In the Forex market, the Euro and the Dollar are the two go-to currencies, which investors and traders scramble to when there is general uncertainty. Whenever the operations of the global economy are jeopardised by an external factor, such as the case now with the coronavirus pandemic, the demand for safe-havens is bolstered tremendously. Never is this effect more pronounced elsewhere than it is in the demand for liquid and easily convertible currencies. The euro is not a de facto safe-haven asset in the classic understanding of the term, but the recent developments have caused a massive surge in the global demand for the common currency.

Investors' panic is epitomised by their fears of the unknown, and more specifically by the concerns of how much worse the current situation can get before it gets better. Presently, it is widely accepted that the world will enter into a deep recession during Q1 of 2020 because of the many national lockdowns and closedowns of many economies. To hedge against these and other unknown risks, investors, traders, and other individuals seek stable currencies such as the euro and the greenback, which can be easily convertible during an economic crisis. This quality is highly valued as the market uncertainty intensifies.

Consequently, the heightened demand for the two separate mainstays of the forex market has led to a drastic increase in EURUSD's liquidity and volatility. All of this has resulted in massive fluctuations in the pair's price action over the past several weeks, as the underlying market pressures are constantly being altered by the changing circumstances of the coronavirus situation.

It is, therefore, the purpose of this analysis to delve into these changeable market pressures and to examine the impact of the most recent economic data in the EU and the US on the EURUSD's price action.

1. Long Term Outlook:

The weekly chart below demonstrates the relatively structured and layered behaviour of EURUSD's price action prior to the global outbreak of SARS-Cov-2, with distinct ranges and trends. After mid-February, however, the price action became much more sporadic and volatile.

It has been mostly contained below the major resistance level at 1.13000, with one attempt at a breakout reaching the major resistance level at 1.15000, and the significant support level at 1.07000. This is a massive area, and typical range-trading strategy rules do not apply in the context of the current market environment. The substantial in size price swings have been going up and down without a single comprehensive direction, which underlines the lack of a broader trend's existence. In other words, it cannot be postulated as to whether the euro or the dollar is going to ultimately come on top, even though the pair appears to be headed south.

The most recent behaviour of the price action encompasses this mounting bearish momentum. As can be seen, last week the price rebounded from the 10-day EMA and continued heading lower this week. In addition, the 10-day EMA is threading below the 10-day MA, which is another confirmation of the bearish sentiment in the market that has become more pronounced over the past couple of weeks.

The currently evolving bearish downswing can continue heading lower and even fall to the significant support level at 1.07000 before the price manages to rebound. Even though the current consolidation area (indicated as 'Intermittent price action' on the chart) is extensive, it has distinctive boundaries, one of them being the significant support level at 1.07000. This entails the considerable likelihood of a rebound once the price action reaches it. Any breakdowns below the area's lower edge seem highly improbable at present.

2. Fundamental Outlook:

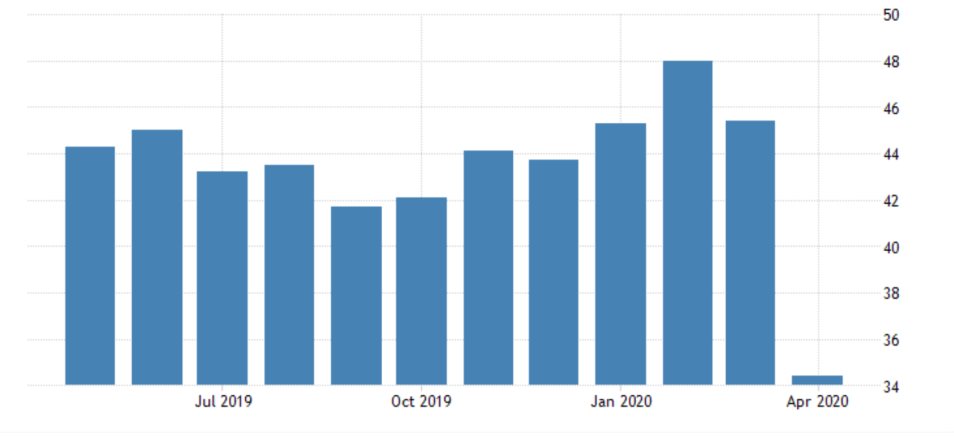

As most countries in the Eurozone and the US as well have started drawing out plans for their economies' gradual reopening, it is time to examine the underlying economic factors that might affect EURUSD's price action in the near future. Some industry PMI numbers were released in Germany and France today, which are respectively the first and second-largest economies in the Eurozone, thereby affecting the valuation of the single currency. Meanwhile, the greenback was also affected by the newest unemployment claims in the United States.

- Economic Indicators in the Eurozone. First of all, the French Manufacturing and Services PMI data for March came below the consensus forecasts, thereby underpinning the more detrimental impact of the coronavirus fallout on the French economy than initially anticipated.

The French Manufacturing PMI was reported at 31.5, down from the 43.2 points reported the previous month. Meanwhile, the country's Services PMI, which is arguably the more important gauge of industrial activity, was reported at 10.4 points, down from February's 27.4.

Meanwhile, Germany's Manufacturing PMI data for March was reported at 34.4 points, down from 45.4. The country's Services PMI, which encompasses the most significant chunk of the country's economy, came in at the disappointing 15.9, almost two times lower than February's 31.7.

