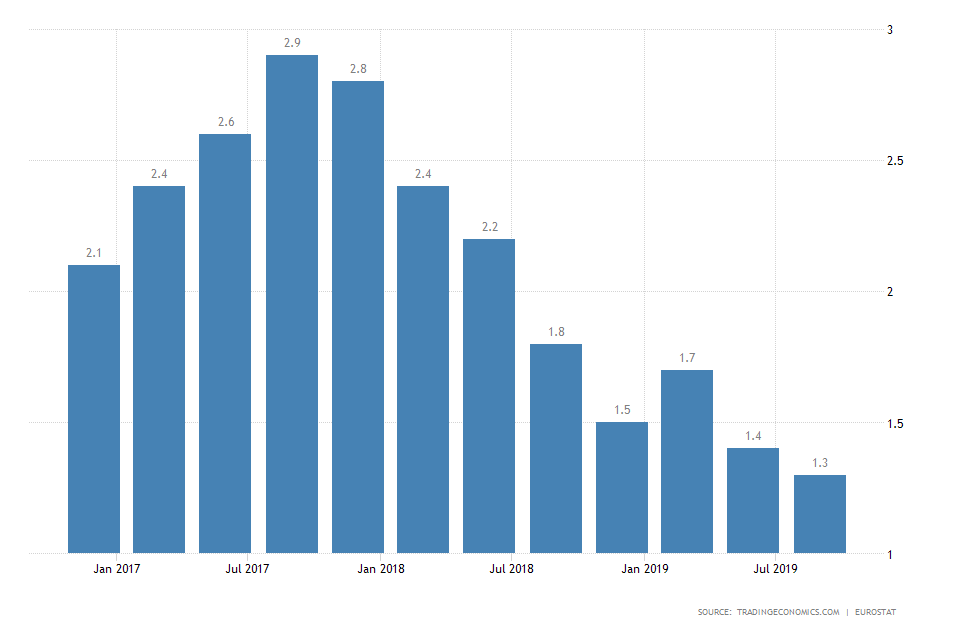

Meanwhile, the GDP Growth Rate in the entire EU reached 1.3 per cent in Q3 of 2019 and is currently at its lowest level in over five years.

She said that in addition to these primarily geopolitical issues, the EU is also suffering from more `structural` challenges to growth, which are influenced by specific transformational trends in international economics.

“We are starting to see a global shift – driven mainly by emerging markets – from external demand to domestic demand, from investment to consumption and from manufacturing to services. In parallel, world trade is being reordered as new technologies disrupt conventional supply chains and workplace organisation, and as potential new risks emerge from climate change.”

What she inexplicitly tried to imply here is that the European economy is starting to lag behind some of its main competitors, chiefly the US, in terms of technological research and development and innovation into renewable energy to tackle down the rising threat of global warming.

In other words, Europe is getting outpaced by the rate of innovation of other advanced economies, and it is for that reason its manufacturing production is starting to exhibit the signs of this apparent lagging in the economic cycle.

From this observation of the waning general economic activity, Lagarde argued that Europe has to reorganise itself to support its external sector.

“Advanced economies are in the midst of a long-term deceleration in growth rates, which have roughly halved since the late 1980s. This is reflected in the long-term decline of global interest rates.[…] Supply-side factors, such as productivity and demographics, are clearly one driver behind this. […] But there is evidence that demand-side factors are playing a role as well. In the euro area, domestic demand has contributed to the recovery, helping to create 11.4 million new jobs since mid-2013. But over the past ten years, domestic demand growth has been almost 2 percentage points lower on average than it was in the decade before the crisis, and it has been slower than that of our main trading partners.”

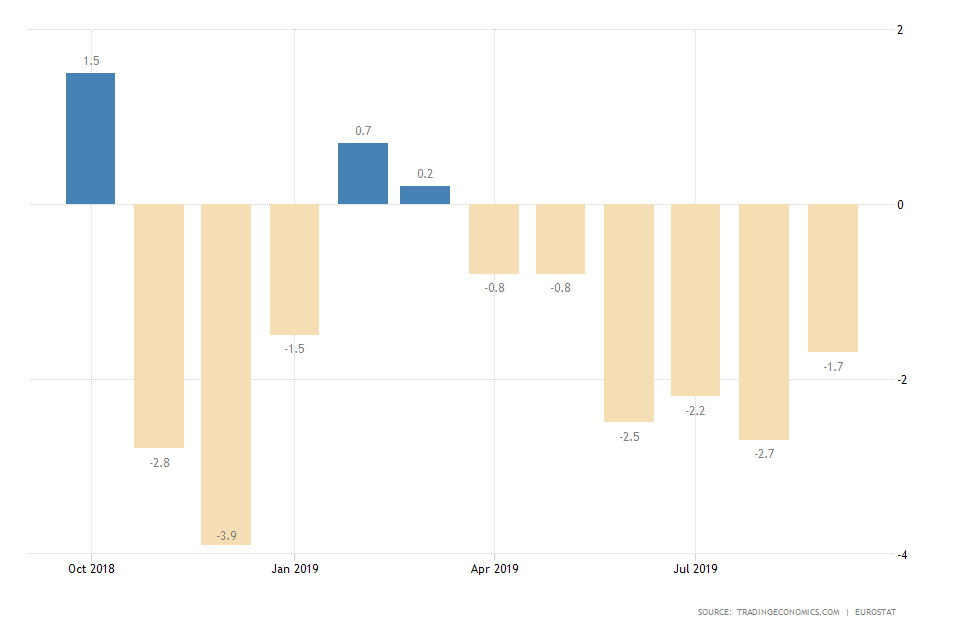

Monetary programs such as the three stages of the TLTRO initiative were introduced to tackle this subdued internal demand by making the borrowing costs to local investors, especially low. However, the rate of investment within the EU economy is still somewhat subdued, and the ECB is intentionally keeping the interest rates low so that internal demand can finally start picking up. Based on this general observation, the following question arises – What can Lagarde do next now that she is on the helm, in order to further boost the aggregate demand in the Eurozone?

Resilience and Rebalancing

In the concluding portion of her speech, Lagarde stressed the importance of the implementation of a new European Policy Mix. It is intended to expand on the current accommodative monetary policy of the ECB by strengthening the resilience of the services sector in the economy. Lagarde said that the central bank would not implement any significant changes to its current programs and policies right away; however, she also promised that its monetary policy "will undergo a strategic review due to begin in the near future".

“The ECB’s accommodative policy stance has been a key driver of domestic demand during the recovery, and that stance remains in place. As laid out in the ECB’s forward guidance, monetary policy will continue to support the economy and respond to future risks in line with our price stability mandate. And we will continuously monitor the side effects of our policies.”

It is unlikely for Lagarde to call for any transformational changes to the operations of the European Central Bank by the end of 2019, as crucial economic data for Q4 is still lacking. However, her economic optimism is likely to prompt her to make more decisive actions from the start of the new year. The goals are clear – to make the European economy more competitive in these times of structural changes in the global trade systems. It also seems that Christine Lagarde has already drawn her plans for achieving the tasks at hand – investing in innovation and services to boost the internal demand and thereby making the economy of the Eurozone more sustainable.