The coronavirus pandemic has swept through the world, exerting an enormous toll on the global economy and the international supply chains. At present, two key industries appear to be strained the most from the severity of the virus – tourism and air travel. With many international flights being cancelled and tourists locked at home, policymakers around the world have scrambled to propose bailout plans to save those particularly hard-hit industries from failing.

And while the attention of the markets is focused on the survival of those particular sectors, another industry is already starting to suffer from the disruptions associated with the national lockdowns and the global effort to curtail the spread of the pathogen. Even so, for the time being, this struggling industry appears to have gone under the radar, and many traders do not seem to have given it much consideration.

Agriculture remains the primary sector in many developing economies, which makes nations that are net exporters of food, particularly exposed and vulnerable to future disruptions in the global supply chains. Investors and policymakers have focused so much on measuring and curtailing the negative impact that the strong dollar is exerting on these emerging markets, that the threat to the agricultural industry has been sidelined or vastly ignored.

Moreover, even farming in advanced economies is now exposed to the threat of disruption in activity, which could have substantial consequences for the prices of some foods. Today’s analysis focuses on one particular staple food, which is also among the most heavily traded commodities in the world – wheat. The price of wheat is typically affected by market seasonality, as there is a strong correlation between the time of the year and the global supply of wheat. It all boils down to when the world’s top producers plant the staple, and when the harvest takes place.

Right now, however, national lockdowns could very likely affect those strict timelines, which, in turn, is going to reflect on the global supply of wheat in the following months. Hence, the current analysis examines the expected impact of the global COVID-19 pandemic on the cultivation of wheat and evaluates the likely way in which such distortions could affect the price of the commodity in the long run.

1. Long Term Outlook:

As can be seen from the weekly chart below, the price of wheat has jumped by more than 12 per cent over the past two weeks. The price is currently testing the strength of the major resistance level at 5.809, which acted as an upper boundary of the previous Distribution range. Hence, if the price manages to break out above it, this would be a clear indication that the long-term market sentiment is ostensibly bullish, and that the price is likely to extend its gains further north.

The price action has developed distinctly recognisable stages of the comprehensive Wyckoff cycle, and evidently, it appears to be advancing in a predictable manner. The price has recently reached the 5.000 level, which has psychological importance due to the three zeroes in the number.

It can be seen that the preceding markdown has indeed been terminated around that level, which unsurprisingly acted as a turning point for the direction of the underlying price action. This happened just as global tensions and fear on Wall Street started to rise due to the spread of the coronavirus pandemic. The one question that remains is how much further north can the new Markup reach as the underlying fundamentals continue to evolve?

2. The Top Three and Panic Stockpiling:

Four significant points require close consideration if one wants to understand the nature of the shifting supply and demand equilibrium in the market for wheat. These include a closer review of the current situationс in the world's top three producers of wheat – China; India and Russia. This is important for understanding the most recent tendencies in the supply-side of the market. Additionally, understanding the mass-market mentality of individuals in affected countries can shed light on the latest trends in the demand-side of the market.

- Production in China. By now everybody knows that the novel coronavirus originated in China, which was also the first country to go on national lockdown. In the last several days, however, the government-imposed restrictions even in the epicentre of the outbreak – the Hubei province – have been eased off, as individuals return to their workplaces.

Even as the economic activity in China starts to pick up gradually, economists expect a gradual period of adjustment to pass before the world's second-biggest economy reaches the pre-coronavirus rate of growth. What this means essentially is that even though the Chinese economy is being restarted now, it would need time to catch up to its previous pace.

