1. The Aftermath of the Outbreak on the SSE

The new coronavirus, which has resulted in 25 casualties as of the 23rd of January, is starting to exert a negative impact on the Chinese economy. Investors and market analysts fear that as the panic in China and elsewhere grows and speculations of a new likely pandemic spread, the recovering Chinese economy could be hit with new rounds of uncertainty, which would have a negative spillover effect on the stock market. The purpose of this analysis is to examine the likely consequences for the stock market and the Chinese economy as a whole, that are stemming from such fears. The analysis will reflect the most recent developments and project the most likely short-term ramifications for the SSE Composite index in China as the situation continues to evolve.

So far the biggest fear is that the coronavirus, which has been dubbed the "Wuhan Virus" after the capital city in the Hubei province where the outbreak is believed to have originated, is going to cause even more harm than the SARS virus. The latter claimed more than 800 lives almost two decades ago.

Bloomberg reported that in the wake of SARS's spread in 2003, the Chinese Gross Domestic Product had tumbled by two percentage points, from 11.1 per cent to 9.1 per cent. In comparison, that is more than the losses that were made last year from the trade war with the US. Thus, if the current epidemic continues to spread and grow to the point where it starts to resemble in magnitude the situation back then, the currently recovering Chinese economy could take a new devastating hit just as the global trade tensions seem to be de-escalating. So far the current situation has been registered by the SSE Composite Index in China, however, provided that the epidemic's proportions escalate further, the ramifications from it could get international dimensions.

So far the SSE Composite Index, which incorporates the biggest companies on the Shanghai Stock Exchange, has tumbled by 1.22 per cent this week, which would have been a much more significant drop if it weren't for momentary trimmings in the generated losses. Nevertheless, the re-accumulation phase, which was previously anticipated to turn into a new bullish trend on the easing of the global trade tensions, could instead result in a new bearish trend if the market sentiment continues to worsen.

The long-term momentum is still mostly bullish, with the Relative Strength Indicator (RSI) being above 50 points. However, the most recent developments have already caused a slight swing in the general momentum towards the downside.

The 10-day Moving Average and the 10-day Exponential Moving Average are still trading in an ascending order, which manifests the long-term bullish sentiment despite the EMA already showing signs of a possible reversal. So far, the price action has been contained above them, which exemplifies strong support. However, this week's momentary probing below the two averages could turn out to be the first of other attempts by the market to form a bearish correction.

If a short-term bearish correction does indeed continue to develop as a consequence of the Wuhan virus, the downswing is likely to find support at the channel's lower boundary as well as on the 38.2 per cent Fibonacci Retracement level at 2901.8874.

2. What is Known So Far and the Measures that Have Been Implemented:

As it was already stated, as of the 23rd of January, the death toll has reached 25 from 18. The youngest casualty is 36 years old, with news that the number of affected people has already surpassed 800, and that the youngest infected person is reportedly ten years old. Thus, the epidemic has now affected 32 out of China's 34 provinces. Additionally, cases of infected people have also been reported in neighbouring countries such as South Korea, Japan and Singapore.

The World Health Organization released a statement earlier today, in which it recognised the seriousness of the situation but also it was said that the situation does not necessitate the upgrade of the Wuhan virus to a status of Public Health Emergency of International Concern (PHEIC). Due to the rapid progression of the virus, the WHO has decided to deliberate on the same matters again tomorrow in order to discern whether a global pandemic has to be recognised.

“On 22 January, the members of the Emergency Committee expressed divergent views on whether this event constitutes a PHEIC or not. At that time, the advice was that the event did not constitute a PHEIC, but the Committee members agreed on the urgency of the situation and suggested that the Committee should be reconvened in a matter of days to examine the situation further.”

Meanwhile, Chinese authorities have imposed severe restrictions on travel, which are affecting over 40 million people in China in the eve of the Lunar New Year, which is typically a period that is marked by heightened travel of Chinese tourists nationally and abroad. Additionally, the sale of tour packages has been suspended as of today, which is going to affect the national tourism industry noticeably.

