1. The Shifting Forces of Supply and Demand in the Market

The beginning of 2020 marked an unremarkable start of the new decade for the oil market. The price of crude consolidated in early January amidst an ongoing trade war between the US and China, escalating tensions and unrest in the Middle East, promises for further cuts in the production by the OPEC, and growing public demands globally for a shift towards renewable energy. Yet, despite all of these uncertainties concerning the future of the oil market as a whole, 2020 might be the most significant year for crude oil since 2012.

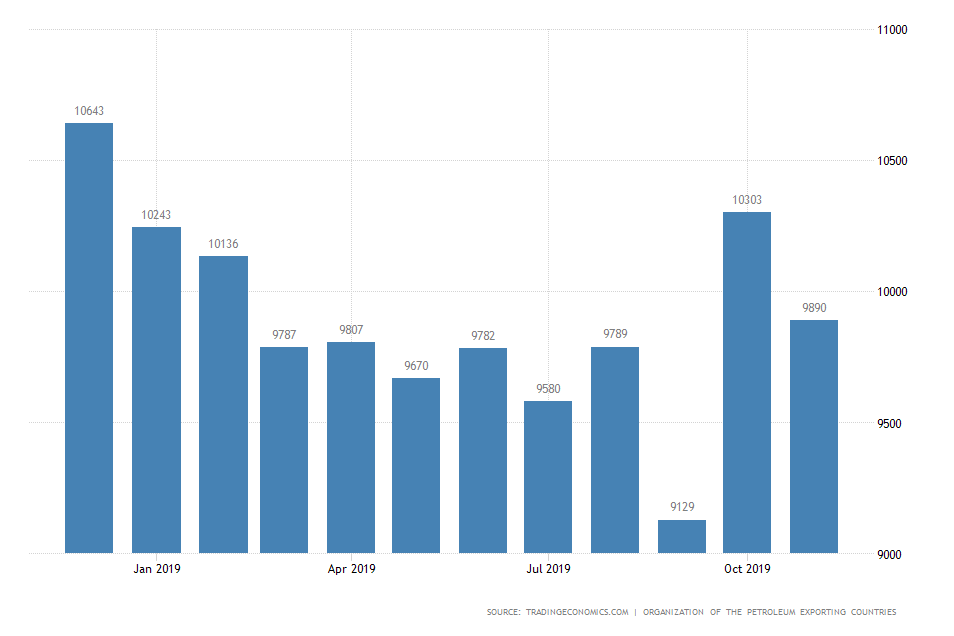

As regards supply, the current tendencies in global production converge towards a reduction in net supply, which is intended to stabilise the supply and demand equilibrium and lessen the current excess in the market’s spare capacity.

Last December the OPEC+ group announced that the member-states have agreed to lower their combined output by 500 000 barrels a day, plus an additional reduction of 400 000 barrels a day by Saudi Arabia, on the condition that each member committed to fulfilling its promise. The announcement came weeks before the long-anticipated IPO of Saudi Aramco, which at the time was intended to stabilise the market ahead of the company’s listing on the Tadawul Stock Exchange.

Due to the implemented reductions of production, OPEC’s net output has been steadily decreasing since 2017. Nevertheless, the global oil inventories currently seem quite resilient to short-term distortions in supply due to the aforementioned excess in spare capacity. In its oil report for January, The International Energy Agency commented on this by stating that:

“Today’s market where non-OPEC production is rising strongly and OECD stocks are 9 mb above the five-year average, provides a solid base from which to react to any escalation in geopolitical tension. As a back-up resource, the value of strategic stocks has once again been confirmed.”

It is exactly because of the impact of these substantial strategic reserves that the current trend of falling net oil production has had a somewhat muted effect thus far on the global energy markets. Consequently, the price of crude oil has been consolidating in a range between the significant resistance level at $70 and the major intermediary support level at $55 as the impact of the diminishing oil production by OPEC+ member-states is partially offset by the considerable oil reserves worldwide.

For the time being, the changing tendencies in the global supply of oil are not enough to prompt a new bullish trend; however, the impact of the diminished overall production is likely to become more substantial in the second part of 2020. The monthly price chart of crude oil demonstrates the consolidation of the price in a narrow range between the two aforementioned price levels.

