In the forex market, the GBPJPY pair is one of the most heavily traded currency pairs, and its price action is usually characterised by the massive trading volume that is transacted daily. In light of the recent developments on the global capital market, the GBPJPY has become even more volatile and appealing to traders.

The pair’s price moved by the remarkable 9 per cent (nearly 12 Yens) over the past three weeks, which illustrates the robust trending environment and the very advantageous conditions for profitmaking by trading. That is why traders are currently eager to join the market and catch some of the massive price swings that are expected to take place over the next few days. Nevertheless, caution must be exercised.

Joining an existing trend is arguably the easiest way to execute a successful trade; however, imprecise entry into such a position would substantially lessen the outlook of the trade and correspondingly increase the underlying risk. Conversely, entering the market on the expectation for trend reversal entails considerable risk as well.

That is why, regardless of one’s opinions of the pair and its price action, caution must be exercised, and both bulls and bears need to play the ‘waiting game’ and join the market only when it would be most pertinent to do so. Chiefly, bulls need to be on the lookout for indications that the current trend has reached a dip; and bears would do well to wait for the formation of a pullback so that they can enter short at its peak.

The exercise of patience is especially important now, given that the GBPJPY is nearing a significant price level and a potential turning point for the direction of its price action. That is why the present analysis examines the underlying evidence pointing to the likely continuation of the existing trend, as well as the available evidence in support of a potential trend reversal.

1. Long Term Outlook:

As can be seen on the weekly chart below, the price has recently broken down below the 61.8 per cent Fibonacci retracement level at 134.127. It is currently headed towards the significant support level at 131.000. It looks almost certain that the pair will reach that support level shortly and it will test its strength, but why is it so important?

The significant support level at 131.000 is a potential turning point for two reasons. First of all, it is close to 130.000, which is psychologically important due to the many zeroes at the back of the number. As we have established on multiple occasions in our previous analyses, such psychological levels frequently have the capacity to change the direction of the underlying price action, due to the fact that traders prefer to collect their running profits around them. Such actions result in the termination of multiple orders around the same level, which creates discrepancies in the underlying supply and demand pressures. In turn, the altered underlying market sentiment can disrupt the pre-existing trend and change its direction.

Second of all, the significant support level at 131.000 is also acting as the upper boundary of the previous Accumulation range, which increases its importance. Traders would soon start recognising that the price action is about to enter an area, which is where the previous bearish trend was held back and eventually lost its strength. Thereby, the behaviour of the GBPJPY around the 131.000 mark - whether it manages to break down below it immediately, or it starts consolidating around - it is going to be quite telling of how the market is going to behave next.

Therefore, market bulls would be expecting the price to start consolidating around the 131.000 level, which would be illustrative of a potential trend reversal in the making. Conversely, if the pair instead manages to break down below the support relatively easy, this would give market bears additional evidence that the downtrend is likely to persist, and they can consider joining it then and there. Both types of traders would be on the lookout for the development of the next Accumulation range.

2. The Underlying Fundamentals:

Three fundamental factors deserve our close attention – one in Japan and two in the UK.

- In the UK. Yesterday the Bank of England became the third major central bank after the RBA and the FED to cut its interest rate in a bid to offset the economic fallout from the coronavirus on the global economy.

The Monetary Policy Committee (MPC) of the BOE decided to reduce the interest rate by 50 basis points to 0.25 per cent at an emergency meeting. In addition to this, the Committee also decided to increase the available liquidity in the economy in an effort to stimulate the shaken but not stirred consumer confidence in the UK.

The GBPJPY fell by 1.75 per cent in the wake of the monetary policy statement’s release. That is owing to traders’ perception of diminished competitiveness of the pound.

The interest rate decision is likely to continue having a significant impact on the GBPJPY in the next two or three trading days until the market manages to price in the news completely.