China has been undergoing a rigorous process of introducing structural changes to its economy over the past several years in a bid to diversify its industry from being heavily dependent on manufacturing to developing a solid services sector. The tourism sector, in turn, is a vital component of the services industry and the current prohibition of travel, which was implemented just today, is undoubtedly going to hurt this particular industry. What is yet unclear is the eventual size of this hit on Chinese services. What is known is that the recorded losses would continue to increase of as long as the ban on travel gets extended further into the future.

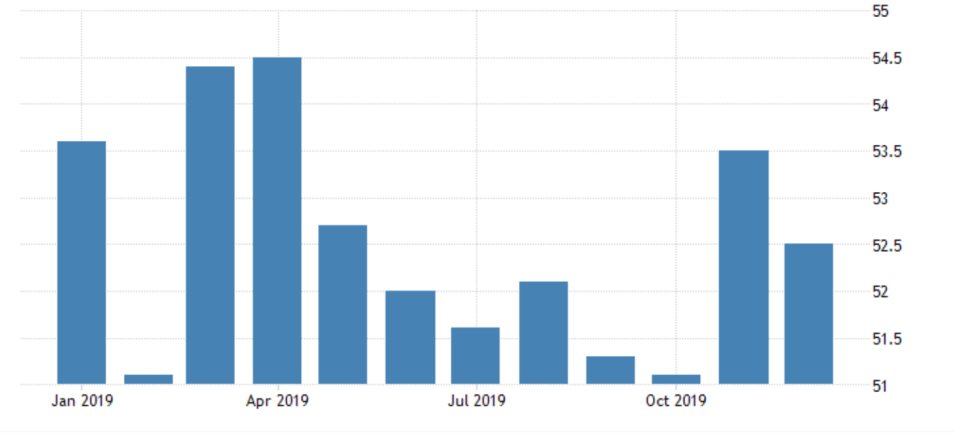

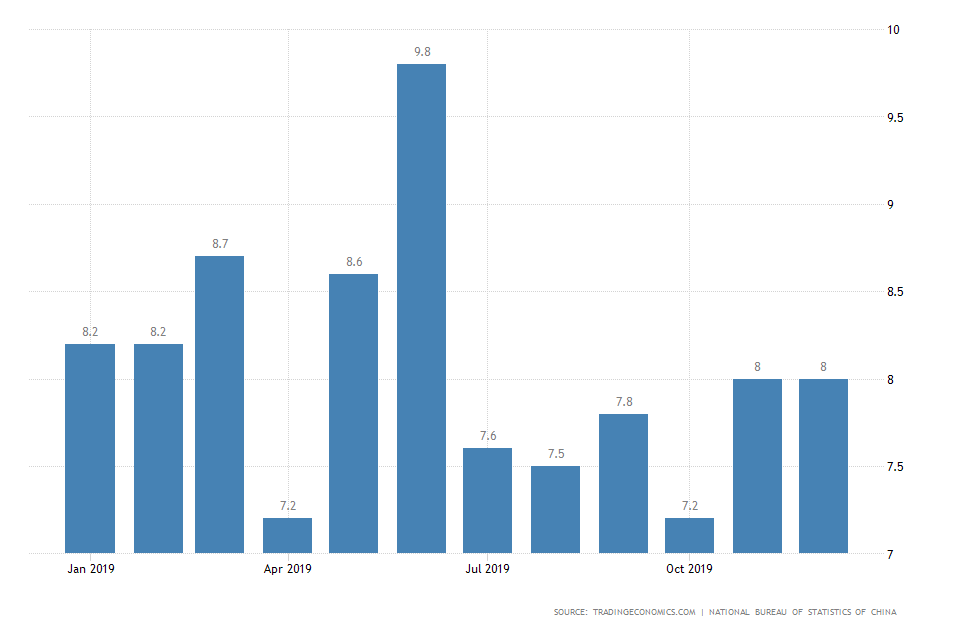

As can be seen from the above graph, the Chinese Services PMI has barely begun to register improvement in October and December from the previously subdued performance, which was recorded during the escalation of the US/China trade war. In the wake of the signing of Phase One in the trade, negotiations between the two countries, it was hoped that with the expected decrease in global trade uncertainty, the Chinese industry would be able to recover some of the previous losses and that services would surpass October's 7-month high. Now, however, analysts fear that the economy might be hit by a new type of uncertainty – rising concerns of infection. This would lead to reduced consumer spending as people would prefer rather to stay at home as opposed to going to public places such as cinemas, shopping malls, restaurants and others, which are the essential flagships of the services sector and the retail industry as a whole. Thus, the next most likely development would be reduced consumer spending.