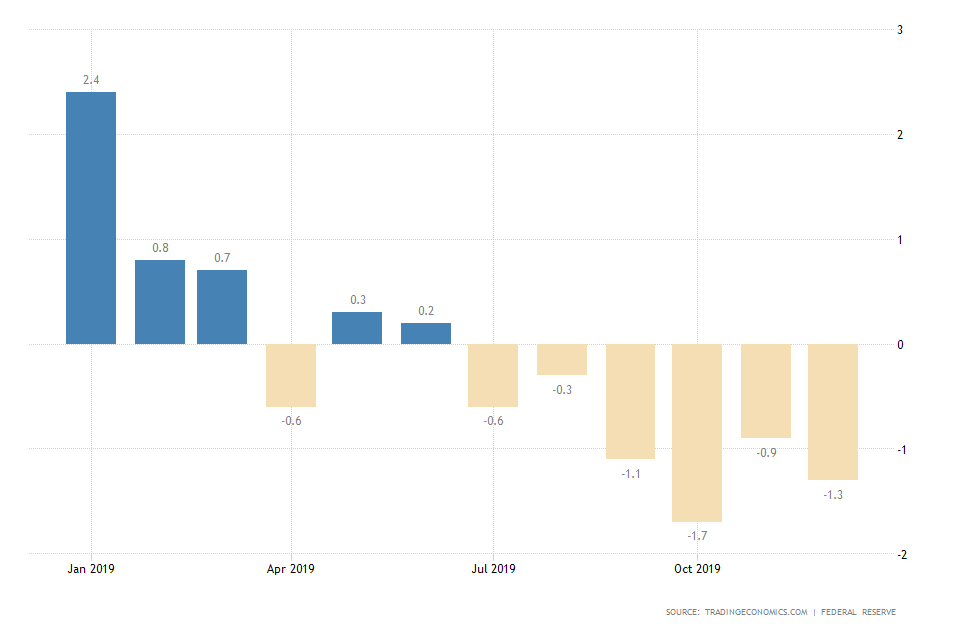

As regards demand, the current situation seems a bit more volatile at the present moment. On the one hand, the industrial imprint on the global environment is becoming more apparent and ecological crises such as the Australian bushfires have prompted demands internationally towards the adoption of renewable energy and the termination of the usage of fossil fuels. While many commentators have been quick to argue that public opinion worldwide might be enough to lessen the overall demand for oil, the current evidence suggests otherwise.

While the push towards using more renewable energy is unquestionable, the industry is not yet ready to altogether ditch fossil fuels. Notable car manufacturers such as BMW, Ford and Hyundai have all recently expressed their intentions to continue producing automobiles with diesel engines into the foreseeable future, which means that environmental concerns would not completely impede the demand in the oil markets.

In fact, the most recent data suggests the complete opposite – unlike supply, global oil demand seems to be rising, which would eventually be felt in the price setting of the commodity. According to the most recent ‘Oil Market Report’ compiled by OPEC:

“World oil demand in 2020 is foreseen to increase by 1.22 mb/d, up by 0.14 mb/d from last month’s report, to average 100.98 mb/d for the year. Improved trade sentiment between the US and China, as well as an improved economic outlook in various economies — coupled with a low baseline — propelled the upward revision.”

Last year, manufacturing in the US, Europe, and across the emerging markets was hit by the slump in international trade, which subsequently affected the overall demand in most commodities markets. This year, however, begins with a revised sentiment, and now most central banks and market analysts anticipate an improvement in the industry output and consequently in manufacturing as well. Thus, rapidly rising oil demand is more than likely to be positively impacted by the stabilisation of the industry conditions.

Overall, in the next following years, global oil supply is going to continue to decrease in countries that are members of OPEC. Meanwhile, global demand is likely to grow, albeit at a slower pace, as the international geopolitical tensions and trade negotiations continue to stabilise. This growth factor, however, is expected to be partially offset by the growing environmental concerns. Ultimately, the price of crude oil is more than likely to be positively impacted by the current tendencies of the changing global supply and demand equilibrium. The price of crude oil is thus likely to form a new bullish trend as soon as the disparity in the supply and demand forces worldwide becomes more distinctly noticeable. In the following 1-2 years, the price is likely to break out above the $70 threshold and converge towards the $80 target.

2. The Bears Prevail in the Short-Term

Despite the considerably bullish outlook of oil in the long-term, currently, the market is behaving in a distinctly bearish manner.

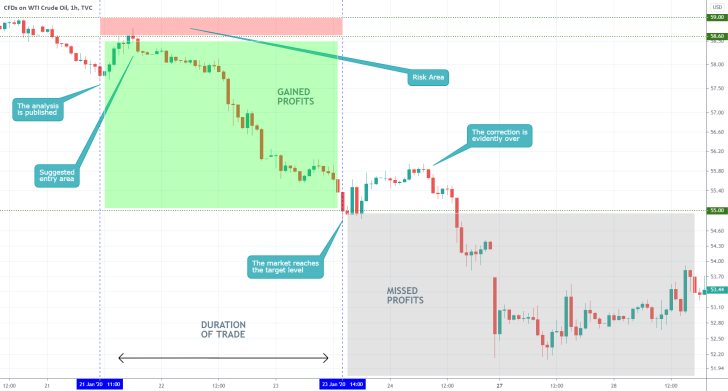

The price has failed to break out above the Major Resistance level at 63.60, as indicated by the chart below. Subsequently, the most recent Markup was terminated, and the price is currently establishing a bearish correction, which might very likely turn into a new Markdown. Thus, there is a possibility for the execution of short-term selling orders.

