The fear of what Trump is going to tweet next is what puts the markets on edge.

At the present rate it should not be a surprise to anyone that Donald Trump is the first president in any country to utilize social media to such a great extent, but what is really unique about his way of communicating with “fans”, is the fact that he is actually using Twitter as part of his policymaking process.

This new type of platform for mass-communication that was established partly due to the rampant advancement of social media technologies has allowed information to be transmitted instantaneously around the world so that news and topics of interest can become viral in a matter of minutes. The easiness with which information can be transmitted nowadays is what perplexes the market and is the prime reason as to why the global stocks indices have become so volatile.

It is no surprise that Trump is posting on Twitter regularly and his style of expression tends towards being very divisive on key issues, such as the Muller report, the nuclear deal with Iran and of course, the trade war with China. For that reason, Trump’s tweets are not seen as randomly passing opinions on social media, amongst the countless others, but because they are coming from the President of the US, the general market perceives each statement with a great deal of scrutiny.

The real issue with Donal Trump’s habit of using Twitter to enforce his protectionist policies is the suddenness of every new post. By now the market has become accustomed to expect occasional presidential outbursts on Twitter every once in a while, however, the real complications for the market stem from Trump’s tendency to disclose seemingly completely antithetical statements in a short period. Because of that, the market is given a very little time to react to the sudden changes in the course of US’ general policy towards its trade relationship with China, only for that set policy to be perceivably wholly diverted by a new post by Trump a few days later.

The obvious ramifications for the market owing to these abrupt revisions in US foreign policy are measured in an increased volatility and investor uneasiness mostly because of the apparent lack of a long-lasting coherent strategy. Not knowing what to expect next from Trump is what makes investors fear that they can expect anything and everything from the eccentric President.

Over the course of the past two days, the United States and China have held candid and constructive conversations on the status of the trade relationship between both countries. The relationship between President Xi and myself remains a very strong one, and conversations....

— Donald J. Trump (@realDonaldTrump) May 10, 2019

Despite the ongoing deadlock in the trade relationships between China and the US, on Friday Donald Trump stated that he continues to have a “very strong relationship” with Xi Jinping, which gave investors worldwide a moment of respite, as the President seemed to be alluding towards the prospect of stronger cooperation between the two. However, Wall street's allusions of a potential "seize fire" on the economic impasse between the US and China were curtailed by yet another tweet on the very next day.

I think that China felt they were being beaten so badly in the recent negotiation that they may as well wait around for the next election, 2020, to see if they could get lucky & have a Democrat win - in which case they would continue to rip-off the USA for $500 Billion a year....

— Donald J. Trump (@realDonaldTrump) May 11, 2019

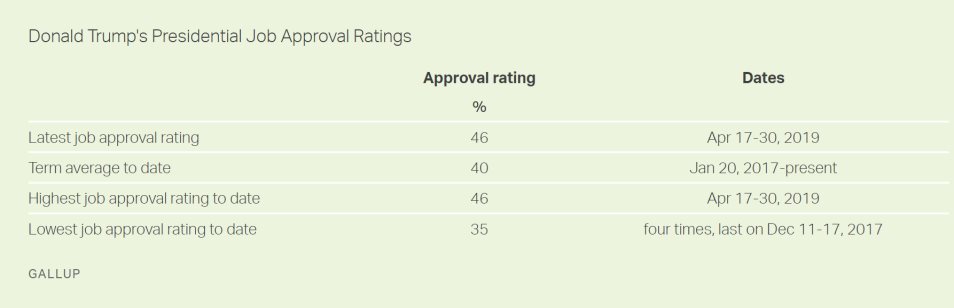

It seems as if Trump wants to have it all – to appear as a charismatic leader who can establish strong ties with foreign leaders; to push his “America First” agenda forward as long as he continues to emerge as the most influential figure. Trump enjoys to present himself in the best possible light, as the man who should be praised for the current economic advancements in the US; and finally to fire shots at the Democratic party to get an early lead in the next presidential campaign. The issue is that he is attempting to achieve all of that by using the condensed template of Twitter which ultimately leaves investors and analysts perplexed, as they struggle to make out what to think of Trump’s ever-changing plans for the future out of just a few sentences from his routine posts on Twitter. Seemingly, the lack of a coherent strategy in Trump's online rhetoric could be an indication of his ambition to never stay quiet for too long and to keep the hype surrounding his persona going, which has thus far proven to be an effective technique of sustaining a strong approval rating within the general public.

