The GBPCAD has been consolidating in a narrow range over the past several days due to the massive uncertainty that is weighing down on the global markets. The current situation is quite volatile, and as a result of that, the price action on the currency pair has become overly erratic due to the swiftly changing underlying market sentiment.

Two crucial economic events that are taking place today are undoubtedly going to impact the market so that the GBPCAD price action is likely to register new massive fluctuations. The employment data in Canada in addition to the outcome from the OPEC+ meeting are going to affect the dynamics currently affecting the Canadian dollar. Meanwhile, the coronavirus epidemic continues to be on the rise in Britain, as the death toll increases. Even the Prime Minister Boris Johnson, who was diagnosed with COVID-19 over ten days ago, has been moved to the ICU as his symptoms recently worsened.

The continuously evolving healthcare crisis in conjunction with the fallout currently affecting the Canadian and British economies are going to continue impacting the GBPCAD’s price action, which would create interesting trading opportunities. Therefore, the purpose of today's analysis is to examine those fundamental developments as well as the technical outlook on the pair and to underscore the most likely future behaviour of the GBPCAD's price action.

1. Long Term Outlook:

As can be seen on the weekly chart below, the coronavirus tribulations have brought about the emergence of a new significant range. Unlike the previous two Accumulations, however, this range is characterised by more seemingly random price fluctuations and no decisive sentiment to set the stage for a future trend formation. In other words, the new range supervenes the last Markup, but there is no definitive underlying evidence to point to a subsequent continuation of the bullish market or the formation of a new bearish trend.

The price action during the last couple of weeks has been especially unpredictable, judging by the massive upper and lower shadows and the uncharacteristically small bodies of the candlesticks representing that period. Evidently, this indecisiveness of the market is prompted by the increased uncertainty stemming from the coronavirus pandemic and its accompanying developments. At present, the adverse volatility in the market is reaching new heights.

By examining the past price action, two prominent support and resistance levels can be drawn—the major resistance level at 1.77400 and the major support level at 1.72000. The former has been confirmed by the last Markup, which reached a peak there. The significance of the latter, in turn, has been established during the formation of the first Accumulation range. The 1.72000 level served as its upper boundary. Any new fluctuations in the immediate future are likely to bounce between these two crucial turning points.

2. Canadian Unemployment, British GDP, and OPEC+ Ambiguity:

Three recent developments should be taken under consideration so that the fundamental analysis on the GBPCAD can be complete.