Eurozone's economy is taking a decisive hit from the coronavirus fallout, and the above figures are demonstrating the massive toll that is being exerted on it by the national lockdowns in France and Germany. The latter has already started gradually easing off its restrictions; however, it is far too early to be expecting any sizable corrections in the near term. Overall, in the short term, we are likely to see the euro reeling from the tremendous pressure that is being felt by the bloc's broader economy before any form of stabilisation can be expected to take shape.

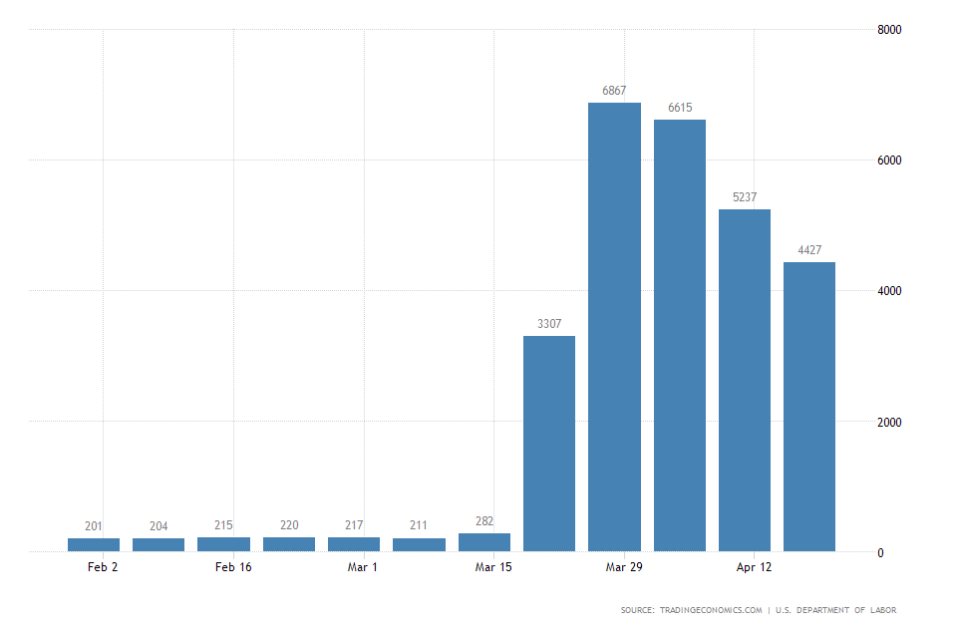

- The Labour Market in the US. The situation is eerily similar on the other side of the Atlantic, with the US economy reeling from the coronavirus fallout. Earlier today, the Department of Labor reported 4.427 million new unemployment claims that were failed over the last week. With that, the total number of individuals seeking unemployment benefits in the US has surpassed 27 million in just five weeks.

Even though the US labour market appears to be undergoing through its most difficult period since the Great Depression, there is an evident tendency of falling numbers of newly out of work individuals from week to week. This cannot be considered as a decisive improvement, but as a lesser deterioration on a weekly basis. Consequently, the greenback is likely to be pressured by the apparent deterioration of the US employment conditions, but at least the impact is somewhat mitigated, giving the USD a slight advantage over the EUR.

3. Short Term Outlook:

As can be seen on the daily chart below, the EURUSD has entered into a technical range-trading environment on the 31st of March, as indicated by the ADX. This means that as the ADX continues to fall, the price swings are likely to become more frequent each time the price nears a prominent support or resistance level. In the context of the 4H chart, we are likely to continue observing fluctuations that are contained within the boundaries of the triangle pattern below.

The Stochastic RSI exemplifies the rising selling pressure in the market as the indicator nears the 'Oversold' extreme. There is additional spare capacity, which implies that more selling orders can be placed, thereby increasing the selling pressure, before the price bounces back. In other words, the EURUSD can fall to the significant support level at 1.07000 (or even slightly lower) before a new bullish swing is formed.

The Bollinger Bands on the 4H chart below have become quite narrow over the last two days, indicating small levels of adverse volatility in the short term. The price action, however, is currently attempting to break down below the minor support level at 1.0800, which would be an attempt at forming the aforementioned directional downswing to or below the next significant support level.

The MACD, too, is treading in the negative territory, which is indicative of a likely downswing forming in the immediate future.

4. Concluding Remarks:

The EURUSD continues to be trading within the boundaries of a massive range, which is best demonstrated on the weekly and daily charts above. This behaviour manifests the likelihood for the formation of many upswings and downswings within the limits of set range. Delving into the last two charts with smaller timeframes illustrates the current development of one such downswing, which is expected to fall to around 1.0700 before the price action finds the necessary support.

At present, both the euro and the dollar are being pressured by muted economic data, with the greenback being in a slightly better position, but simultaneously the global demand for the two currencies is continuously surging. Consequently, the underlying fundamentals provide the perfect conditions for sustaining the aforementioned range-trading environment in the foreseeable future.

- The short-term projections of the analysis were met only partly. The price did not find support around the 1.07000 level, but instead, consolidated around the market price at the time of the analysis' publication. The long-term projections were quite profitable as the price reached the suggested target-level. The biggest takeaway here, similarly to many previous cases, is that traders need to be patient and bide their time. As can be seen above, sometimes it takes few weeks before the underlying market sentiment changes as initially expected.

Disclaimer: Your capital is at risk! Trading and investing on the financial markets carries a significant risk of loss. Each material, shown on this website, is provided for educational purposes only. A perfect, 100% accurate method of analysis does not exist. If you make a decision to trade or invest, based on the information from this website, you will be doing it at your own risk. Under no circumstances is Trendsharks responsible for any capital losses or damages you might suffer, while using the company’s products and services. For more information read our Terms & Conditions and Risk Disclaimer.