3. What is the First Major Hit to the Chinese Economy Likely to be and How Would the SSE Index Reflect It?

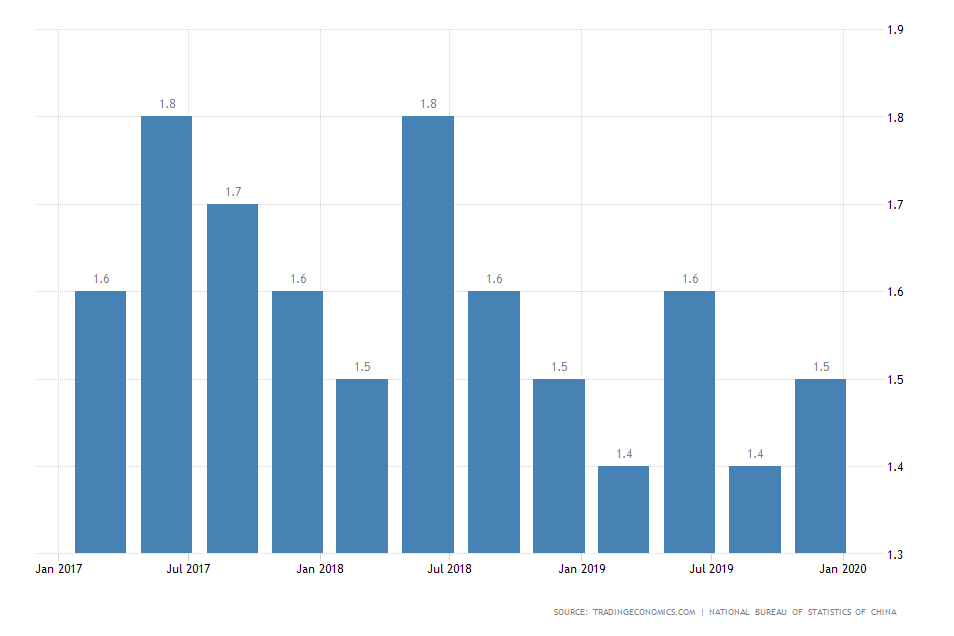

As it was mentioned above, the Chinese economy was capable of generating marginal growth in the last fiscal quarter ending December 2019. It grew by 1.5 per cent on a quarterly basis, which is up by a percentage point compared to Q3. Thus, the overall economy was able to grow at 6 per cent on an annual basis, a final result that slightly exceeded the initial forecasts. These final results gave investors reasons for optimism as they started to expected growth to increase more steadily as international trade complications wind down.

The most vulnerable sector of the Chinese economy, which is still reeling from the impact of international trade complications and US tariffs, is the retail industry. As it was demonstrated earlier, lessened travel and consumer spending would be the final outcomes from quarantines and people preferring to stay at home as opposed to going out for leisure.

Thus, falling retail sales would be the most likely first economic casualties of prolonged deterioration of the consumer sentiment. Depending on the severity of the virus’ outbreak and its future complications the retail industry could be affected in many different ways. The resulting shock in the retail industry could have deeper and longer-lasting implications for the overall economy if the damage of the virus continues to increase. The immediate consequences for the stock market could be a precursor for what is yet to come if the situation does indeed continue to worsen.

According to Bloomberg's analyst James Teo:

“In addition to tour operators such as China International Travel Service Corp. and UTour Group Co., the local airline industry will be hurt by the suspension. Air China Ltd., China Southern Airlines Co. and China Eastern Airlines Corp.’s shares have taken a hit since the virus outbreak. Air China could be most vulnerable because of its outsized exposure to international traffic.”