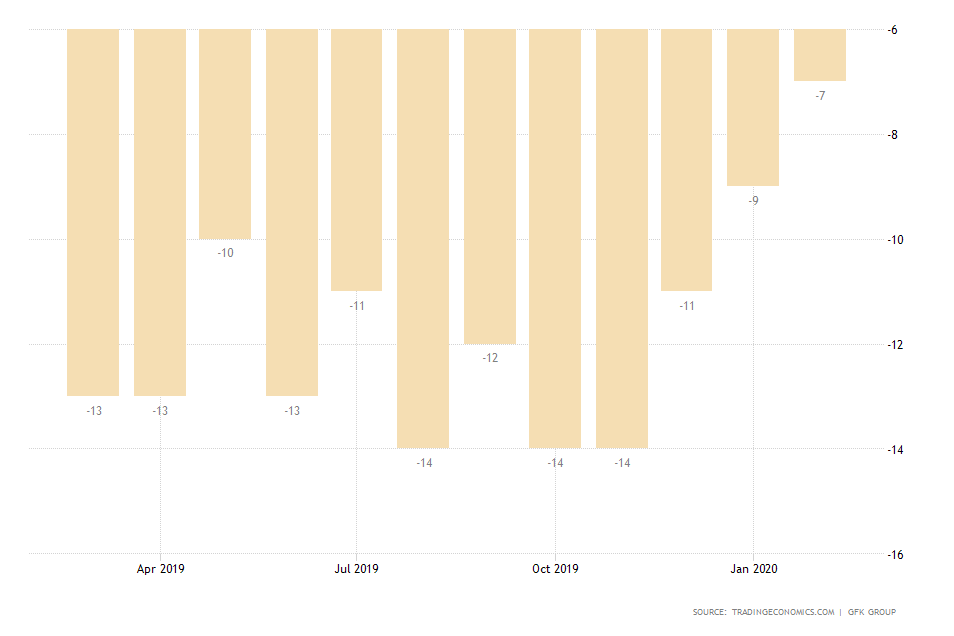

Even with these structural changes to the BOE's monetary policy, the consumer sentiment in the UK remains solid. Following the moderately successful Brexit transition, the British consumer confidence climbed for the third consecutive month in February 2020. Moreover, the index is currently at its highest in over a year, which is illustrative of the heightened optimism in Britain.

Thereby, the pound is likely to be supported in the short run by these positive economic pressures, provided that the coronavirus epidemic does not weigh down on them heavily in the following weeks and months.

- In Japan. The Japanese yen is surging on investors’ fears as a safe-haven asset. The demand for it is bolstered by investors fleeing to low-risk markets, such as the case with gold and bonds.

This trend is likely to persist in the foreseeable future as the coronavirus situation continues to develop. Thereby, the BOE's decision to cut the rate in addition to the heightened demand for the Yen is likely to continue driving the GBPJPY further south.

One factor that might disrupt this trend is a potential announcement that the summer Olympics in Tokyo are cancelled. This massive public project is Shinzo Abe’s, the Prime Minister of Japan, key focus over the past few weeks.

The potential cancellation of the games is going to turn into a failed investment project with no returns, which is going to jolt the national business confidence and strike the Yen. Consequently, the currency is likely to suffer from it.

3. Short Term Outlook:

As can be seen on the daily chart above, the markdown is currently in full swing. The ADX is threading above 25 index points, which is confirming the strength of the present bearish trend.

The pair consolidated momentarily around the last two important price levels before eventually breaking down below them. This could be an indication of how it would likely behave around the significant support level at 131.000. Thereby, a consolidation above it would not necessarily imply that the bearish trend is exhausted and that a new bullish upswing is due.

Meanwhile, the 4H chart above demonstrates that the recent markdown is evolving within the boundaries of a descending channel. Moreover, the price has recently broken down within the lower part of the channel, which is exhibitive of increasing bearish sentiment. What is even more noteworthy is that this breakdown occurred at the same time the price managed to break down below the 61.8 per cent Fibonacci retracement level at 134.127.

This is confirming the strength of the underlying bearish sentiment even more. To top it all up, the MACD has recently turned prevailingly bearish following the crossover on the 11th of March. With the increasing bearish momentum, the price action seems more likely to break down below the aforementioned support level.

4. Concluding Remarks:

As a whole, the global economy appears to be in the early stages of entering into a new bearish market. This would change the general outlook and alter the nature of trading compared to the last few months.

With the prevailing adverse volatility and the erratic behaviour of many assets, it is not very easy to project the long-term behaviour of the GBPJPY. This is especially true if the Yen continues to be a preferred safe-haven asset.

Nevertheless, there are still good opportunities for trading in the short term. Before joining the market, it is crucial to be seen how the price of the pair behaves around the significant support level at 131.000.

- The successful trend-continuation trade gained good profits, but the trade could have been structured better. The entry was suboptimal because the analysis suggested refraining from trading until the price action broke down below the significant support at 131.00. While this decision was justified because there was no guarantee that the market would eventually break down below this historic support, the analysis could have recognised the fact that the market was already in an established downtrend. Hence, joining an existing trend after the completion of a minor correction would also have been justified.

Disclaimer: Your capital is at risk! Trading and investing on the financial markets carries a significant risk of loss. Each material, shown on this website, is provided for educational purposes only. A perfect, 100% accurate method of analysis does not exist. If you make a decision to trade or invest, based on the information from this website, you will be doing it at your own risk. Under no circumstances is Trendsharks responsible for any capital losses or damages you might suffer, while using the company’s products and services. For more information read our Terms & Conditions and Risk Disclaimer.