1. An Opportunity to Enter the Market at the End of the Bearish Price Correction:

The GBPUSD, also referred to as 'The Cable', is currently trading close to the psychologically important support level at 1.30000. The support has psychological importance due to the four zeroes that are gathered at this particular price level. Such levels typically mark turning points in the market and are usually found at the end of intermediate price corrections.

The currently developing market setup creates a favourable opportunity for entry into the established bullish trend, which is expected to continue its development following the termination of the current short-term price correction.

Prominent fundamental events taking place this week in addition to the nearing of the pivotal Brexit deadline – 31st of January – are expected to affect the near-term market pressures that are currently driving the price action of the pair.

2. Long-Term Outlook on the GBPUSD:

The pair started developing a new uptrend (markup) in late August 2019, when the bulls began to became increasingly likelier to enter the market as the overall Brexit uncertainty started to gradually diminish with the nearing of the eventual Brexit deadline, which admittedly was postponed several times.

This uncertainty is prompted by investors’ fears that the UK will not be able to secure a trade deal with the EU prior to its departure from the bloc. However, the general uncertainty started to get gradually wane down as Boris Johnson, and his Tory party won the last general election.

The pivotal victory for the PM in the House of Commons means that Johnson would be able to pursue his ‘Brexit without any further delays’ agenda and get the UK out of the EU by the aforementioned date.

While this move undoubtedly decreased the overall uncertainty regarding the UK's immediate future, because the government will most certainly refrain from postponing the Brexit departure any further, potential woes for Britain are not entirely removed from the picture.

At the current rate, it is not yet clear what kind of trade relationship the UK will have with the EU after the 31st. The British economy could potentially suffer if Johnson's government does not manage to find a swift solution to the current impasse in the trade negotiations.

Nevertheless, the pound has been strengthening in the second part of 2019 because the market has already more or less priced in the worst-case Brexit scenario for the British economy, and investors expect it to grow this year, albeit at a slower pace, even if the trade deal is not secured prior to the 31st.

Thus, the bulls expect the pound to continue its strengthening against the dollar but how and when can the pair be expected to resume extending its gains?

An examination of the weekly price chart of the pair reveals that it is currently consolidating between the significant resistance level at 1.31708 and the major support level at 1.29800.

The recent price correction, which is highlighted by the red ellipse, is perceived to be a natural retracement under the 5-waves Elliott Pattern. The retracement itself is unlikely to turn into a trend reversal, given the longer-term technical outlook.

The major support level at 1.29800 alongside the aforementioned 1.30000 level with psychological significance coincides with the previous re-distribution range's lower boundary, which increases the importance of the support. Hence, the likelihood of a new bullish swing from the current support is bolstered.

If the support, however, were to fail and the GBPUSD were to break down below 1.29800, the next significant support level is at 1.27850. This is the secondary price level from which a renewed bullish swing can be anticipated to take place.

In both cases, the long-term target level for the GBPUSD remains the same – the last distribution’s lower boundary at 1.38240.

3. Fundamental Outlook – Revised IMF Projections for Global Growth in Addition to British Manufacturing Data:

Earlier today the IMF announced its revised projections for global growth of the world economy in 2020, which anticipate an acceleration of the rate to 3.3 per cent from 2019’s 2.9 per cent. Nevertheless, both numbers are revised down from the IMF’s previous projections in last October.

The downgrading of the economic forecasts is attributed to international geopolitical issues, such as the recent escalation of the tensions between the US and Iran in the Persian Gulf.

IMF’s estimate for the US economy’s growth in 2020 was decreased by 0.1 percentage point to 2 per cent, which is likely to scale down the net demand for the US dollar. Consequently, if the economic growth in the world’s largest economy is indeed diminished, the GBPUSD would be impacted positively as the overall demand for the pound starts to increase against the greenback.

Additionally, the IMF stated that the global slump in the manufacturing industry appears to be “bottoming out”, which is an especially welcoming news for the British economy.

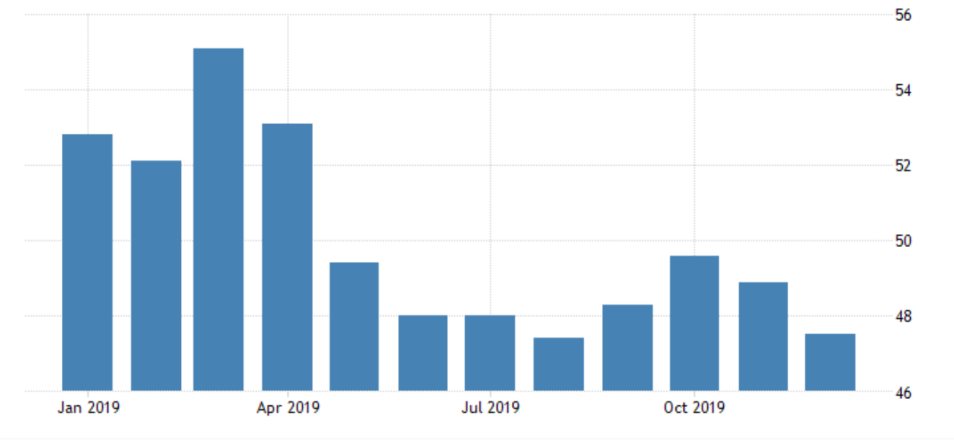

Markit is scheduled to report the most recent changes in the Flash Manufacturing PMI in the UK this Friday. The consensus forecasts expect the index to edge higher from the current rate of 47.5, which is the lowest level on record since July 2012, to 48.8.

