The forthcoming elections for the allocation of seats within the European Parliament raise many questions about the future of the bloc, amidst increasing tensions of international trade and also the ever-looming pressure exerted on the European officials from the ongoing struggles with Brexit. Undoubtedly one of the most pressing matters connected to the elections would be the future results from the Italian vote and the ramifications it would have for the Italian economy following the final count of the ballot boxes.

Investors have been struggling to weigh in on the potential consequences of a populist-majority occupying the delegates' seats of the EU Parliament chambers for the representatives from Italy, and whether that could lead to a new wave of distortions for the European community since Italian populists are also some of the most vocal eurosceptics.

How did the FTSE MIB develop since the inauguration of the most recent populist government in Italy?

The Milano Italia Borsa is the most influential stocks index in the country, and it is comprised of the 30 biggest Italian companies, and presently it is experiencing an increase in volatility as the date of the election comes closer. The index has experienced a great deal of volatility since the formation of the most recent Italian government, spearheaded by Matteo Salvini (the leader of the Centre-right Coalition and the political party "League") and Luigi Di Maio (the leader of the "Five Star Movement") on the 1st of June 2018, after three months of intense deliberations between the two sides of the political divide.

Shortly after the incumbent Salvini and Di Mario took control of the national Parliament, the stock index began to tumble into a short-selling action which lasted until the end of the year. The FTSE MIB collapsed from the 1st of June’s High of 22416.47 to the year’s low of 17914.03 on the 27th of December, which also marked a low-point for the coalition government and the Italian economy as a whole. 2018’s dip recorded levels that had been last seen in December 2016.

The indexes’ sizable collapse of 4500 points in the 3d and 4th quarters of 2018 was mostly caused by the market’s struggle to come to terms with the new government, consistent of a populist majority. Moreover, Italy experienced economy woes, which were respectively derived from the intensified fears that the country could secede from the European Union as part of Mr Silvano’s Eurosceptic agenda.

In comparison, the FTSE MIB has been much more upbeat in 2019, as global trade tensions have gradually cooled down in the first quarter of the fiscal year before Trump's renewed rhetorical charge in May. The primary Italian index alongside a string of other influential European market indices has been steadily rising for the more significant part of 2019 to early-May. For that reason, arguably, the buoyant bullish momentum across multiple European industries can be attributed chiefly to the bloc's overarching economic activity growing in unison, as opposed to crediting the FTSE MIB’s growth solely on Italy’s populist government.

However, the lateral movement of the major European indices was distorted in mid-April, as the European Parliament released a precise estimation of the final pre-election evaluations segregated by states, which highlighted a great deal of the most recent changes in political attitudes across the bloc. While the French CAC and the German Dax were able to recover relatively swiftly from the sudden loss of momentum following the release of the forecasts, the FTSE MIB is somewhat still struggling to recover, as the numbers in the report demonstrate a sizable polarization of Italian voters and their attitudes.

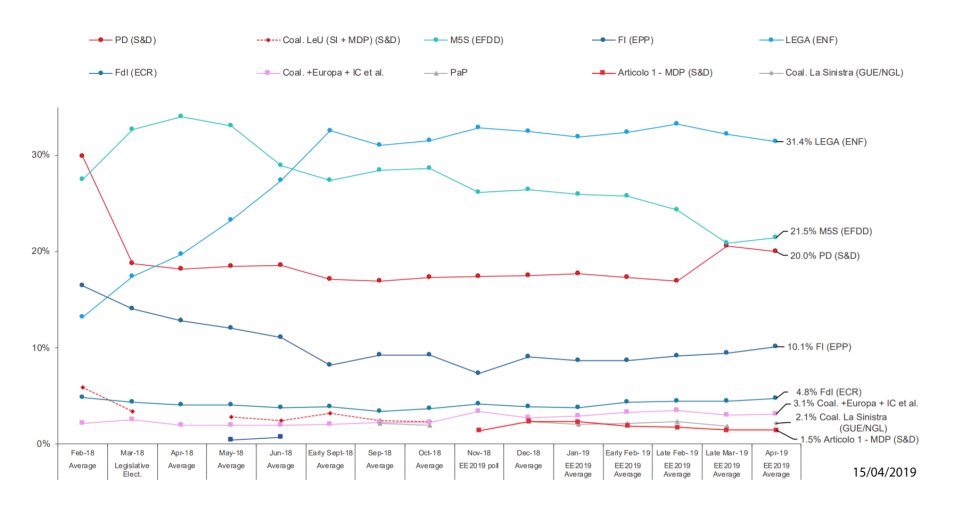

The Five Star Movement has registered a noticeable drop in support from more than 30% in April 2018 to 21.5% in April 2019, which, however, is still enough to rank the party as the second highest rated political force in the country. Conversely, the eurosceptic coalition of "Europe of Freedom and Democracy" is forecasted to find strong support from Italian voters, despite the somewhat weaker preliminary forecasts in the months leading to the election.

On the other hand, the LEGA has experienced the most significant movement in the poles from the disappointing 12% in February 2018 to 31.4% of the overall vote in the final projections from April 2019. The ENF (Europe of Nations and Freedom), which is backed up by LEGA, is a hardline Eurosceptical coalition, and it is eyeing at almost 1/3d of the Italian votes.

Overall, these final projections expect at least 50% of the seats in the European Parliament reserved for Italian representatives to go to a coalition of populists, who are also stridently expressing their reservations for the European project. As a result of those recent forecasts, investors are beginning to worry that a majority-led coalition with such divisive outlooks on general European policy might have divisive consequences for the social cohesion within the bloc, and even possibly follow similar steps to Brexit in an attempt to distance Italy from the union.

Ever since the projections report was released on the 18th of April, the FTSE MIB has been falling as pressures, and the elections come closer. The price of the index fell from 21956.59 to as low as 20586.13 on the 13th of May and eventually correcting itself slightly to 21105.28. This substantial drop of almost 1500 points in the span of less than a month stems from the investors' fears that the populists could seize the majority power in the EU Parliament after already obtaining it in the national chambers.

On the whole, after the official poll results get publicized this Sunday, much volatility can be expected to come sweeping through the European Stocks Market, as investors weigh in on the longer-term ramifications from the newly formed governmental power. In the case of Italy, the shock from an expected populist win should be lessened to a degree since it will not come off as a total surprise, however, it is perceivable to assume that there are still going to be significant distortions in the next few months, as the general market assimilates the transition of political powers.

Arguably, a more impactful consequence on the FTSE MIB can likely stem from a more discernible victory of the LEGA and the Five Star Movement and their respective coalitions that they support, in case that they manage to win over more votes and thus surpass the initial forecasts. Consequently, the index is likely to suffer from more clearly distinguished short-selling spikes before the market can adjust and ultimately start climbing once again.