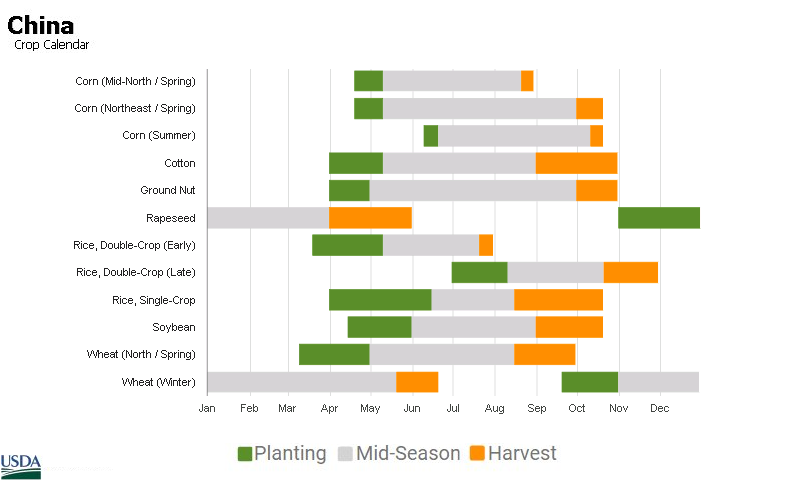

As regards wheat, China remains the biggest producer in the world, but its market for staple foods is undoubtedly going to be affected to a degree from the recent lockdown. The country typically has two harvests during the year – a summer one and a winter one. As regards the winter harvest, the planting process begins in mid-March and continues until late-May, according to the United States Department of Agriculture.

Hence, Chinese farmers returning to work after quarantine would not have missed much of the planting deadline. Nevertheless, the farming industry in China is most certainly going to be affected to some degree by the outbreak of COVID-19, but it is not yet clear to what extent.

What can be expected, however, is a potential fall in the aggregate production of wheat this year, which is going to affect China’s exports negatively. Hence, China’s contribution to the global wheat supply can be anticipated to decline this year. But the exact extent of such a reduction is not yet clear.

- Production in India. India is the second-largest producer of wheat in the world and its capacity to grow it is likely to be affected in almost the same way. Unlike China, however, India's production is going to suffer markedly due to worse timing.

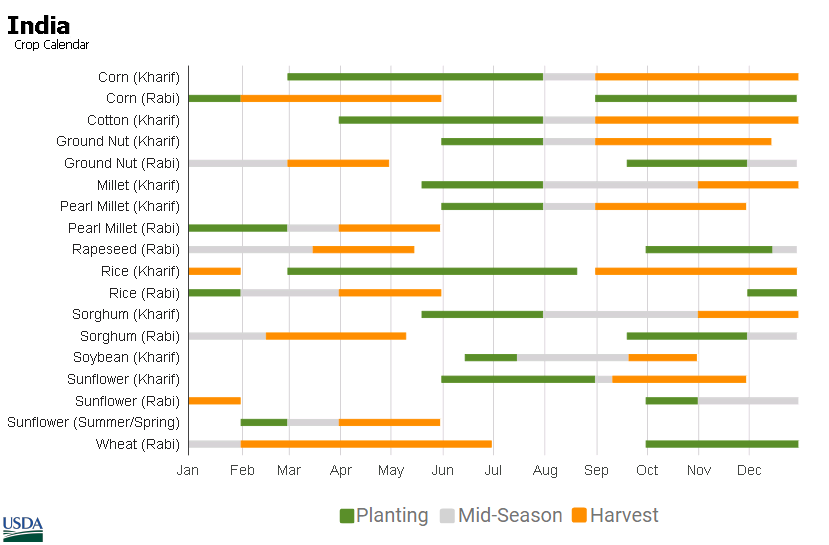

According to the United States Department of Agriculture, India typically harvests wheat in the months between February and July. Due to the rapidly increasing number of confirmed COVID-19 cases in the country, however, India's Prime Minister Narendra Modi has recently ordered India to go on lockdown too. Unfortunately for local farmers, this decision comes precisely when the harvest season should start picking up speed. So, unless some special concessions are granted to Indian farmers, and they are allowed to continue with their work, India is going to suffer from sizable fall in wheat production this year.

It is yet unclear how the Indian government is going to proceed hereafter, but the negative impact on the country’s wheat exports by the end of the year is likely to be much more pronounced than it is in China. This means that global wheat supply is indeed going to fall in 2020.