If these prevailing forecasts are met on Friday, the GBP would be undoubtedly strengthened on the news, as the BOE would have one less incentive to reduce its interest rate level during its next monetary policy meeting.

4. Short-Term Outlook on the GBPUSD

An examination of the GBPUSD's daily chart reveals that the bearish sentiment is starting to lose steam as the bullish pressures begin to pick up, as indicated by the Relative Strength Index indicator, which is currently consolidating in the middle of the range.

Looking at the pair’s 4H price chart further illustrates the waning bearish sentiment in the market.

The ABC formation is a common retracement pattern which typically follows the establishment of a 1-5 Elliott Wave Formation. Thus, the market anticipates the bearish retracement to be getting close to termination as A and B have already been established and C, too, seems to be close to getting fully developed.

The strength of the aforementioned support level seems to confirmed by the two green rectangles, which demonstrate the inability of the price action to successfully break down below the support level on two separate occasions.

The MACD and the angle of descent of the two downswings both manifest the lessening bearish commitment in the market and the build-up of bullish pressure.

5. What Could Potentially Disrupt the Strengthening of the Pound?

Coincidently, the biggest threat to the aforementioned strengthening of the pound is the Bank of England itself.

The Monetary Policy Committee (MPC) of the BOE now seems to have the most dovish stance in the last three years and is at its most likely to ease up the underlying monetary policy and cut the interest rate.

The outcome of the previous two interest rate decisions in November and December came up the same way – the Committee voted 0-2-7 in favour of keeping the interest rate at the current 0.75 per cent level. The fact that two out of the MPC's nine members voted in favour of a reduction two times in a row is evocative of the Committee's increasingly negative outlook on the British economy's future. The last time that the BOE was so accommodative was in August of 2016.

The next monetary policy meeting of the central bank’s MPC is scheduled for the 30th of January (next Thursday), which is just a day before the latest Brexit deadline.

Thus, the current subdued inflation rate in the UK – 1.3 per cent, down from November’s 1.5 per cent and the lowest level on record since November 2016 – in addition to the ongoing trade concerns stemming from the aforementioned Brexit uncertainty, might be enough to prompt the MPC to cut the interest rate by 25 basis points next Thursday.

Because of that, the pound is likely to suffer momentarily if the BOE does indeed decide to become more accommodative. In such a scenario, the current bearish correction, which was outlined above, could turn into a full bearish downswing (a new markdown), driven by these likely fundamental developments.

Subsequently, the price action is going to change as the market sentiment changes and the bulls begin to give way to the bears. Two likely technical setups would encapsulate such a development:

On the one hand, if the price depreciates below 1.29200 (the low of A as illustrated above), it would manifest the noticeably increasing strength of the bears in the market.

On the other hand, if the price manages to break out above the minor resistance level at 1.30700 momentarily – as represented on the hourly chart above – but afterwards it reverts itself back below it (as is the case with the previous false breakout), then the market would not be ready to continue establishing the last bullish trend.

- It took the market four days to reach the short-term target leading to a net profit of around 170 pips (depending on the exact entry and exit levels). The best thing to do after the market had already moved by 50+ pips in our favour would have been to substitute the initial fixed stop-loss with a floating stop-loss placed at 30 pips from the recent high. That way the position would have been hedged against the pullback that followed after the 24th of January.

- Even though the longer-term target was not realised, the market behaved exactly as per our initial expectations. The temporary breakout above 1.31700 was immediately followed by a reversal, which signified uncertainty in the market. This behaviour consequently signalled the need for a quick exit out of the underlying position.

- The big takeaway from this trade – fixed stop-loss levels have diminishing returns as the underlying sentiment changes. Thus, they should be substituted with floating stop-losses after the market had moved in our favour by a certain margin.

Disclaimer: Your capital is at risk! Trading and investing on the financial markets carries a significant risk of loss. Each material, shown on this website, is provided for educational purposes only. A perfect, 100% accurate method of analysis does not exist. If you make a decision to trade or invest, based on the information from this website, you will be doing it at your own risk. Under no circumstances is Trendsharks responsible for any capital losses or damages you might suffer, while using the company’s products and services. For more information read our Terms & Conditions and Risk Disclaimer.