Yesterday marked one of the biggest routs in recent stock market history, as stocks globally tumbled markedly on investors’ fears concerning the coronavirus epidemic worldwide and the brewing crude oil price war between Russia and Saudi Arabia. Japanese stocks were no exception, and the Nikkei composite index tumbled by 5.07 per cent during yesterday's trading session.

As of today, Japan has registered 514 confirmed cases of the novel COVID-19 disease and 9 deaths. In comparison, the Diamond Princess cruise ship, which has been quarantined in a local harbour for the past several weeks after a single case was reported on board, has 714 confirmed cases and 7 deaths. Even though the death toll in Japan as of yet has not been as severe as in China or Italy, tensions are running high.

It is now known that the coronavirus has a high fatality rate among senior citizens above 70 and patients with other pre-existing respiratory conditions. Demographics play an important role in understanding the impact and spread of the virus, which is especially relevant for Japan. The country has one of the most ageing demographics in the world, which puts its citizens at comparatively higher risk.

All of these concerns are currently exerting a heavy toll on the Japanese economy, and some market experts fear that the worst may be yet to come. Tokyo is set to host the next summer Olympics; however, talks are now being held, and there is a real possibility for the games to be suspended if the outbreak is not contained in time.

The coronavirus fallout on the Japanese economy is alarming but not devastating as of yet. Regardless, the situation is continually evolving, and it is plausible for the economic headwinds to deteriorate considerably in the following weeks. All of this is likely to have a substantial impact on the local stock market, which has been especially volatile since the global COVID-19 epidemic started picking up the pace.

At today’s market open global stocks rallied following yesterday's crushing rout, and the Nikkei climbed by 0.85 per cent so far during today's trading session. The main question is whether this is a temporary pullback before the rout is continued, or the general selloff has finally reached a dip, and the market is ready to revert its direction. The current analysis examines the present economic and financial situations in Japan and projects the most likely future developments for the economy of the rising sun.

1. Long Term Outlook:

Unlike the S&P 500 or the Dow Jones Industrial Average, the Nikkei was not trading in a decided uptrend prior to the stock market rout, as can be seen from the weekly chart below. Instead, its price was loosely contained within the boundaries of a significant range, spanning from the major resistance level at 24121.09 to the major support level at 20183.68.

In the wake of the recent selloff, the Nikkei has broken down below the aforementioned support and is now consolidating between it (currently acting as a temporary resistance level) and the major support level at 19236.40. Thus, two significant possibilities should be considered.

Firstly, whether the index’s price would promptly get back within the boundaries of the range, thereby avoiding the continuation of the selloff. Secondly, whether the market has now decidedly become bearish and these are just the early stages in the development of a new significant downtrend.

As regards the first possibility, two crucial factors are supporting such a potential outcome. The most recent candlestick has a huge lower shadow, which is indicative of market uncertainty – lacking significant commitment that is necessary for the continuation of the downswing. If the present week finishes around the current market price or higher, this would be a significant indication that the market would most likely correct itself and get back within the boundaries of the aforementioned range.

Moreover, it should be acknowledged that the price is currently consolidating around the 20 000 mark, whose psychological importance cannot be underestimated! Due to the four zeroes in the number, this price level is very likely to be a significant turning point for the direction of the underlying price action. That is so because due to the mass-market mentality, traders prefer to collect their profits at such round numbers, which is why the underlying trading volumes typically change around such psychological levels. This, in turn, creates excellent opportunities for entries into the market and confirms the expectation for a reversal in the direction of the index' price.

As regards the second possibility, the sheer size of the selloff that has occurred during the last three weeks is considerable. The Nikkei has lost more than 15 per cent of its size, which is quite illustrative of the underlying market pressures and their strength. Thereby, going against the trend in these volatile conditions would be especially risky, and would be appealing only to those contrarian traders who have nerves made of steel. The most persuasive case that can be made in favour of the continuation of the current downswing can be made with regards to the prevailing fundamental factors.

2. Olympic Concerns Amidst Unexpected Oil Relief:

Two major developments demand attention for a comprehensive fundamental analysis. On the one hand, there are the aforementioned fears that the summer Olympic games in Tokyo can be cancelled. On the other hand, there is the surprising and indirect relief for Japan resulting from the oil price war.

- What Would a Cancelation of the Games Mean for the Japanese Economy? Japan had recently voted to boost its government spending in a bid to accelerate its economic growth. This was perceived by market experts as a necessary undertaking, given the country's loose monetary policy which has limited scope for providing future monetary stimulus. The Bank of Japan currently implements negative interest rates of -0.10 per cent.

Thus, heightened government spending into public projects, including the preparations for the Olympic games, was expected to yield future results supporting growth. The FDI and expected capital from foreign tourists flocking to Japan for the games was projected to help the economy grow and offset some of its tremendous government debt.