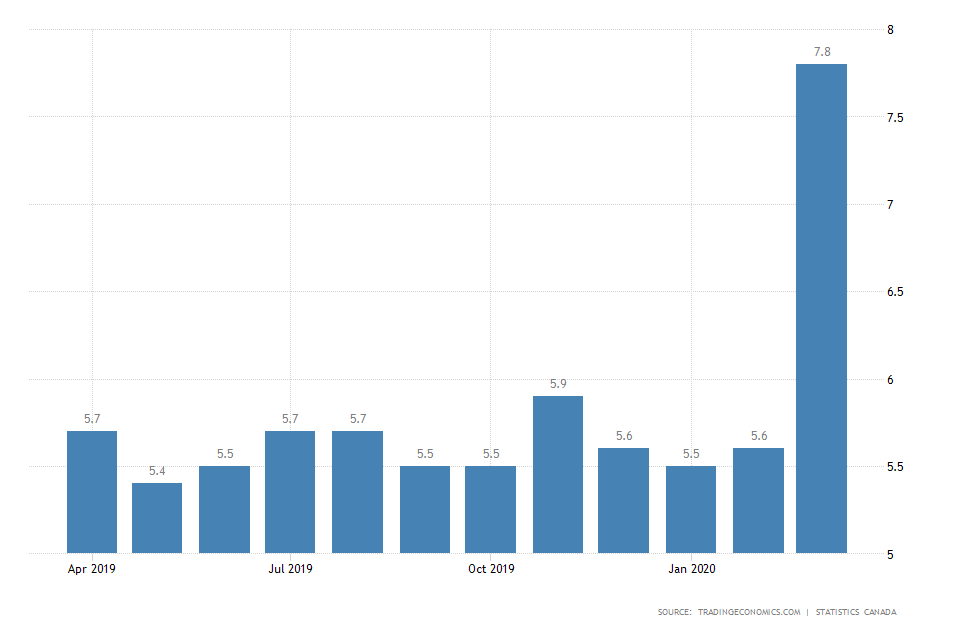

- Surging Unemployment in Canada. Statistics Canada just released its most recent Labour Force Survey for March 2020, which recorded a massive jump in unemployment. Following the implementation of Canada’s virus-related restrictions, the economic activity in the country has dived due to the self-isolation of the workforce.

According to the findings of the survey, the economy has lost more than 1 million jobs in March, which is more than double the consensus forecasts for 427 thousand lost jobs were projecting. The unemployment rate has thus risen from 5.6 per cent in February to a staggering 7.8 per cent in March. The massive rise of 2.2 per cent exceeded the initial market expectations by 0.4 percentage points.

The rampant surge in unemployment is undoubtedly going to pressure the Loonie in the long term. The weaker labour market is going to impede the Canadian economic activity, and this impact is going to become increasingly more pronounced as the situation continues to deepen.

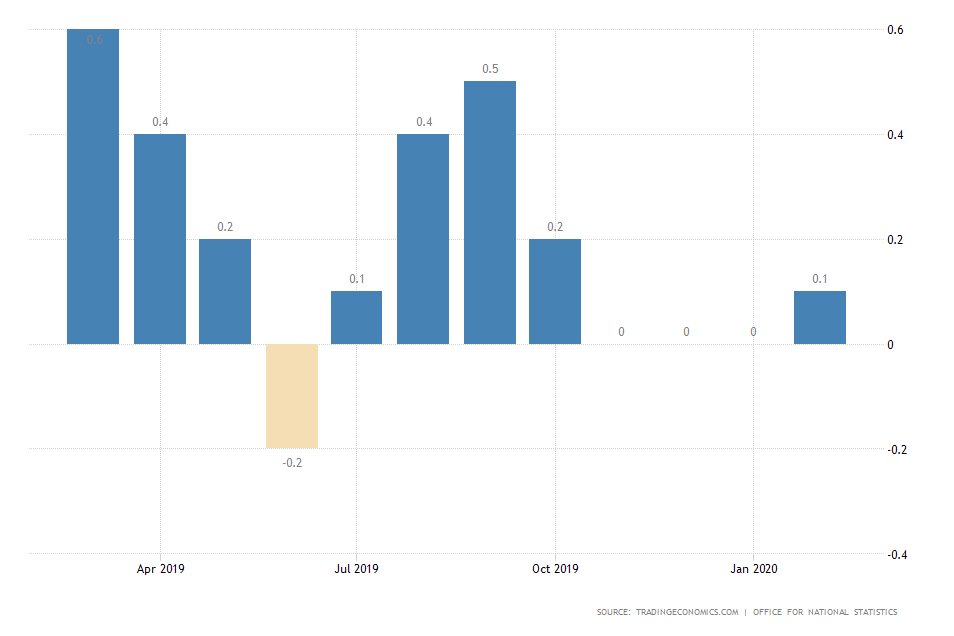

- The British Economy Contracted in February. The Office for National Statistics in the UK released GDP data, which revealed an economic contraction just before the government imposed the strident restrictions in the country. These unexpected developments are troubling because the continuously developing coronavirus situation is now likely to amplify the trend of economic contraction initiated prior to the healthcare crisis.

The GDP for March fell by 0.1 per cent, which was below the market expectations, underpinning the sluggish economic activity for Q1 in Britain.

This deterioration is going to reflect negatively on the performance of the GBP in the long run by making it less competitive. However, the pound was not hit dramatically in the short term, indicating the currency’s stability at present.

