Apple and Amazon, which are the last participants of the 'Big Tech' sector to report earnings for the current quarter, are bound to stir heightened price action on their stocks after the market close today, by announcing the pandemic's impact on their performances in Q1. These two reports are anticipated by investors to seal the faith of the US tech industry in the wake of the coronavirus crisis, which is causing the most substantial economic contraction since the 2008 credit crunch.

For reasons which we outlined in our previous analysis, we expect these two reports to illustrate the extent of the hit caused by the coronavirus fallout on the US stock market, thereby drawing traders and investors' attention. Hence, the market is bracing for volatile price action on Apple and Amazon's stocks following the releases of the two companies' earnings reports for Q1 2020. And while in Amazon's case the market anticipates the delivery of a very robust quarterly performance due to the retailer's business model, the situation for Apple seems drastically different.

The rampant spread of COVID-19 globally has prompted governments to impose stringent national lockdowns and close down their economies in a bid to curtail the pace of the outbreak, which has affected negatively the global supply chains and the global economic activity in general. As regards the operations of Apple, these developments have resulted in massive headwinds for the previously biggest company in the world.

Prior to the outbreak of the novel coronavirus in the Chinese province of Hubei, Apple had started to transform its business model from being product-oriented towards becoming services-based. The company had announced plans to develop the services on its App Store in a bid to decrease its dependency on iPhone sales. This transition, however, did not come soon enough as production and demand were both severely hit from the outset of China's lockdown, thereby seriously jeopardising Apple's revenue streams this quarter.

The subsequent escalation of the coronavirus crisis has highlighted all manners of vulnerabilities in Apple's production-cantered business model, which is reeling from both supply-side and demand-side distortions caused by the aforementioned lockdowns.

That is why the purpose of today's analysis is to examine the current fundamental outlook for Apple's shares, prior to the release of the earnings report, and to underscore the most likely future price action following its publication.

1. Long Term Outlook:

As can be seen on the weekly chart below, the underlying price action is quite responsive to the established major levels of support and resistance. That is how the substantial selloff triggered by rising investors' fears in the early days of the pandemic, was stopped at the major support level at 230.00. This price level was established as an important turning point in late-2018, at which time it served as a historical resistance. Seeing as how the major support level there converges towards the lower boundary of the massive ascending channel, any future breakdowns below 230.00 seem highly unlikely.

By measuring the size and slope of the considerable bullish market preceding the selloff, the most important Fibonacci retracement levels can be drawn on the chart. Given the aforementioned responsiveness of the price action to such crucial levels as likely turning points, adverse price swings can be anticipated to form each time the price action nears one such level but fails to break it.

The behaviour of the price action confirms this assertion at the time when the selloff reached its lowest point at 212.75, which is a prominent support level represented by the 61.8 per cent Fibonacci Retracement level. Afterwards, the price action quickly rebounded from that level in what has since turned into a distinctive V-Shaped correction pattern, manifesting the existence of substantial bullish sentiment in the market.

This week Apple's share price has attempted to break out above the 23.6 per cent Fibonacci retracement level at 283.55, which represents the last obstacle for the bullish correction's development. It is, however, still too early to conclude whether or not the breakout is successful. This can be done only after the initial volatility caused by the earnings report's release settles down. Only if at that point the price action remains threading above the 23.6 per cent Fibonacci retracement level the recent breakout can be considered as successful.

This is quite important not only because the price action is currently attempting to break out above a prominent Fibonacci level, but also because it is trying to close above the ascending channel's middle line, which, too, serves a role as an intermediate resistance level. Hence, if the price action manages to consolidate above it following the release of the earnings report, this would be a necessary step for the eventual recovery back to the historical resistance level at 325.00. Conversely, if the price action reverts its direction, it can keep falling until it finds support from the next prominent level, which is the 38.2 per cent Fibonacci at 256.49.