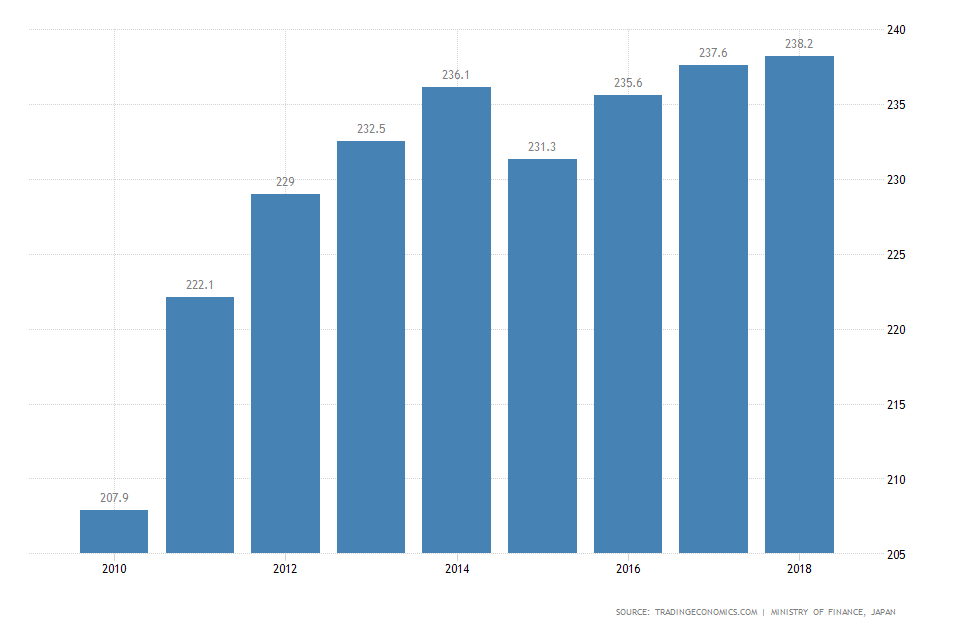

The country's government debt currently amounts to 238.2 per cent of its Gross Domestic Product for 2018 and is the highest one on record ever.

Thereby, potential cancellation of the Olympic games would mean zero return on investment, which could have rippling negative impact on the entire economy and not just for the tourism industry. Hence, it would increase the likelihood of Japan entering into a recession.

- Falling Oil Prices. One moderate reason for optimism is the falling crude oil prices as a result of the increasing tensions between Russia and Saudi Arabia (read more about it here). Japan is a significant importer of the precious commodity, which means that it would benefit from the tanking prices of crude oil. Consequently, its industry's spending costs would be diminished, and production would be supported. Both factors would likely have a positive impact on the Nikkei in the long run.

3. Short Term Outlook:

As can be seen from the daily chart below, the market sentiment has recently changed, and the Nikkei is currently trading in a robust downtrend. This is confirmed by the ADX, which is threading above 25 index points.

From the daily chart, it can also be deduced that the coronavirus acted as a catalyst for the current bearish trend. Prior to its commencement, the market was trading in a moderate bullish trend, characterised by the 1-5 impulse wave pattern that is postulated by the Elliott Wave Theory. A typical ABC correction followed the pattern, and immediately afterwards, the selloff began.

All of this underpins the changed market sentiment from moderately bullish to distinctly bearish; however, it does not necessarily mean that the price action would continue heading south. As can be seen, the major support level at 19236.40 has so far been able to hold back the downswing.

As can be seen on the 4H chart above, the underlying momentum is distinctly bearish but waning down, exhibited by the increasingly smaller stochastic bars on the MACD.

The aforementioned ABC correction from the daily chart appears as a Distribution stage on the smaller timeframe. The selloff itself represents a classic Markdown, which begs the question of where will the next Accumulation form. Could it be between the major support (temporarily acting as resistance) level at 20183.68 and the major support level at 19236.40?

At present, these two levels seem to be the most obvious candidates for the formation of an intermediate-range, regardless of whether the price would continue going up or down afterwards.

The hammer candlestick at the bottom of the markdown conveys a potential change in the direction of the price action, which could also mean that the bearish trend is either terminated or at the very least its losing steam. The second proposition is supported by the waning bearish momentum, as represented by the MACD.

4. Concluding Remarks:

The Nikkei index was struck by the coronavirus panic, which has grappled the entire global economy. The prevailing market sentiment remains distinctly bearish and executing inherently contrarian positions at the current moment (placing long orders) would entail considerable risk. Even though there are specific reasons to believe that at least for the time being, the market has reached a dip and that a sharp reversal in the underlying price action is plausible.

It seems that the most likely outcome in the wake of the recent selloff would be the formation of a consolidating range in the following days and weeks. The consolidation range is likely to be prompted by the attempt of central banks and governments to curb further losses to global stocks by implementing emergency countermeasures.

In the long run, the wellbeing of the Japanese economy is closely tied to the summer Olympics in Tokyo for a number of reasons. If the games are indeed cancelled in a bid to curb the spread of COVID-19 globally, the Nikkei index is surely going to be impacted by the decision.

- The analysis was correct to project the longer-term stabilisation of Japanese stocks. It was mostly successful in anticipating the impact of the liquidity support on the reeling stock market, however, it was wrong in its expectations concerning the short-term. Chiefly, the analysis failed to emphasise more on the opportunities for further slides in the index' price in the near term, before the Nikkei could start to stabilise. This led to the missed trading opportunity (the area in grey). The big takeaway here is a psychological recommendation – at times of market turmoil, most traders are unwillingly hoping for a rebound in stocks, because most people do not like making profits from crashing markets. This could, in some ways, impede their judgement regarding the opportunities for selling. If you want to make profits by trading, then you can`t allow yourself to misread the market because of your feelings.

Disclaimer: Your capital is at risk! Trading and investing on the financial markets carries a significant risk of loss. Each material, shown on this website, is provided for educational purposes only. A perfect, 100% accurate method of analysis does not exist. If you make a decision to trade or invest, based on the information from this website, you will be doing it at your own risk. Under no circumstances is Trendsharks responsible for any capital losses or damages you might suffer, while using the company’s products and services. For more information read our Terms & Conditions and Risk Disclaimer.