- Russia’s Policy. Russia is the third-biggest producer of wheat in the world, but it is its biggest exporter, which makes Vladimir Putin’s foreign policy quite important.

The country maintains that it has been relatively unscathed by the global pandemic and has downplayed the risk of the coronavirus. Even still, it has started implementing certain policies, which suggest that the government is preparing for a significant outbreak in Russia as well. The country has followed suit to many European countries and has closed down its borders to foreigners, but it is Russia’s policy on exports that has concerned traders. According to Bloomberg:

“The world’s top wheat shipper briefly suspended exports of some processed grains and asked officials whether there should be curbs on overseas sales of consumer goods like foods and medicine. While there’s been no specific government mention of wheat, Russia has a history of shaking up the global market by restricting sales through export taxes, bans or informal limits.”

These actions have already contributed to the aforementioned surge in the price of wheat futures, and the situation could escalate further. In a scenario in which the global pandemic continues to deteriorate, Russia and other exporters are very likely to continue reducing the size of their wheat exports so that they can stockpile their own food reserves. Such actions are, of course, going to contribute to the rising prices of wheat in the long run.

- Global Food Hoarding. As regards demand-side trends in the market, there is one factor that requires closer attention. People are still rushing to stockpile with food in their homes due to the looming uncertainty emanating from the pandemic.

Shoppers are rushing to hoard non-perishable foods like pasta, while governments have ramped up their efforts to add to their strategic inventories.

In conclusion, the global supply of wheat is expected to fall in the long run (unless the situation changes promptly), while demand is already surging in the short run. This discrepancy has caused the price of wheat futures to rise, and this trend is likely to become even more pronounced in the future.

3. Short Term Outlook:

The ADX on the daily chart below illustrates the rising strength of the recent bullish spike, as the indicator is threading above 25 points. This means that the bullish sentiment in the market is picking up steam.

Elliott Wave Theory is utilised to categorise the various impulses and pullbacks in the different trends' development. As can be seen, the market has developed a distinct 1-5 impulse wave pattern, followed by a classic ABC correction. This observation, coupled with the expectation for increasingly more robust trending environment, means that the present bullish uptrend is likely to continue rising in the future.

The price of wheat is likely to continue heading further north, as the underlying fundamentals evidently support such behaviour. However, the uptrend is expected to follow the familiar 1-5 impulse wave pattern, which is postulated by EWT. Hence, a new pullback may be due to form soon. A retracement to the major resistance level (currently serving as a support) at 5.510 seems to be the most likely outcome.

There are reasons to expect a minor correction in the short run before the broader trend can continue its development. As can be seen on the 4H chart below, the bullish momentum appears to have peaked, which signifies inevitable exhaustion in the market. A bearish correction now would prompt more bulls to enter long at a discount once the price of wheat reaches a dip.

Right now, the lower Bollinger band in addition to the regression channel’s middle line are both converging towards the major resistance (support) level at 5.510, all of which confirms the level’s importance. If the price were indeed to start falling now, this level would be an ideal contender for a dip of the anticipated pullback, so we are likely to see increased buying pressure around it.

4. Concluding Remarks:

Global supply of wheat is likely to continue falling in the long run while demand is exponentially rising in the short run, all of which contributes to the currently ascending price of wheat. But even though the market seems bound to continue going north, this does not mean that traders could go long just about anywhere. There is ample evidence suggesting that the price is due for a minor correction, which would create favourable opportunities for entering long at a discount once the anticipated pullback reaches a dip.

Disclaimer: Your capital is at risk! Trading and investing on the financial markets carries a significant risk of loss. Each material, shown on this website, is provided for educational purposes only. A perfect, 100% accurate method of analysis does not exist. If you make a decision to trade or invest, based on the information from this website, you will be doing it at your own risk. Under no circumstances is Trendsharks responsible for any capital losses or damages you might suffer, while using the company’s products and services. For more information read our Terms & Conditions and Risk Disclaimer.