2. Fundamental Outlook:

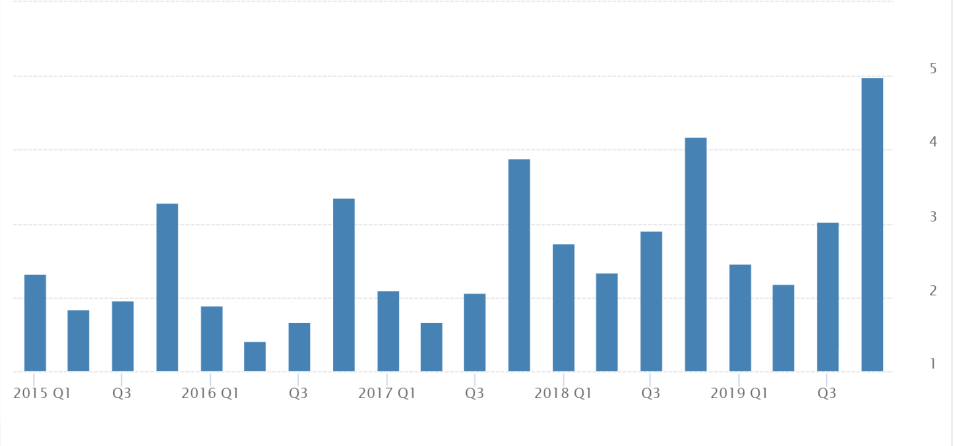

As it was argued earlier, market experts anticipate the recent developments to have impeded Apple's production as well as the global demand for its products. Consequently, the consensus forecasts project a considerable depreciation in the Earnings Per Share of Apple's common stock. The EPS for Q1 of 2020 are expected to fall to $2.09, which would be almost two times smaller compared to the $4.99 EPS reported for Q4 of 2019. Such an outcome would also fall short of the $2.46 EPS, which were reported for the same period last year.

As can be seen on the chart above, Apple tends to perform quite strongly in the last quarter of each year, which is when the festive period takes place. Then its revenue suffers in the first quarter of each new year, which can be explained by people not spending as much in January and February. This year the coronavirus crisis coincided with this historically weak period for Apple, which would likely amplify the negative impact exerted on the company's revenue streams.

In its previous earnings report, Apple published forward-looking statements projecting its revenue to be between $63.0 billion and $67.0 billion; however, the aforementioned issues could make the tech giant miss its target. This would naturally affect negatively its stock price, which could tumble if the gap between the anticipated and actual revenue is quite drastic.

Due to the aforementioned transition of Apple from having a product-centred business plan towards a services-oriented business model, investors are most likely to focus their attention on one crucial metric – the company's revenue from services. Even if its net revenue misses the initial expectations, a recorded surge in the revenue generated from services is likely going to mitigate the hit, resulting in a smaller fall of the share price after the release.

3. Short Term Outlook:

As can be seen on the daily chart above, the ADX has been threading below 25 points, which means that the price action is currently range-trading. Additionally, the price is threading in the lower part of the minor ascending channel, which means that a probable breakout above its middle line would entail the existence of more distinctive bullish sentiment in the market.

The bullish correction that followed the selloff's termination is characterised by the common 1-5 impulse wave pattern, similar to what was done for Microsoft's price action in the previous analysis. Hence, the price action's midterm outlook looks prevailingly bullish, regardless of the earnings report's eventual findings. The existence of this bullish sentiment is further confirmed by the RSI, which has registered a moderate fall despite the underlying price action's appreciation.

Moreover, the 10-day EMA has recently crossed above the 10-day MA, which is threading higher than the 20-day MA, as can be seen on the 4H chart below. All of this confirms the prevalence of the bullish momentum in the short term as well.

4. Concluding Remarks:

Overall, the technical outlook on Apple's share price looks mostly bullish. However, the fundamental analysis suggests that the company would likely continue to feel the strain of the coronavirus pandemic. This apparent juxtaposition of the technical and fundamental analyses' findings could likely result in the emergence of massive adverse volatility following the release of the earnings report.

The price action could start fluctuating intermittently until the underlying pressures find a new equilibrium. Afterwards, it seems as though the price action would most likely continue with developing the present bullish correction, albeit at a slower pace due to the perceived impact of the pandemic on Apple's revenue.

Disclaimer: Your capital is at risk! Trading and investing on the financial markets carries a significant risk of loss. Each material, shown on this website, is provided for educational purposes only. A perfect, 100% accurate method of analysis does not exist. If you make a decision to trade or invest, based on the information from this website, you will be doing it at your own risk. Under no circumstances is Trendsharks responsible for any capital losses or damages you might suffer, while using the company’s products and services. For more information read our Terms & Conditions and Risk Disclaimer.