On Thursday’s trading session, the SSE Composite fell by 2.75 per cent mostly because of the hit on the shares of companies such as Air China Ltd. and the China International Travel Service on the news of the new bans on travel and restrictions on the sales of travel packages. This was the initial aftermath on the stock market, which was propelled by the Chinese Government’s anti-spread measures.

Thus, as the aforementioned bans on travel and tourism are extended further into the future, and these and others retail and tourism companies continue to suffer from diminished revenue streams, the currently developing bearish momentum on the index’s price is only likely to grow. The question is, how low the price can go before it finds support?

As it is indicated on the chart above, the first most likely level of support is the channel's lower boundary, which at the current time is positioned at 2930.7000. If the virus's negative impact on the Chinese retail industry becomes more ostensibly noticeable, the price of the index is likely to fall even further below. The second fundamental level of support is the 38.2 per cent Fibonacci retracement at 2901.8874. The third fundamentally important support level is the 23.6 per cent Fibonacci retracement level at 2746.3060. The market sentiment has already become noticeably bearish, as indicated by the negative convergence of the 10-day MA and EMA in addition to the negative convergence of the MACD histogram.

4. Recommendations for Traders:

Generally, the most sensible decision in light of the current situation would be to abstain from executing positions on the SSE index or other related stocks and assets, which are in one way or another connected to the Chinese retail industry. That is so because even though the technical analysis seems transparent, the fundamental picture could become quite unpredictable and spontaneous in these volatile market conditions, which are the result of the Wuhan virus’s spread. In other words, the price action of such assets, chiefly the SSE index, could become quite erratic.

If, however, one wants to enter the market regardless of the huge volatility levels (see the widening of the Bollinger Bands on the chart below), one has to apply caution. In this particular scenario, the timing of execution would be even more important than it typically is. It would be better to wait until morning for executing a trade, as too many unforeseeable events and developments could transpire during the weekend, which could ultimately wipe out any open positions that are left unchecked during this time. Thus, Monday's open of the Asian trading session should reveal how and whether the market has discounted such events, and also the manner in which the index would start the new week. There are three likely scenarios which could transpire on Monday morning and should be duly noted. Consider the following 1H chart:

Scenario 1 – There is no Gap at the Open and the Market Price Remains the Same. In this case, the trader's best choice would be to wait and see whether the price would manage to break down successfully below the minor support at 2960.5050, as it so far remains unbroken.

Entry Level – In the range between 2959.0000 and 2950.0000

Stop-loss – 2972.0500

First Target Level – 38.2 per cent Fibonacci @ 2901.8874

Second Target Level – 23.6 per cent Fibonacci @ 2746.3060

Scenario 2 – The Market Opens with a Gap. If the market opens in the range between the minor support at 2960.5050 and the 38.2 per cent Fibonacci at 2901.8874, it means that the bearish sentiment has gotten stronger since Friday and thus a short position should have a better chance of becoming profitable. Nevertheless, the trader should be cautious of the formation of very probable retracements back to these important price levels, as the market attempts to form short-term corrections before the longer-lasting bearish trend is continued. Thus, at the present moment, it would be counterproductive to try and conjecture the shape and size of such likely retracements if the market does indeed open with a gap. The trader is advised to be patient and wait for the formation of the first such bullish retracement before he or she opens a short position at its peak.

Scenario 3 – The Market Opens Higher Compared to Last Week’s Close. It means that the market is trying to recover last week’s losses and thus any trading should be at least momentarily postponed until the new conditions get cleared.

- The market shock was even bigger-than-expected, which made the analysis unusable. The takeaway from this scenario is that 'Black Swan' events are too volatile and unpredictable, which makes trading them highly undesirable.

Disclaimer: Your capital is at risk! Trading and investing on the financial markets carries a significant risk of loss. Each material, shown on this website, is provided for educational purposes only. A perfect, 100% accurate method of analysis does not exist. If you make a decision to trade or invest, based on the information from this website, you will be doing it at your own risk. Under no circumstances is Trendsharks responsible for any capital losses or damages you might suffer, while using the company’s products and services. For more information read our Terms & Conditions and Risk Disclaimer.