- OPEC+ and the Hopes for the Termination of the Oil Price War. At the time of writing, members of the OPEC+ organisation, amongst which are Saudi Arabia and Russia, are holding a teleconference of crucial importance for the stabilisation of the energy market. Market analysts are expecting the members of the organisation to reach an agreement, which would result in the reduction of the aggregate oil production. This would effectively end the oil price war, which has thrown the market in turmoil.

The outcome of the meeting is going to have a major impact on the Canadian dollar as well, due to the currency's correlation with the price of crude oil. The correlation emanates from the fact that Canada is one of the biggest producers of crude oil in the world.

If a deal is reached today (most likely to be announced tomorrow), the price of crude is most likely going to rise. This, in turn, is going to exert pressure on the GBPCAD, as the Loonie starts to appreciate. If, however, Saudi Arabia and Russia fail to reach a mutually satisfactory agreement due to their recent row, this is going to be perceived by the market as an unexpected shock.

The market has already started to price in a resolution to the price war, so a new rift is going to cause the price of crude oil to plummet once again. Consequently, the Canadian dollar is also going to be impacted negatively by the news.

3. Short Term Outlook:

As can be seen, by the ADX indicator on the daily chart below, the GBPCAD has been range-trading since 27th of December 2019. This condition is unlikely to be broken soon, as the aforementioned adverse volatility is likely to keep the price action fluctuating within the boundaries of the range in the foreseeable future as well.

The wide Bollinger Bands underscore the massive volatility levels that were mentioned earlier. The Bands have started to contract over the last several days, which is an early indication of the underlying price action’s stabilisation.

As can be seen, the price has rebounded from two Fibonacci retracement levels, which have become intermediate turning points. The 61.8 per cent Fibonacci Retracement at 1.67022 is acting as a support, and the 23.6 per cent Fibonacci Retracement at 1.74981 is currently serving as a resistance. The price action is likely to continue bouncing between the two until a new and decisive trend is formed.

Meanwhile, the 4H chart below confirms the significance of the major support level at 1.72000. As can be seen, the level itself coincides with the lower boundary of the regression channel. This boosts its significance as a likely turning point. The channel’s middle line serves as a resistance level.

The Stochastic RSI has been threading in the ‘Oversold’ extreme between the 1st of April and the 7th of April, but the price action has continued consolidating. This behaviour is illustrative of indecisiveness in the market. Thereby, even though the price action currently finds itself in the 'Overbought' extreme, the following dropdown is likely to be a marginal one, ahead of the expected significant breakout in either direction.

4. Concluding Remarks:

The immediate future behaviour of the GBPCAD is going to depend mostly on the outcome of the OPEC+ videoconference. The high unemployment in Canada is matched by the economic contraction in the UK. The two developments are likely to pressure the respective currencies, albeit at a different pace. Meanwhile, the outcome of the videoconference can either boost the Loonie significantly, or it could increase the pressure currently exerted on it tremendously.

- Even though the analysis resulted in net profit, its inherent shortcomings caused losses that could have been prevented. Its biggest failure is suggesting the implementation of trading strategies for trending markets at a time when the price was range-trading instead. Traders need to be aware of the underlying market sentiment before they place any trades, lest they risk making crucial mistakes. Chiefly, expecting the price action to behave in a certain way when the underlying market pressures are making it behave in a comparatively different way. That is why the two rebounds from the resistance at 1.74981 were interpreted as the beginnings of new price swings instead of interim fluctuations that are common place in ranging markets.

Disclaimer: Your capital is at risk! Trading and investing on the financial markets carries a significant risk of loss. Each material, shown on this website, is provided for educational purposes only. A perfect, 100% accurate method of analysis does not exist. If you make a decision to trade or invest, based on the information from this website, you will be doing it at your own risk. Under no circumstances is Trendsharks responsible for any capital losses or damages you might suffer, while using the company’s products and services. For more information read our Terms & Conditions and Risk Disclaimer.