The price has recently broken down below the support level at 59.10 (currently acting as a resistance), which creates the possibility for entering the market by the execution of a short spot position. The MACD indicator confirms the prevailingly bearish sentiment and judging by the past price action; crude oil could fall as low as 55.00 (or even to the next level at 52.10) before it finds support.

3. What Fundamental Forces Are Driving the Oil Market Currently?

The price of crude oil is currently falling for the second consecutive day despite some investors’ concerns from Monday following the momentary disruption of Libyan exports due to the ongoing civil war.

Khalifa Hafrat, a Libyan military commander who is currently fighting against the UN-backed Libyan government, captured pivotal ports in response to a gathering of world leaders in Berlin this Saturday, who threatened Hafrat in a bid to accommodate a cease-fire in Libya.

The price of crude oil temporarily surged on the news that the country’s oil exports have been impeded. However, it quickly fell after it was acknowledged that the aforementioned spare capacity of the global strategic reserves is more than sufficient to offset such distortions in production caused by geopolitical crises.

Jeffrey Halley, a senior market analyst at Oanda in Singapore, was quoted by Bloomberg as commenting on the situation:

“Markets appear to have moved on from the Libya and Iraq issues because of more pressing concerns over demand. […] OPEC and its allies have enough spare capacity to make up for any loss of supply from Libya, and there are no signs yet of the Iraq situation “becoming a structural problem.”

Thus, at the present rate, the oil market is driven by investors’ confidence in the sufficiently stacked global strategic reserves, and also by waning concerns over the potentially detrimental impact of similar geopolitical crises in the Middle East. Essentially, as global supply continues to be robust, the international environment stabilises, and trade uncertainty lessens, the price of crude is likely to continue falling in the short term by offsetting some of last month's gains.

4. What Are the Crucial Price Levels to Watch for and What Are the Hidden Dangers of Selling Now?

The price is currently testing the strength of the minor support level at 58.10. If it manages to break down below it successfully, the corrective swing is likely to turn into a new bearish trend. Then, the next most likely target level for the crude oil would be the Major Intermediate Level at 55.00. Conversely, if the minor support holds and the price bounces off it, the next most likely target would be the Momentary Resistance level at 59.10. The price can test the strength of that resistance at least one more time before a sizable downswing finally occurs.

5. How Can a Trade Be Executed om the Current Setup?

Scenario 1 – Sell at the spot market price.

Open a short-term selling order at the current market price of the crude oil. The trade is intended to catch the likely bearish correction towards the direction of the intermediate support at 55.00 (that is not to say that the price would definitely reach that level!). The threat to such a position would be an immediate rebound of the price towards the momentary resistance at 59.10. Thus:

Entry price level – around 58.60

Stop-loss – in the range 58.90 – 59.10

Take profit – best-case scenario at 55.00 (it would likely take more than a week for the price to fall as much, if at all). Conversely, the position can be terminated somewhere between 55.00 and 58.10 at the trader’s will.

Scenario 2 - Sell at the momentary resistance at 59.10. Such a position would be justified by more or less the same underlying conditions. Scenario 2 involves less trading risk compared to scenario 1, which is why it is more suitable for more risk-averse traders. On the flip side, however, the chance for execution is also correspondingly diminished as the current throwback may not reach the momentary resistance at all.

Entry price level – 59.10

Stop-loss – 59.35

Take profit – same rules apply

Scenario 3 – Wait to buy into the market after the downturn swing (suitable for long-term bulls)

The expectations for the rising price of crude oil in the long-term would motivate such a trading decision. Thus, traders can hope to catch a $15+ movement in the underlying price in single or multiple consecutive positions. However, such a strategy might take weeks or even months to come to fruition, if at all. The trader would have to wait for confirmation that the bearish sentiment is exhausted and that the bulls have once again taken full control in the market.

Entry price level – at least at 60.00. At any rate, even more solid evidence might be needed at a later stage. Hence, a long position might be opened in the 60.00-60.70 range, depending on how the market evolves in the future.

Stop-loss – cannot be specified precisely so prematurely as the prevailing short-term sentiment is still noticeably bearish

Take profit – the ultimate goal of such a long-term setup would be the significant resistance level at 70.00

- This trade performed exceptionally well, catching 360 cents in the span of two days. Shortly after the target level at 55.00 was reached the market went on to establish a minor bullish correction. The issue is that this opportunity was not exploited, meaning that the opportunity to catch another 250-350 cents was missed.

- The old trading adage "Le your winners grow" applies here as the most significant takeaway from this trade. Trending markets are ideal for making consistently successful trades. In future, look for corrections in trending markets to add to existing trades or open new ones, coinciding with the existing trend.

Disclaimer: Your capital is at risk! Trading and investing on the financial markets carries a significant risk of loss. Each material, shown on this website, is provided for educational purposes only. A perfect, 100% accurate method of analysis does not exist. If you make a decision to trade or invest, based on the information from this website, you will be doing it at your own risk. Under no circumstances is Trendsharks responsible for any capital losses or damages you might suffer, while using the company’s products and services. For more information read our Terms & Conditions and Risk Disclaimer.