Trump's Recent Tweets – a Random Outburst or a Clever Ploy?

From the post below, one thing becomes crystal-clear – Donald Trump is not afraid to pull any punches when he addresses a few issues at the same time. However, before any assertions can be made about the tariffs themselves, it is worthwhile to analyse his other remarks.

....The only problem is that they know I am going to win (best economy & employment numbers in U.S. history, & much more), and the deal will become far worse for them if it has to be negotiated in my second term. Would be wise for them to act now, but love collecting BIG TARIFFS!

— Donald J. Trump (@realDonaldTrump) May 11, 2019

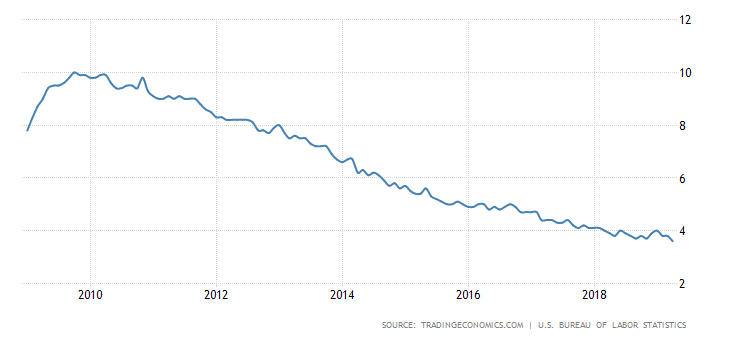

"Best economy and employment numbers in US history" – While it is true that the US labour market is performing exceptionally well at the present rate, a quick fact-check shows that the last time the US economy was at 3.6% unemployment was in December 1969. In other words, Donald Trump was already 25 years old the last time he experienced these allegedly unprecedented numbers in the US economy. Donald Trump will also miss out on the opportunity to go down in history as the first US president to twist the facts to present himself in a better light, but why does it matter if he lies now?

The apparent trend of reduction in the underlying unemployment was initiated before the inauguration of the 45th President, and Barack Obama should be at the very least be partially commended on the excellent work. Conversely, it could be argued that Trump is merely trying to increase his rating before the next election which could also explain his eagerness to reinstate his trade offensive against China, as part of the overall plan to boost his ratings, a strategy that for the time being is working.

According to a recent poll by Gallup, Donald Trump is presently enjoying the highest approval rating of his presidency at 46%, which has exponentially grown from the 35% lowest point of his presidential career.

Conversely, this means that either the general public in the US is too oblivious to notice his brazen narcissistic lying, or they simply do not care. Either way, Trump’s PR approach has thus far proven effective, and from this reasoning, it goes to show that might also be inclined to go even further to solidify his overall approval rating – manufacture the trade war as just another PR ploy.

Initially, the argument was made by Trump that China had been exploiting the US by systematically abusing its trust, and also that the US had been losing more than $500 billion as a result of that. Even if that is so, his rhetoric has changed, and the general purpose of his protectionism no longer seems to be centred around the promotion of fairness to the markets. He is making it blatantly apparent that he is not afraid to reinstate new and more significant tariffs on more and more goods, as a part of an expansionary policy, but what is the current market picture?

The Dow Jones Industrial Average has experienced a tremendous increase from the beginning of the new year, ever since the government shutdown was brought to an end. Presently it appears that the price has reached a fundamentally significant resistance level and many market analysts speculate that the index is due for a corrective downturn, as a natural part of the business cycle.

If that is true, then Donald Trump can use the developing situation to his advantage by pressing on with his agenda of tariffs impositions, as any resulting negatives from this action can be attributed to the parallel short-selling in the stock market. Moreover, if Trump anticipates such a forthcoming corrective move, then it would make sense for him to send his threats now, simultaneously with the “best economy in the US History”.

Donald Trump is above everything else, an unpredictable president and that makes it increasingly challenging to build forecasts and models about future market trends, based on his constantly-changing policies. However, it can also be anticipated that as the 2020 elections draw closer, his statements are likely to become bolder with even more blatant threats. Overall, it appears that his highest priority is to secure a solid approval rating, and the actual plans for new rounds of tariffs can become side-lined to his ambitions for a second term in office.